Bankan gold project, Guinea

Photo by Predictive Discovery

Name of the Project

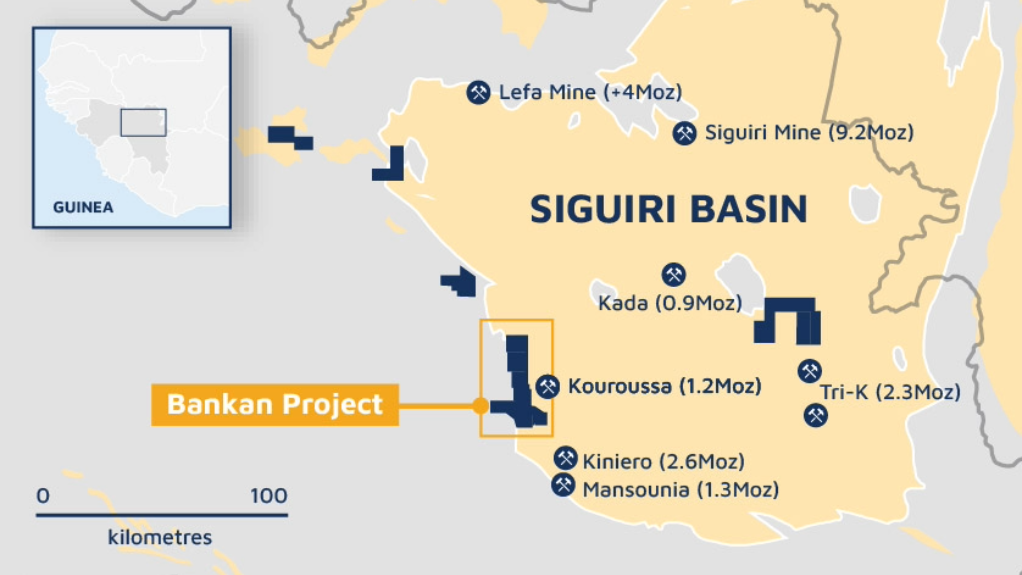

Bankan gold project.

Location

Siguiri basin, in the north-east of Guinea.

Project Owner/s

Explorer and developer of gold reserves in West Africa Predictive Discovery.

Project Description

A definitive feasibility study (DFS), completed in June 2025, has provided greater confidence in development and operating plans, reaffirming the project’s large scale, long mine life and compelling financials.

The DFS proposes openpit mines at NEB, Gbengbeden (GBE) and BC, with associated waste-rock dumps at NEB and BC, and an underground mine beneath the NEB pit, with access from the GBE pit and the associated ventilation, cooling and paste plant infrastructure.

Average production over the 12.2-year life-of-mine (LoM) is about 250 000 oz/y from mill feed of 54.5-million tonnes at 1.86 g/t containing 3.26-million ounces of gold. Openpit mining will be used as a conventional drill, blast, truck and shovel operation, which is considered appropriate for the style of the deposits. The mining method is based on three pit stages in NEB and a single pit stage each in GBE and BC.

The NEB openpit will be mined in three stages to prioritise access to higher-grade ore and allow for material movements to be balanced over the LoM. Prestripping at NEB will be initiated three months prior to the start of production and mining will continue throughout the LoM.

The GBE pit will be mined and stockpiled over the first nine months of the construction period to allow for a portal to establish underground access to fresh rock at the base of the pit. Underground development will take about 15 months to access the first stope ore, with development ore stockpiled during this period.

The BC openpit will be mined in years 9 to 11, deferring the additional capital cost required to establish mining operations at the deposit.

The underground mining method is a combination of transverse and longitudinal longhole stoping with engineered paste fill.

The process plant design has been based on a throughput of 4.5-million tonnes a year and will use conventional carbon-in-leach technology with upfront gravity recovery.

The project has shown excellent potential for the mine life to be extended through additional drilling and exploration. The NEB deposit is open at depth beneath the existing underground mineral resources, while the BC and GBE deposits have the potential to be expanded through additional targeted drilling. There is also significant exploration potential at near-resource and regional exploration targets.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The DFS notes that, at a consensus gold price assumption of $2 400/oz, the project delivers an after-tax net present value, at a 5% discount rate, of $1.64-billion and an internal rate of return of 46%, achieving payback in 1.9 years.

Capital Expenditure

Total preproduction costs are estimated at $463-million.

Planned Start/End Date

Construction is scheduled over a two-year period, which is expected to start in the second quarter of 2026, following execution readiness activities and selected early works, consequently allowing for the start of commercial production in the second quarter of 2028.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

Not disclosed.

Contact Details for Project Information

Predictive Discovery, tel +61 8 9216 1000.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation