Bushveld to dispose of Vanchem asset to SPR, working capital advanced

Aim-listed Bushveld Minerals has secured additional funding to provide immediate working capital relief and ensure continuity of its operations by entering into a binding term sheet with Southern Point Resources Fund (SPR) to conditionally sell the entire Vanchem vanadium processing plant asset for up to $40.6-million.

The transaction comprises an initial consideration of $20.6-million and a deferred consideration of between $15-million and $20-million.

The proposed terms of the disposal replace those announced in November last year for the sale by Bushveld to SPR of a 50% interest in Vanchem.

The disposal is conditional on shareholder approval.

As Bushveld Minerals requires additional funding to pay creditors and ensure it has sufficient working capital to fund ongoing operations, SPR has also agreed to increase the funding available through the interim working capital facility secured against production at the Vanchem plant by a further $9-million.

Bushveld received an initial additional advance of $3-million on May 3.

SPR has agreed to advance a further $5-million on May 31 and $1-million on June 30, subject to certain conditions.

As announced by Bushveld in its first-quarter-2024 operational and corporate update, the company’s working capital was extremely tight owing to a number of factors, including the continued delay in receiving funds from the equity fundraising; a delay in the completion of the sale of a 50% interest in Vanchem for $21.3-million and the sale of a 64% interest in a subsidiary that owns the Mokopane Vanadium project for $3.7-million; production levels being materially affected; and notably weaker vanadium prices.

Accordingly, as previously disclosed to shareholders, the company was dependent on the receipt of further funding to continue operations.

Bushveld says it has explored all available funding options including the further issue of equity; however, as a result of the company’s share price trading below par value, this was not a viable option, given the immediate need for funding.

Accordingly, the board has determined that, for the company to continue as a going concern, having consulted with its key stakeholders, the only viable option to bring in immediate funds is through an increased working capital facility with SPR and to sell its remaining interest in Vanchem.

“The extension of the working capital facility provides vital funds to continue as a going concern. The proposed sale of Vanchem will enable the group to move forward in a more agile and lean manner and help pay down our creditors. Further details will be provided in due course but absent this funding the company would have had no option but to apply for business rescue.

“Fortunately, our turnaround at Vanchem has allowed us to achieve meaningful value for this asset, which we are able to monetise over a short space of time and focus on getting the Vametco plant and its long-life mine into an efficient, sustainable, cash-producing position,” Bushveld CEO Craig Coltman says.

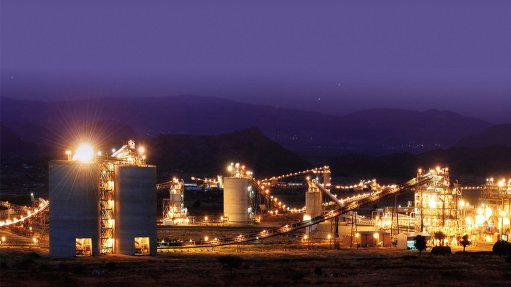

The Vanchem plant is located in Mpumalanga, South Africa, while Bushveld’s other significant operation Vametco is located in the country’s North West province.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation