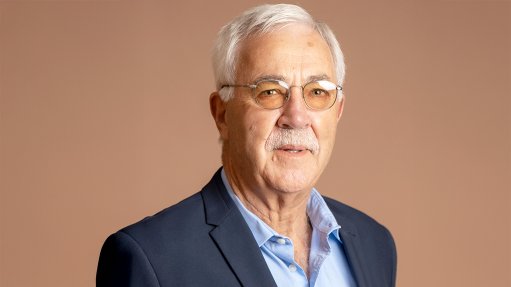

Commodity markets entering period of stability, Orica CEO says

PERTH – Orica, the largest supplier of explosives to the mining industry, has begun to observe stability in commodity markets that have been marked by volatility, sinking profits and job cuts after a global boom ended.

“We still see a lot of volatility, but I think that I’ve seen more stability than I’ve seen in some time,” in the past month, CEO Alberto Calderon told reporters after an industry briefing in Perth on Thursday.

“When I talk to our customers I get the sense they are saying ‘Well let’s get on with it’. They have done a very good job of cost-cutting. They just need to continue to grow, and that’s the behavior we are seeing.”

After declining for five years, the Bloomberg Commodity Index has increased 12% in 2016 as metals started to recover and energy rebounded. Last month, it moved less than 0.3% for the smallest change since 2012. In the medium term, Calderon, formerly a BHP Billiton executive, said that he saw iron-ore and coal prices staying depressed because of oversupply.

“It means there will be no big investments, no big capex, greenfield investments for a while in coal, iron-ore,” he said. Chinese iron-ore production may face further cuts of as much as 100-million metric tons of unprofitable output, he said.

Orica’s profit in the six months to March 31 fell by a third to A$149-million from a year earlier. It has cut its capital-expenditure forecasts and replaced a progressive dividend policy with a so-called payout ration, citing market conditions that had deteriorated more than anticipated.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation