Are the planets aligning for a resurgence in African mining investment?

By Nivaash Singh: Co-Head Mining and Resources Finance; Nedbank CIB

The global energy transition imperative has understandably had a massive impact on the vast majority of industries and sectors. It could be argued that this impact has been felt the most intensely in the mining sector, where mines and other industry participants have had to comprehensively rethink how they utilise resources to power their operations. While this has been a global mining paradigm shift, mines in Africa have had to make the biggest changes given the still immense dependency that most have had on fossil fuel-based energy sources.

Mines on the continent are faced with a growing need to remain competitive by delivering ever-higher levels of performance, despite the challenges of volatile commodity prices, increasing stakeholder pressure and rising awareness of the need to adapt to climate change, water scarcity and social issues.

Exacerbating the situation is a growing trend amongst financial institutions to reduce their involvement in, and support of, many mining operations on the basis that they no longer consider the industry in alignment with their strategic objectives, particularly with regard to sustainable development.

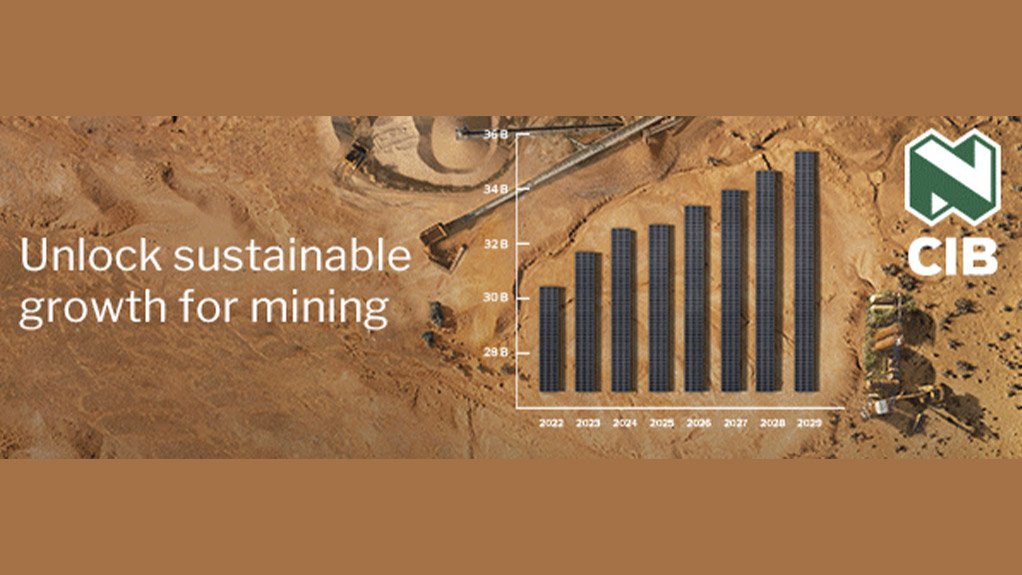

This argument doesn’t really hold water. In fact, at Nedbank CIB, we consider the opposite to be true; with real opportunities for mining as a whole to become a significant contributor to a more sustainable future for South Africa and Africa. As such, Nedbank CIB remains ‘open for business’ in terms of partnering with mining companies, particularly with respect to their sustainable development and growth aspirations.

We are actively involved in many such mining finance transactions in the sustainability and renewable energy space. The positive outcomes that these are already delivering validate our belief that mining can, and will, return to a position of prominence as a key driver of economic growth on the continent; only this time around, that contribution will be more sustainable, more inclusive, and more transformative than it has ever been in the past.

Many of these transactions are reinforcing the fact that the sustainable transformation of mines is not a one-sided process. There is, in fact, a level of co-dependence between the mining and energy sectors. Mines are essential for the supply of commodities that are needed for the production and operation of renewable energy infrastructure, and at the same time, renewable energy is imperative for the effective sustainable transformation of the mines themselves.

This mutual dependency means that, contrary to widely held misperceptions that there is little place in a sustainable world future for mines, the reality is that the mining industry has a pivotal role to play in creating, and eventually sustaining, that future. As such, appropriate mining finance should form an integral part of any financial institution’s sustainable development contribution strategy.

In addition, the recent reopening of China’s trade borders, coupled with the steady improvements in global supply chain efficiencies, makes this positive case for the future of Africa’s mining sector even stronger - and even adds a very compelling commercial returns component to the equation. This is clearly illustrated by an almost immediate 14% increase in the price of copper, accompanied by a concurrent spike in global demand for the majority of metals. Clearly, the sleeping giant is finally awakening, and investors underestimate the positive knock-on effect of this for mines around the world at their peril.

The question, of course, is: “will the improving global sentiment that will undoubtedly accompany China’s re-entry into the global trade arena be sufficient to override the many challenges that still face the mining industry in Africa, and particularly South Africa?” While it’s impossible to predict with absolute certainty that this will be the case, it’s very likely. The strong positive influence on commodity prices delivered by China’s renewed involvement in global markets will undoubtedly increase foreign exchange revenues, to the point that the mining sector here will once again become highly attractive to investors, irrespective of the issues it is facing and the often negative press that it receives.

Interestingly, there are already a number of international investors and mining companies that recognize this growth potential for mining in South Africa and that are funding some very large projects in the country. Just one example is the US$1,5bn Platreef PGM project by Canadian-listed Ivanhoe Mines, which combines a portion of debt funding from local banks and equity capital from Canada. Vedanta Zinc International’s US$500m investment into expansion projects at its Black Mountain and Gamsberg Mines is another example of the still positive sentiment towards South Africa by international mining investors.

For us at Nedbank CIB, this combination of China’s trade re-entry, a gradual but steady uptick in global investor sentiment, the intensified global focus on mining transformation, and the hoped-for imminent resolution of many of SA’s lingering regulatory challenges represents a proverbial aligning of the planets for this country’s mining sector. Should this alignment continue, there’s no doubt that there is significant potential for mining to regain its place of prominence as a vital, and invaluable, contributor to Africa’s long-awaited, and long-overdue, sustainable economic turnaround.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation