Copper 360 credibility level will invariably attract investor support, says Bridge Capital

Bridge Capital Advisors corporate finance director Pieter Veldtman interviewed by Engineering News & Mining Weekly’s Martin Creamer.

Management with the level of credibility that the Copper 360 team is able to offer will invariably gain investor support. That is the view of Bridge Capital Advisors corporate finance director Pieter Veldtman, who served as an advisor in the listing of Copper 360 on the Alternative Exchange (AltX) of the Johannesburg Stock Exchange (JSE).

Bridge, which is registered as a sponsor to a number of JSE-listed companies, is also a designated AltX adviser.

Regarding the demand for shares in Copper 360, Veldtman had this to say to Engineering News & Mining Weekly: “It was very gratifying to see very good demand in a tough market.” (See below to watch Creamer Media video.)

Amid limited activity and after considering alternative options, it became clear to Bridge that the time and the environment for the listing was right.

He highlighted the commitment of Copper 360 management and its founders of a significant amount of their own capital into copper, a product with highly visible growth expectations owing to its use in electric vehicles and renewable energy in particular.

He pointed to the success of the listing also being assisted by the coming together of sustainability through tailings reprocessing of older dumps and the assets being located in an area where access to jobs is a significant issue.

He emphasised, however, that the listing is by no means the end game, but rather the start of a new phase of growth and the unlocking of value for more stakeholders – “and hopefully a phase of growth where the JSE will play its part and allow the company to access additional rounds of capital going forward”.

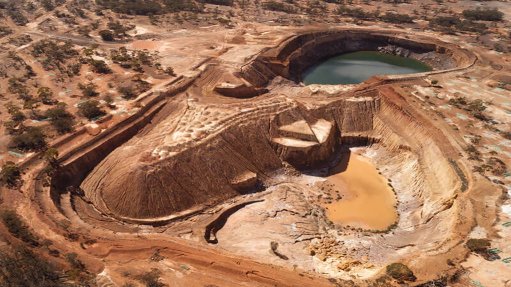

But, without doubt, listing has been financially advantageous. “The company had a requirement for growth capital. There was a small SX/EW plant in operation but the business and the business model needed significant new capital to build out the concentrator plant and also to develop the entire SHiP property and its prospects.

"As always with a JSE listing, you access investors with mandates that require a listed environment and listing was thus important for Copper 360 to gain access to additional pools of capital," Veldtman explained during a Zoom interview.

Do you foresee the listing continuing to be advantageous for Copper 360 in the medium to long term?

Absolutely. There’s significant growth opportunities within the business that are still to be unlocked and, in all probability, that would require access to additional funding. Not all of the opportunities would be able to be unlocked over the short to medium term from operational cash flow and we've already seen some very positive SENS announcements detailing upgrades in the resource. There's a drilling programme that continues, so we're likely to see more news on that going forward and I suspect there'll be opportunities to raise more capital through the listed instrument.

Why did Copper 360 decide to sell shares to invited private placement investors ahead of listing?

It's easier to access those pools of capital. There's fewer people to deal with and it becomes quicker to execute. But important to note is that it doesn't exclude the retail investor.

How did Copper 360 arrive at a placement price of R4 per private placement share?

The dark art of valuations – that's probably a story in a series of articles all on its own. As advisors, we like the discounted cash flow methodology and we base that on management forecast and estimates. But in the case of a resource listing, you also have the added benefit of a competent person’s report on the resource and that arrives at its own valuation, using a range of prescribed and allowed methodologies in terms of the South African code for the reporting of exploration results, mineral resources and mineral reserves (Samrec) and the South African code for the reporting of mineral asset valuation (Samval). Then, the ultimate part of the art is always to make sure that you price the share at a level where you are certain that you'll have support from key investors. In combination, that's kind of where the R4 comes about.

Did the JSE, in your view, live up to Copper 360’s expectations?

Absolutely. We found the JSE to be very proactive and supportive throughout the process. They were accessible. We had a number of one-on-one and team interactions with them, and it was a pleasure to work with the team at the JSE.

What new steps can be taken now to make it easier for retail investors to buy Copper 360 shares?

I'm not sure we need to take new steps. There are any number of platforms through which retail investors can gain access. The likes of EasyEquities decide to trade on their own if they don't wish to have that indirect benefit through their contractual savings and it's up to retail investors to do their homework and access the share.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation