Madaouela uranium project, Niger – update

Photo by GoviEx

Name of the Project

Madaouela uranium project.

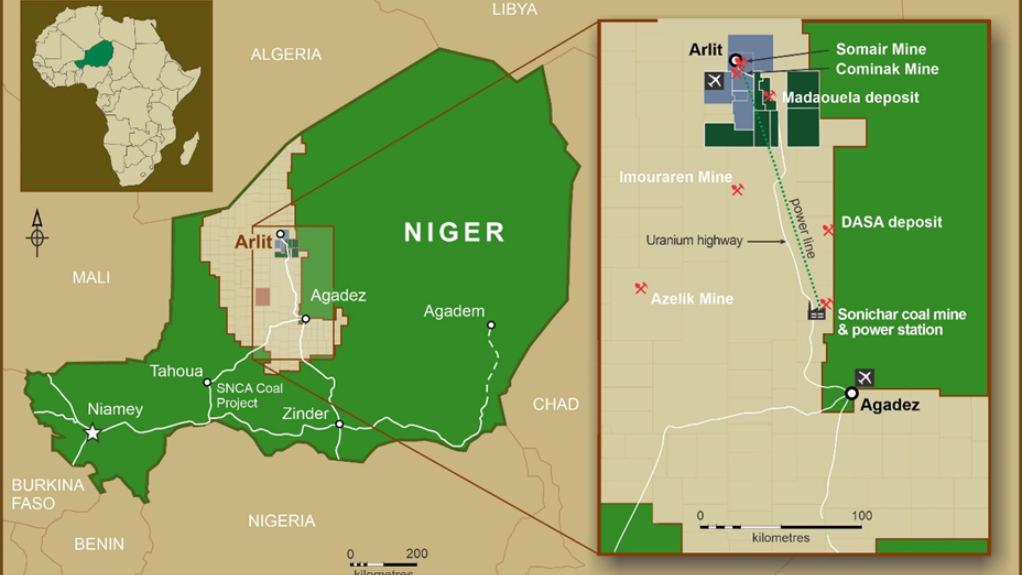

Location

Agadez region, northern Niger.

Project Owner/s

Mineral resources company GoviEx.

GoviEx holds 80% in COMIMA SA, the Nigerien company established to develop the project, and the Nigerien government 20%, of which 10% represents a free-carry interest.

Project Description

The project hosts one of the biggest uranium resources in the world, with 100-million pounds of uranium in measured and indicated mineral resources, and inferred resources of 20-million pounds of uranium.

The mineral resources comprise the Miriam, M&M, MSNE, MYVE, MSEE and MSCE sandstone-hosted uranium deposits.

The project is based on a self-sustaining operation, including process plant and renewable power supply, without any reliance on third-party facilities.

Mining operations are planned to be based on standard truck-and-shovel openpit mining for the Miriam deposit at one-million tonnes a year of ore feed to the process plant.

The M&M and MSNE-Maryvonne deposits are planned to be mined as two separate underground room-and-pillar operations. M&M will be mined first, after the completion of the Miriam openpit operation, with MSNE-Maryvonne to be mined after M&M.

At both underground operations, the mine development and ore-production operations are planned to be mined using conventional drill-and-blast methods. The process plant is designed around two-stage acid leaching to maximise uranium and molybdenum recovery while reducing overall acid consumption. Plant feed is designed at one-million tonnes a year, with ore initially crushed before milling.

Life-of-mine uranium production is estimated at 50.8-million pounds of uranium, averaging 2.67-million pound of uranium a year over 19 years.

Potential Job Creation

The project is expected to create up to 800 skilled and semiskilled jobs over its forecast 20-year mine life. Madaouela is also expected to contribute substantial royalty payments and taxes to the Nigerien government.

Net Present Value/Internal Rate of Return

The project boasts a forecast after-tax net present value, at an 8% discount rate, of $376-million and an internal rate of return of 21%.

Capital Expenditure

$343-million.

Planned Start/End Date

Not stated.

Latest Developments

GoviEx has signed a letter of intent with the Niger government agreeing to a structured roadmap that details a mutually acceptable plan to negotiate a resolution to the ongoing dispute regarding the Madaouela project.

The letter formalises the recent discussions held during and subsequent to the 2025 Mining Indaba conference, in Cape Town, where both parties engaged in constructive negotiations aimed at finding an amicable resolution.

As part of this process, GoviEx and the government of Niger have agreed to temporarily suspend the ongoing arbitration proceedings under the ICSID Convention while discussions continue within the agreed framework. This suspension will remain in place until a resolution is reached or until it is determined that no settlement is possible.

Should the parties be unable to reach a definitive resolution, the arbitration proceedings may resume accordingly.

GoviEx will provide further updates to the market as developments occur.

Key Contracts, Suppliers and Consultants

SRK Consulting and SGS Bateman (feasibility); and Endeavour Financial (financial adviser).

Contact Details for Project Information

GoviEx Uranium, tel +1 604 681 5529 or email info@goviex.com.