Zest WEG Group delivers R200m electrical infrastructure solution at Petra’s Cullinan diamond mine

Video on Cullinan Diamond Mine media visit produced by Creamer Media. Camerawork and Editing: Darlene Creamer.

Zest WEG Group Integrated Solutions executive Alastair Gerrard being interviewed by Mining Weekly Online's Martin Creamer

New electrical infrastructure at the Cullinan diamond mine

Photo by Creamer Media

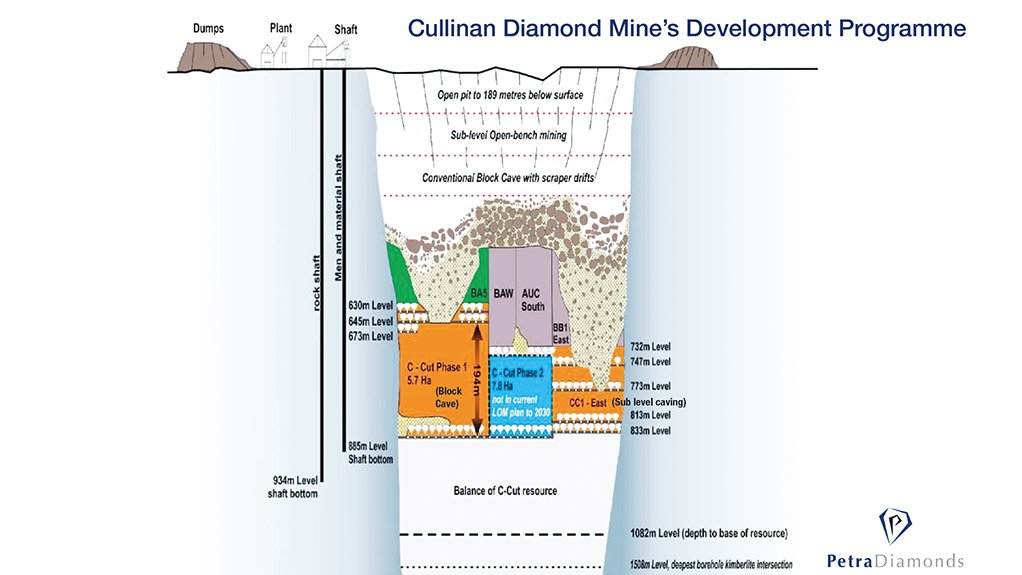

An outline of the C-Cut expansion at the Cullinan diamond mine

Photo by Petra Diamonds

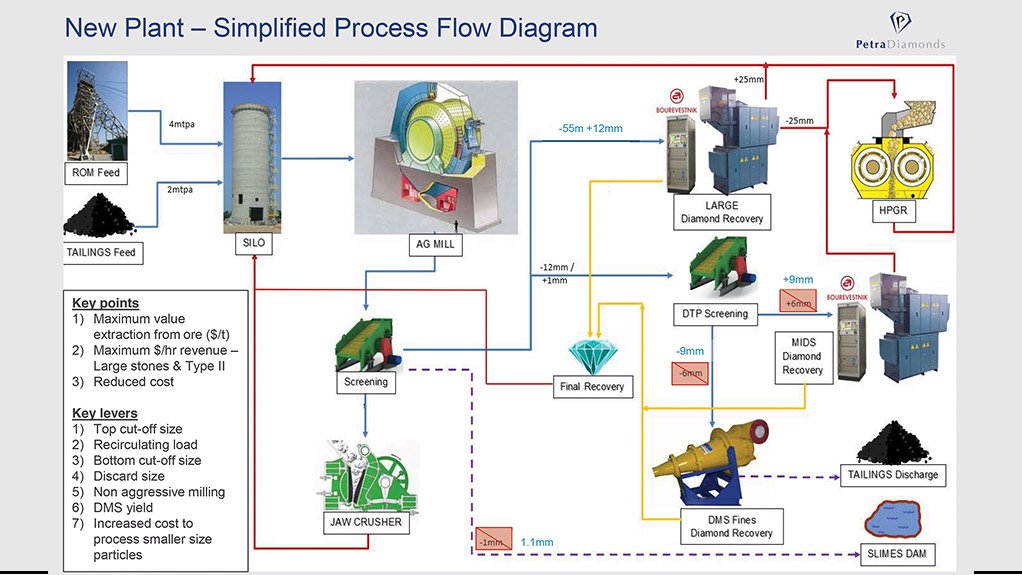

Simplified process flow diagram of new plant

Photo by Petra Diamonds

CULLINAN, Gauteng (miningweekly.com) – A R200-million electrical infrastructure project has been impressively completed at the Cullinan diamond mine of the London-listed Petra Diamonds through the combined effort of four Zest WEG Group companies. The companies adopted an integrated solutions approach in providing multiple and diverse energy packages on surface and underground to power the celebrated 116-year-old mine well into the future.

When Petra bought the Cullinan diamond mine from De Beers in 2008, it had a life-of-mine to 2014, which resulted in Petra’s decision to invest R5-billion in the first phase of the C-Cut to extend mine life to 2030. (Also watch attached Creamer Media video.)

This involved the deepening of shafts No 1 and No 3 by 358 m and 82 m respectively, the construction of new infrastructure and the adoption of the block-cave mining method at a block height of 200 m over 5.7 ha. A major benefit is that the remainder of the ore reserves at the current level can be established with a relatively small capital investment, owing to the winders, ground and infrastructure already being in place.

The expansion will increase production to 1.6-million carats in financial year 2019.

The implementation of the C-Cut project has resulted in undiluted kimberlite ore being brought to surface, which has enhanced the quality of diamonds produced.

Mining is taking place at the 839 m level and drilling shows kimberlite extending beyond the 1 000 m mark. Based on the availability of kimberlite diamond-bearing ore, the mine that in 1905 yielded the largest diamond ever found – the fist-sized 3 106 ct diamond – has at least another 40 years ahead of it.

The Cullinan diamond mine, situated 47 km east of Pretoria, is the world’s key source of rare and highly priced blue diamonds. Initially an opencast mine, it went underground in 1947. The mine has produced more than 800 diamonds weighing over 100 ct, and, of these diamonds, 140 weighed more than 200 ct.

Still in the ground awaiting extraction are some 200-million carats at a time when diamonds are becoming harder to find. Only 30 significant kimberlite mines are currently in production, four of them within the Petra group.

As part of the expansion project just completed, the mine’s 71-year-old outmoded processing plant has been replaced by a R1.7-billion new plant, which features the first autogenous mill in a diamond mine in South Africa.

The design capacity is four-million tonnes from underground and two-million tonnes from surface tailings.

“It’s roughly double the capacity of the old plant at the time the changeover happened,” Cullinan diamond mine GM Juan Kemp told Mining Weekly during a media visit.

POWER TO THE MINE

Zest WEG Group designs, manufactures, markets and installs electrical products and solutions across the full electrical spectrum.

To power the Cullinan diamond mine, Zest WEG Group’s Integrated Solutions division provided an 88 kV switching station to Eskom’s specifications as part of a self-build and handover exercise. The Eskom substation, and the property on which it is built, were given over to the State electricity utility free of charge, with the benefits to Cullinan diamond mine including reduced unit costs, assured supply and advanced protection from the system, which it did not enjoy with the older substation that had to be replaced.

The company also built a new bulk 88 kV substation dedicated to the Cullinan diamond mine and equipped it with two overhead line incoming bays, two bus sections and three 20 MVA power transformers, which were manufactured by group company WEG Transformers Africa.

Again, the bulk substation was designed to Eskom’s specifications and constructed from the ground up by Zest WEG Group’s Integrated Solutions division, which carried out the earthworks, terrace development and civil engineering and erected the structures, installed the electrical equipment, strung everything together and provided overall substation protection.

Twenty-six transformers, with a voltage range of 88kV to 380 V and a power range of 20 MVA to 100 kVA, were supplied by WEG Transformers Africa for use in various areas of the mine. Oil samples are drawn on a regular basis for testing at the company’s oil laboratory in Heidelberg, and recommendations are made on the remedial action required to prolong transformer life.

Zest WEG Group’s Shaw Controls provided six 525 V motor control centres, two 6.4 MW medium-voltage mill drive packages operating at 3.3 kV and using variable-speed drive technology, two low-voltage variable-speed drives of up to 1 MW, 170 low-voltage isolator stations used across the site and two containerised 525 V substations for the project itself. WEG electrical motors were supplied to every motor control centre, every variable-speed drive and various areas of the project.

Zest WEG Group’s EnI Electrical installed and commissioned the two main 88 kV overhead lines from the self-build substation to the main Cullinan bulk substation, as well as a 6.6 kV overhead line that takes electricity from the bulk substation to the new 7 Dam pumpstation. There, EnI installed and commissioned containerised motor-control centres, and provided cable racking, cabling and terminations. The company also removed old racking and equipment from the recovery plant, where it installed and commissioned new motor-control centres, cable racking, cabling and terminations, along with complete system commissioning.

The Cullinan mine’s mill expansion formed the greater portion of the scope for EnI and involved the installation of transformers, switchgear and electrical components, as well as the provision of medium- and low-voltage reticulation systems, cable racking, cabling, terminations, lighting installations and a communication system.

“We expect payback of the plant, in terms of increased efficiencies, to be about four years,” Kemp said in response to Mining Weekly.

EnI was also involved in the C-Cut underground project, where it provided the medium- and low-voltage electrical reticulation systems, cable racking, cabling and terminations, lighting and communication.

Zest WEG earlier this year obtained Level 1 status under the Broad-Based Black Economic-Empowerment (BBBEE) Codes of Good Practice. Ownership of the company’s shares has been facilitated for two black-owned nonprofit organisations (NPOs) that directly benefit communities in need. The two NPOs, together with the company’s employee trust, hold 51.6% of Zest WEG Electric, the South African arm of Zest WEG Group. The three divisions of the new South African company, Zest WEG Manufacturing, are the genset division, the transformer manufacturing division, and Shaw Controls, the group’s panels, motor control centres, E-Houses and containerised solutions manufacturer based in the south of Johannesburg. The black employees of those operations form part of the employee trust that underpins the South African company’s BBBEE status.

One of the NPOs is in the education sector and the other is in the microenterprises support sector. Significantly, the shareholding comprises 32.1% black women beneficiaries, which the company believes helps to sustain the good work of these NPOs into the future.

Keen interest in the company’s BBBEE status is shown in Namibia and Zimbabwe, where similar requirements are sought, with the focus elsewhere in Africa on the company’s competitive pricing, product quality, project delivery and service excellence, Zest WEG CEO Louis Meiring pointed out to Mining Weekly earlier this year.

The company prides itself on sparing no effort to become involved from the initial stages of project viability analysis to examining the attractiveness of the costing model and studying multiple ways of lowering input costs so that investors can achieve mandated capital return.

“This has certainly been a very important and very prestigious project for our group. [Everything] was designed and done in-house, apart from the self-build designs, which were done by Eskom. We also supplied a whole host of products through the likes of our transformer factories in South Africa. We’ve also supplied motor-control centres, low-voltage drive solutions and the medium-voltage mill drive packages, as well as containerised motor-control centres through Shaw Controls, which is another manufacturing business within our group.

“We also did the overall installation and construction, putting them together, as well as the motors, drives, transformers and panels that we supplied, putting them all together into a complete workable electrical solution.

“EnI came in and did all the cable pulling, installed cable racks, put all the equipment into position and essentially put all the pieces of the puzzle together,” Zest WEG Group Integrated Solutions executive Alastair Gerrard outlined to Mining Weekly in the video interview.

“With our integrated solutions approach, where we see these types of projects coming in and multiple different packages being released for the same project, we believe that using the consolidation approach is going to provide a lot of success for our group in such projects going forward.

“This close collaboration and continuous interaction from the very beginning was the key. No project is without its challenges and the Cullinan diamond mine project certainly wasn’t an exception, but it’s a case of working together with all parties to really make it a successful job and to get it over the line,” Gerrard added.

Zest WEG Group has 740 permanent employees and 2 000 nonpermanent employees scattered across African project sites, and comes with a solid sales proposition of cost- effective, rand-based technical solutions that meet tight capital-expenditure targets. A major advantage in all transacting is the international compliance of its product offerings.

In addition to its eight-branch South African enterprise, Zest WEG Group has registered businesses in Mozambique, Tanzania, Zambia and Ghana, with distributors in Angola, Botswana, Cameroon, the Democratic Republic of Congo (DRC), Côte d’Ivoire, Kenya, Mali, Mauritania, Mozambique, Namibia, Senegal, Tanzania, Zimbabwe and Zambia.

West Africa remains very important to Zest WEG Group, which carries substantial stock in Ghana, and the company is reporting growing demand from Burkina Faso, Guinea, Namibia, Mozambique, the DRC, Kenya, Tanzania and Nigeria.

The company regards each country in Africa as being unique and finds it essential to liaise face to face with clients on a continual basis.