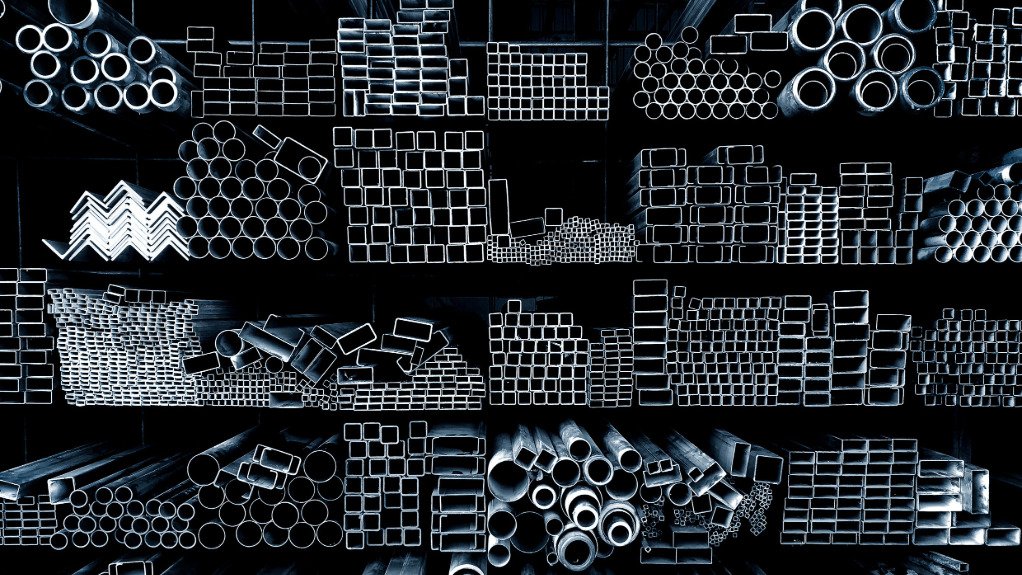

China’s steel demand has shrunk to less than half global total

China will account for less than half of global steel consumption in 2024 for the first time in six years, according to the World Steel Association, as the decline in the country’s real estate sector pummels demand for the metal.

The forecasts from Worldsteel show diverging prospects between China — for two decades the major driver of global demand growth — and steel hot spots in the rest of the world, from South Asia to the Middle East and Latin America.

“China’s at the structural peak in terms of steel demand,” Simon Trott, chief executive for iron-ore at Rio Tinto Group, the world’s largest supplier of the steelmaking ingredient, said at an address in Melbourne on Friday. “The world will need more steel in the next 20 years than it’s used in the last 30, despite the sort of growth we’ve seen in China.”

Worldsteel sees Chinese consumption racking up a fourth year of declines in 2024 to 869-million tons, while demand in the rest of the world rises 1.2% to reach 882-million tons. China’s share will shrink further in 2025, according to the association.

The figures show how the end of China’s decades-long infrastructure and property boom is reshaping the nation’s steel consumption. But they also suggest another reason why China’s exports have surged so dramatically this year to their highest since 2016: There’s rising demand elsewhere.

India’s market will grow by 8% this year — after rising 14% in 2023 — to 143-million tons, while other emerging and developing economies will see growth of around 7% for a second year running, according to Worldsteel.

The rest of the world last surpassed China’s share of demand in 2018. Worldsteel acknowledged risks to its forecasts due to Beijing’s recent barrage of stimulus measures to support growth, citing a “growing possibility of more substantial government intervention and support for the real economy, which could bolster Chinese steel demand in 2025.”

ON THE WIRE

China cut its benchmark lending rates after the central bank lowered interest rates at the end of September as part of a series of measures aimed at reviving economic growth.

China’s domestic yuan traders appear to be more confident than their offshore counterparts that the currency’s turbulence will be contained around the US Presidential election period.

Hong Kong will roll out several measures with the aim of becoming an international trading center for gold and other commodities, Financial Secretary Paul Chan wrote in his blog Sunday.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation