Afrimat says all its mines will be at full operating capacity in June

JSE-listed openpit miner Afrimat says it entered the Covid-19 lockdown with a strong balance sheet that will help it weather the uncertain and volatile business climate that is expected to prevail in the immediate future.

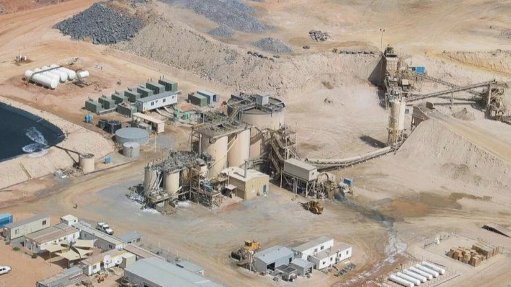

The company points out that the partial reopening of the Demaneng iron-ore mine and certain industrial mineral operations early in the lockdown period helped to dampen the impact of Covid-19.

From April 20, the South African government has allowed industries in the mining and quarrying sectors to resume operations; however, Afrimat has to ramp up its operations according to market demand, so not all its mines are operating at full capacity yet.

The company’s Demaneng iron-ore mine was operating at 100% capacity as at mid-May, the industrial minerals mines were at about 70% of operating capacity and ramping up, while the quarries producing construction materials were at about 50% of operating capacity and also ramping up.

Afrimat envisions that all of its openpit mines and quarries should reach full production capacity during June, assuming that the lockdown is scaled down to Level 3.

The company’s critical staff that are able to work from home continue to do so and the company is continuing to monitor the situation.

Afrimat has about R167-million in cash and R776-million in undrawn debt facilities, which should provide sufficient liquidity to withstand the interruption to operations.

The company cannot yet determine the full financial impacts of the virus on the 2021 financial year.

In the year ended February 29, the company’s Bulk Commodities segment, which consists of the Demaneng iron-ore mine, in the Northern Cape, generated an almost 60% increase in operating profit to R321-million, owing to more volume and favourable pricing in the year.

The Industrial Minerals segment also increased its operating profit by 22.5% year-on-year in the year under review, to R95-million. This segment successfully entered new markets, increased volumes and reduced costs in the reporting year.

The Industrial Minerals segment is made up of openpit limestone, dolomite and silica mines across South Africa.

Afrimat has 25 commercial quarries, including six sand and gravel mines, two limestone mines, two dolomite mines, one silica mine and one iron-ore and manganese mine.

Commenting on the company’s performance beyond the year’s results and during South Africa’s lockdown period, CEO Andries van Heerden says it has been challenging to research the market environment for Afrimat’s commodities, because it is changing every day.

For the company’s industrial minerals, many customers were still ramping up during the Level 4 lockdown, while others can only start operating from Level 3, which impacts on demand for these products.

For iron-ore, Van Heerden says it is a volatile commodity to begin with, but he adds that the company entered into it with a strategic intent.

“We had the management expertise around iron-ore and it gave us exposure to US dollars. This while the opportunities in the market were accessible to us.

“Our iron-ore meets the necessary quality requirements and we have experience in hard rock openpit mining, which made it an excellent operational fit. Logistically, we have our own load house station within 4 km of the processing plant and we could get allocation for transport on Transnet’s rail network,” Van Heerden explains.

He adds that iron-ore has been a better contributor to the company’s profit margins over the years than any other business.

The operating profit margin in Bulk Commodities improved 31% year-on-year, compared with an operating profit margin of 29.5% in the year ended February 28, 2019.

Van Heerden says the iron-ore price is affected by many factors, including the daily price as per the Platts Index, the lumpy premium, quality adjustments based on silica, aluminium and manganese content, the logistics cost to harbour, shipping costs, marketing costs and the dollar:rand exchange rate.

“There is upside and downside risk to the iron-ore price in the next six to twelve months. We seeing strong demand from China so far, while the demand in the European market remains uncertain.”

Meanwhile, the major markets for Afrimat’s industrial minerals are the chemicals, water treatment, glass, agriculture, metallurgical and powders and fillers sectors.

The operating profit margin for Industrial Minerals increased to 17.3% in the year under review, compared with an operating profit margin of 14.3% in the prior year.

The company continues working on expanding the industrial minerals range of products that the company is involved in.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation