Anglo’s copper assets worth $35bn, report shows

Anglo American’s copper assets are valued at about $35-billion and, if BHP aims to clinch these prized operations, the miner must substantially enhance its offer for its competitor.

This is according to a report by CreditSight analysts Wen Li and Michael O’Brien, who estimate Anglo’s enterprise value at $63-billion.

BHP’s initial offer of $32 a share (£25) falls short of the mark, considering that CreditSight’s valuation corresponds to a share price of $39 (£31).

Market sentiment, as gauged from analysts and traders surveyed by Bloomberg converge around an average price of £30.43 a share for a potential deal, with responses ranging between £28 and £35.

Anglo has rejected BHP’s initial offer, asserting that it inadequately reflects the company’s true value and future prospects.

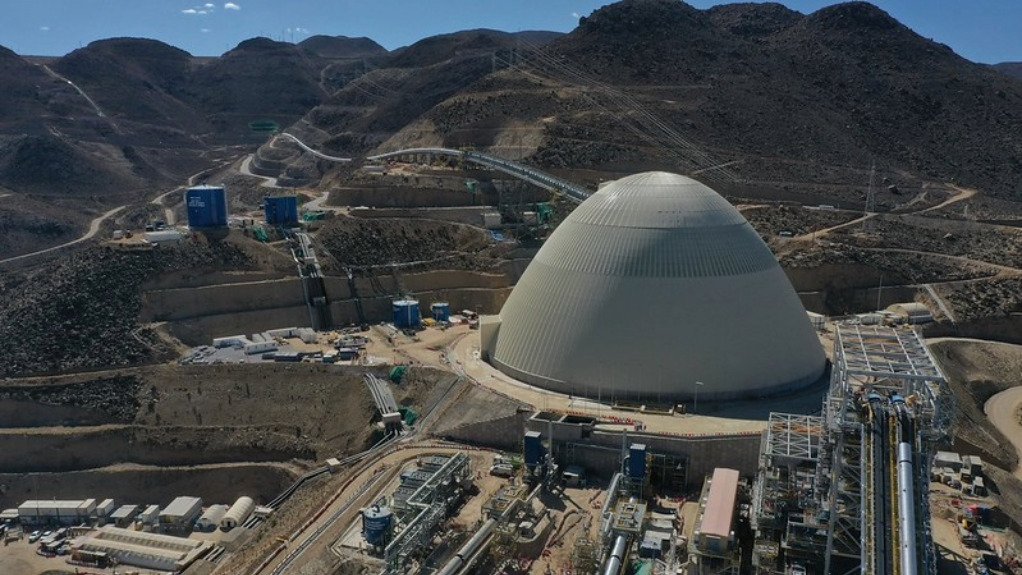

Anglo’s proposition boasts a large, high-margin and high-growth potential copper asset base in close proximity to BHP’s Chilean and Peruvian copper assets. A successful merger would culminate in the formation of the world’s largest copper miner, providing access to a trove of premier copper mines such as Collahuasi (ownership of 44%), Los Bronces (50.1%), El Soldado (50.1%) and Quellaveco (60%).

The amalgamated entity would produce 2.6-million tonnes a year of copper, accounting for about 10% of global production.

Recent news reports suggest BHP is contemplating an improved offer for Anglo. Under UK takeover rules, BHP has until May 22 to come back with a formal offer.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation