Lumwana Expansion project

Canadian miner Barrick Gold Corp has filed technical reports for each of the Reko Diq and Lumwana Expansion projects, in Pakistan and Zambia, respectively.

Barrick indirectly owns 50% of the Reko Diq project and is the operator on behalf of Reko Diq Mining Company (RDMC).

The recently completed feasibility study details two phases of project development.

Phase 1 entails an initial throughput of 45-million tonnes a year of ore from 2028; and Phase 2 entails an expansion to a total throughput of 90-million tonnes a year from 2034 onwards.

The project will comprise two openpit mines, the main openpit at Western Porphyries and a satellite pit at Tanjeel, and a processing plant, together with other associated mine operation and regional infrastructure.

It will produce copper concentrate which includes gold for smelting by third-party operated smelters.

Since the statement of mineral resources reported by Barrick as of December 31, 2022, there have been minor changes to the resource estimate.

The main drivers were changes in the operating costs and processing recoveries which underpin the cutoff grade and pit shell determinations used for reporting. No additional drilling is included in the updated mineral resource estimate (MRE).

The mineral resources summary, at of December 31, 2024, shows a total of 3.9-billion tonnes grading 0.43% copper, for 17-million contained tonnes, in the indicated category.

It also shows a total of 3.7-billion ounces grading 0.25% gold, for 29-million contained ounces, in the indicated category.

The Phase 1 project capital cost is estimated to be $5.6-billion to reach initial production. The Phase 2 project capital is estimated to be $3.3-billion to increase the production capacity.

Sustaining capital costs are $3.8-billion over the life of the mine with an estimated closure cost of $72-million.

RDMC is estimated to pay a total of $7.08-million in taxes across the life of the mine.

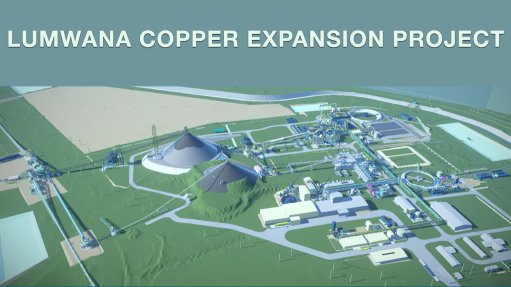

LUMWANA EXPANSION PROJECT

Barrick is the 100% shareholder in Zambia-registered Lumwana Mining Company, an exploration and mining company and the owner of the mine.

Lumwana is an operating mine with two openpits, Chimiwungo and Malundwe, a conventional sulphide flotation processing plant, and associated infrastructure.

Last year, Barrick completed a feasibility for the expansion project, which entails an expansion of the current mining operations at Chimiwungo and Malundwe, the opening of two new openpits at Kamisengo and Kababisa, the expansion of the current processing plant, tailings and water supply infrastructure, and an upgrade of existing site infrastructure.

As of December 31, 2024, the total proven and probable mineral reserves are estimated to be 1.6-billion tonnes at 0.52% copper for 8.3-million tonnes copper.

Proven and probable mineral reserves have increased from 510-million tonnes in 2023 to 1.6-billion tonnes.

The increase in mineral reserves, presented in the feasibility study, represents a 180% increase in contained copper since 2023.

The expansion is expected to considerably increase the mine’s production capacity, extending its operational life by 17 years to 2057, and doubling the capacity of the processing plant from 27-million tonnes yearly to a peak design of 54-million tonnes a year, with 52-million tonnes a year feed targeted for the production schedule.

Yearly copper output will increase from the current range of 120 000 t to 140 000 t, to an average of 240 000 t yearly over the life-of-mine, expected to bring Lumwana to the top 25 copper producers globally.

The MRE, as of December 31, 2024, shows a total of 1.8-billion tonnes grading at 0.50% copper, for 9.2-million contained metal tonnes, in the indicated category. ![]()