Altus sets out intention to buy Legend Gold

The Diba gold resource, on the Korali Sud licence, includes intersections of 5.36 g/t gold over 13 m and 13.88 g/t gold over 8 m

Photo by Legend Gold Corp

JOHANNESBURG (miningweekly.com) – Africa-focused exploration project generator Altus Strategies has signed a nonbinding letter of intent to buy gold exploration company Legend Gold Corp – a TSX-V-listed company with a portfolio of gold projects in Mali.

Aim-listed Altus plans to acquire a 100% interest in Legend and is offering Legend shareholders three Altus shares for every Legend share held.

The exchange ratio represents an aggregate deemed consideration for Legend of C$5.7-million and about C$0.41 per Legend share, which is based on the Altus share midmarket price as at the close of market on October 10.

The consideration represents a premium of about 110% to Legend’s 20-day volume-weighted average price and 130% to Legend’s share price at the close of the TSX-V on October 10.

Legend shareholders will own 27.6% of Altus if the deal is concluded.

Altus CEO Steven Poulton said the company anticipated the proposed transaction to be implemented by way of a plan of arrangement; however, he noted that alternative mechanisms, such as a takeover bid, could also be considered while the parties and their respective advisers negotiate definitive documentation for the proposed transaction and complete due diligence.

LEGEND’S PORTFOLIO

Legend holds a portfolio of prospective gold exploration projects in western and southern Mali, with potential for near-term cashflow and discovery upside.

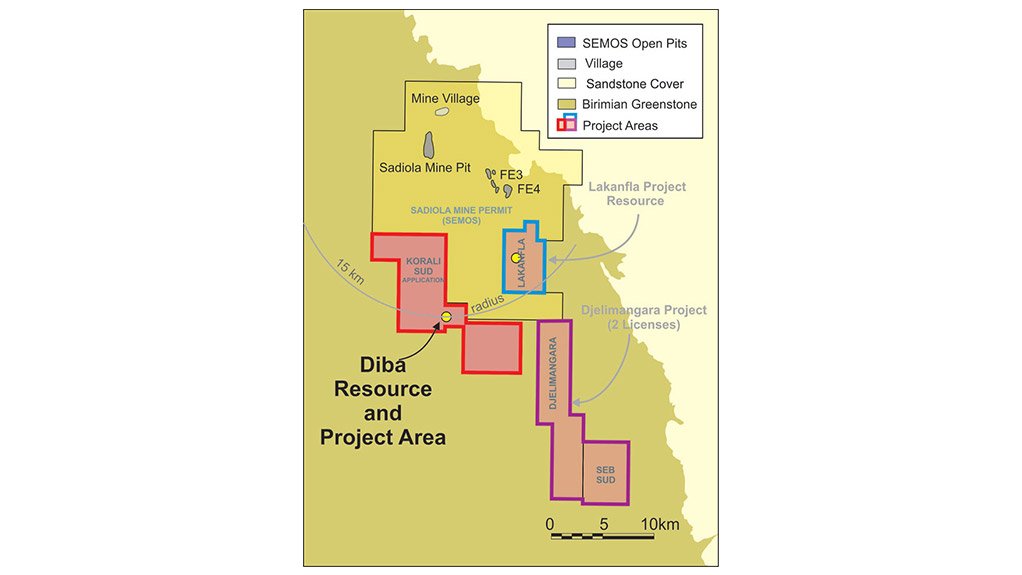

Drilling at the Diba gold resource, on the Korali Sud licence, includes intersections of 5.36 g/t gold over 13 m and 13.88 g/t gold over 8 m. Diba is located 20 km south of the 13-million-ounce Sadiola gold deposit, which is owned by Iamgold, AngloGold Ashanti and the government of Mali.

The Lakanfla licence hosts a potential karst deposit, 35 km southeast of the 4.5-million-ounce Yatela gold deposit, which is also owned by Iamgold, AngloGold Ashanti and the government of Mali.

The Pitiangoma Est licence is a joint venture with ASX-listed gold miner Resolute Mining, and is located 40 km south of the eight-million-ounce Syama gold deposit.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation