As Joburg's gold begins to re-show, Pilgrim’s Rest gold plant project accelerates

Engineering inspection of concrete test cubes.

Project team taking soil compaction tests.

Steel reinforcing installation and preparation for concrete placement.

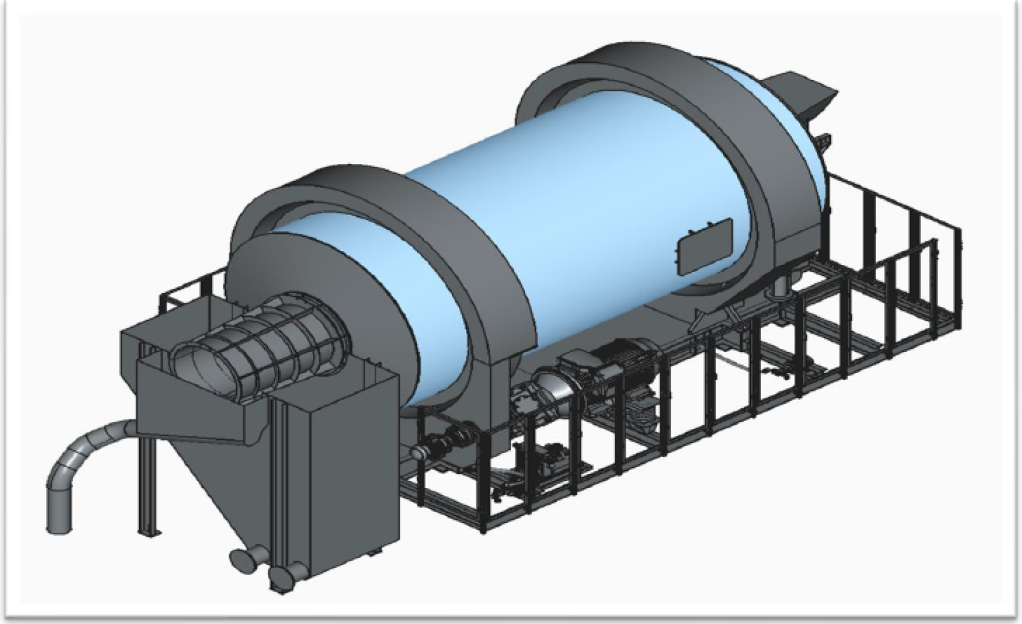

The ball mill.

JOHANNESBURG (miningweekly.com) – Johannesburg and Pilgrim’s Rest, two locations steeped in South African gold mining history, are both making it clear that their gold resources are far from done.

Mining Weekly chalked up reads galore with its update report on the impressively near-term and far-reaching return of gold prospects a mere 15 minutes from the central business district of the Golden City of Johannesburg, at West Wits Mining, on Gauteng’s West Rand.

Now, Mining Weekly can report that a critical milestone is also being reached at the rapidly advancing TGME gold plant of Theta Gold Mines, the core project of which is located next to the historic gold mining town of Pilgrim’s Rest in Mpumalanga province, some 370 km north-east of Johannesburg by road or 95 km north of Mbombela. Theta Gold Mines is building the plant to process ore from its spread of underground gold activities.

While West Wits Mining’s Qala Shallows mine is scheduled to pour its first gold during the first quarter of 2026, Theta Gold Mines’ TGME gold plant is scheduled to process its first gold ore during the first quarter of 2027.

In both cases, Australia Stock Exchange insight is providing kick-start equity funding, amid suggestions of Johannesburg Stock Exchange secondary listing possibilities also beginning to emerge more intensively.

Theta Gold Mines is accelerating the TGME gold plant by procuring a 900 kW ball mill circuit from MechProTech, which describes its Proudly South African modular designs as an essential part of its global success.

The entire mineral processing equipment range of MechProTech is manufactured in South Africa and on-site risk is lowered owing to all equipment being assembled and tested in-house.

MechProTech's locally manufactured package will be delivered in 25 weeks. It has two high-performance ball mills, an integrated feed system, and containerised motor control centre panels. To ensure a smooth commissioning phase, first fills of lubrication and grinding media are included.

“This procurement is not just a major equipment milestone. It’s a clear signal of our commitment to commission the plant by the end of 2026,” Theta Gold Mines executive chairperson Bill Guy emphasised in a media release to Mining Weekly.

The timeline aligns with Theta’s plug-and-play construction model, designed to accelerate build speed and reduce capital expenditure (capex).

Under Theta’s plug-and-play model, the mills and supporting infrastructure will be built in the factory and then trucked to the site to fast-track construction and reduce capex.

The on-site team now totals 137 with civils underway.

Importantly, the mill comes with a performance guarantee and includes full commissioning support, on-site training, and a robust service level agreement that ensures operational readiness from day one.

The partnership with MechProTech strengthens execution capability and reinforces the pathway to first gold production.

The project’s gold sources are the Beta, Rietfontein, Frankfort and Clewer-Dukes Hill-Morgenzon mines.

In the base case, the project has a mine life of 12.9 years, delivering production of 1.24-million ounces of contained gold over the life-of-mine, at a processing rate of 540 000 t/y to initially recover 1.08-million ounces of gold.

Envisaged are 30 000 t a month from Beta, 15 000 t a month from Rietfontein, 15 000 t a month from Frankfort and 10 000 t to 20 000 t a month near the end of Clewer-Dukes Hill-Morgenzon’s life-of-mine.

The existing mining infrastructure will be used, with the addition of new accesses, underground development and predevelopment of the mining grids, to access the planned mining areas at Beta, Frankfort and Clewer-Dukes Hill-Morgenzon.

At Rietfontein, the existing adits and underground development will be used with the addition of new development ends, a new decline and the extension of an existing decline.

The mining strategy for the underground operations is to apply mechanised longhole drilling to narrow-reef mining to selectively mine out only the reef channel, with minimal dilution at Beta, Frankfort and Clewer-Dukes Hill-Morgenzon.

Rietfontein will be mined conventionally using shrinkage stoping, with hybrid loading methods between trackless load-haul-dump trucks and rail-bound locomotives.

The processing plant will have a feed capacity of 45 000 t a month.

Theta Gold Mines holds 100% of Theta Gold South Africa Pty, which owns 74% of TGME and Sabie Mines.

The estimated development capital or peak funding requirement is $77-million.

South Africa’s State-owned Industrial Development Corporation (IDC) has extended a credit-approved loan facility agreement for R622-million, or about A$53.8-million, to part fund the TGME project.

The agreement, which includes a debt term of seven years from first drawdown, follows the completion of due diligence by the IDC and allows for the go-ahead of development and construction.

Clearly, the gold histories of Johannesburg and Pilgrim’s Rest are popping up again, with modern technology providing promising contemporary brightness and the good gold price attracting investor interest.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation