Araguaia ferronickel project, Brazil – update

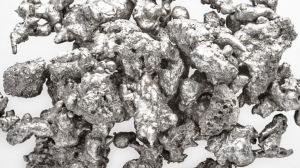

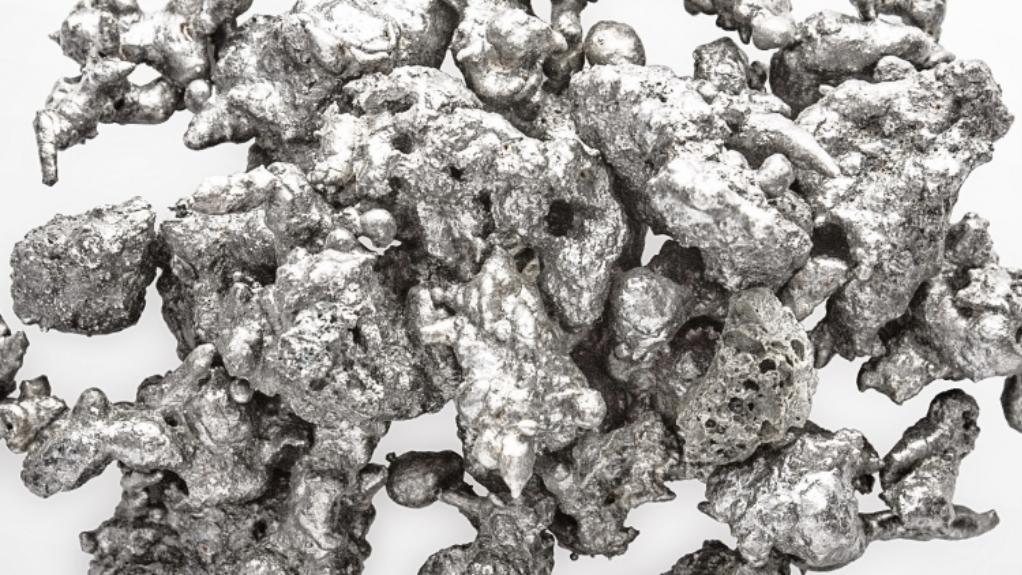

Photo by Horizonte Minerals

Name of the Project

Araguaia ferronickel project.

Location

Pará state, Brazil.

Project Owner/s

Horizonte Minerals.

Project Description

A feasibility study has confirmed Araguaia as a Tier 1 project with a large, high-grade scalable resource, long mine life and low-cost source of ferronickel for the stainless steel industry.

The project has two principal mining centres – Araguaia nickel south (ANS) and Araguaia nickel north (ANN). ANS hosts the Pequizeiro, Baião, Pequizeiro West, Jacutinga, Vila Oito East, Vila Oito West and Vila Oito deposits, while ANN hosts the Vale do Sonhos deposit.

The feasibility study comprises an openpit nickel laterite mining operation that delivers ore from several pits to a central rotary kiln electric furnace (RKEF) metallurgical processing facility.

The metallurgical process comprises a single line (Line 1) RKEF to extract ferronickel from the ore. After an initial ramp-up period, the plant will reach full capacity of about 900 000 t/y of dry ore feed to produce 52 000 t of ferronickel, which, in turn, will contain 14 500 t/y of nickel over a 28-year life-of-mine. The ferronickel product will be transported by road to the Port of Vila do Conde, in the north of the state, for sale to overseas customers.

Included in the study is the option for future construction of a second process line (Line 2), which would double Araguaia’s production capacity from 14 500 t/y of nickel up to 29 000 t/y of nickel.

The Stage 2 expansion envisions a 26-year mine life.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The Stage 2 expansion generates an estimated net present value of $741-million and an internal rate of return of 23.8%.

Capital Expenditure

In February 2024, Horizonte reported that the cost of the Araguaia project had increased from a previous $537-million budget to $1-billion.

Planned Start/End Date

First production has been delayed from the first quarter of 2024 to the third quarter of 2024.

Latest Developments

Horizonte Minerals has failed to secure financing and is now compelled to explore other options, which may put shareholder value at risk.

The alternative scenarios will focus on protecting the interest of secured creditors and include raising financing at the subsidiary level, a sale of the project while in care and maintenance, the liquidation of assets or other options available under Brazilian laws.

The company's endeavours to secure financing involved engaging with existing and potential investors worldwide, including more than 150 parties, with 39 parties entering into nondisclosure agreements. Despite commendation on the project's quality and the comprehensive work by the company's team, investors cited concerns regarding the nickel market environment, including low spot prices and near-term uncertainties.

Interim CEO Karim Nasr has highlighted the challenging market dynamics, particularly the unfavourable nickel market conditions driven by supply surplus from Indonesia.

Key Contracts, Suppliers and Consultants

Ausenco Engineering Canada (process plant design); FLSmidth, Metso Outotec, Uvån Hagfors Teknologi Inteco Melting and Casting Technologies (equipment supply and technical support); and Hatch (furnace contract).

Contact Details for Project Information

Horizonte Minerals, tel +44 203 356 2901.

Tavistock, on behalf of Horizonte Minerals, tel +44 207 920 3150 or email horizonte@tavistock.co.uk.