AngloGold, Gold Fields pause Ghana JV talks to focus on standalone assets

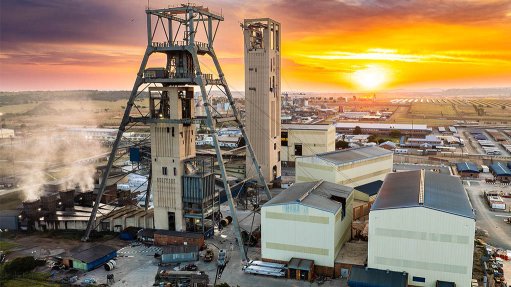

AngloGold's Iduapriem mine (photographed) is about 10 km from Gold Fields' Tarkwa mine.

South Africa-headquartered gold producers AngloGold Ashanti and Gold Fields have agreed to pause discussions on the proposed joint venture (JV) to combine their neighbouring Iduapriem and Tarkwa gold mines in Ghana, as both companies focus on unlocking value from their standalone operations.

Announced in March 2023, the proposed combination was set to create Africa’s biggest gold mine, leveraging operational synergies between AngloGold’s Iduapriem and Gold Fields’ Tarkwa mines. Since then, both parties have engaged in extensive dialogue with the Ghanaian government in pursuit of the necessary approvals.

AngloGold Ashanti stated on Tuesday that it had identified changes in its standalone mine plan for Iduapriem that had the potential to unlock significant additional value.

Gold Fields echoed the sentiment in a parallel update, stating that while the shared value created by a combination of the two mines remained compelling, the miners had agreed to pause discussions related to the JV to allow focus on their respective operations on a standalone basis.

Both companies maintained that the JV still held long-term strategic value but had shifted immediate focus to improving operational performance at their individual mines.

AngloGold’s Iduapriem openpit operation, which is located about 70 km north of Takoradi and 10 km from Tarkwa, was acquired in 2004 through the merger with Ashanti Goldfields.

Tarkwa remained one of Gold Fields’ key assets in West Africa. The company noted that the Ghanaian government had expressed its support for continued operations at Tarkwa and that it would begin preparations for lease renewal applications ahead of their expiry in 2027.

Separately, Gold Fields has also reached an agreement with the Ghanaian government regarding the future of the Damang mine, following the earlier rejection of its application to renew the Damang Main mining lease. The company will receive a 12-month lease extension from April 2025, subject to parliamentary ratification in May.

During this extension, Gold Fields will process stockpiles and restart openpit mining, while also completing a bankable feasibility study to potentially extend the life of the mine.

As part of the broader policy push to enhance local participation in the mining sector, Gold Fields and the government will establish a joint asset transition team to guide the eventual transfer of Damang to Ghanaian ownership.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation