Demerging AngloPlat has confidence in outlook for planet-friendly platinum group metals

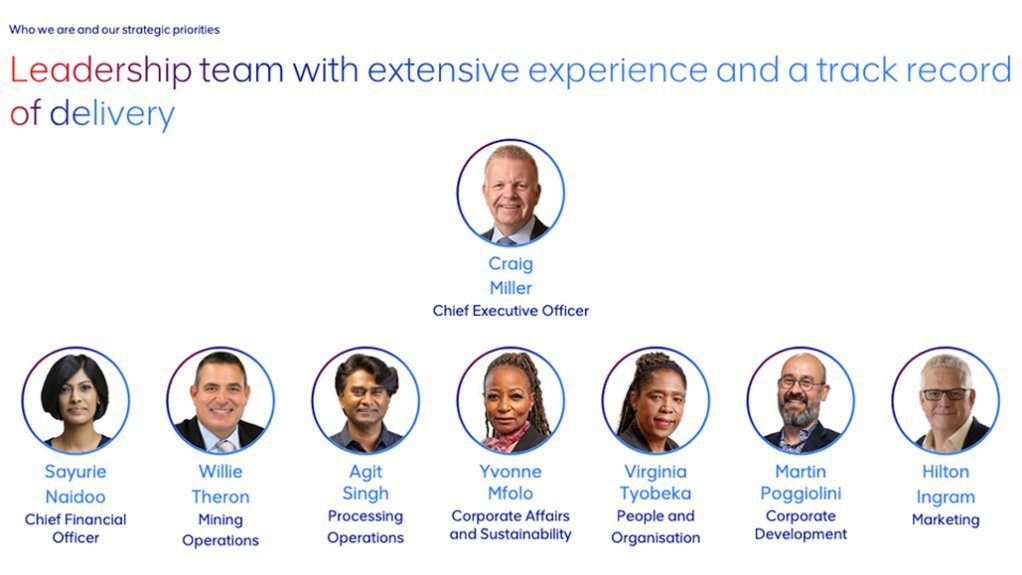

Anglo American Platinum CEO and his leadership team.

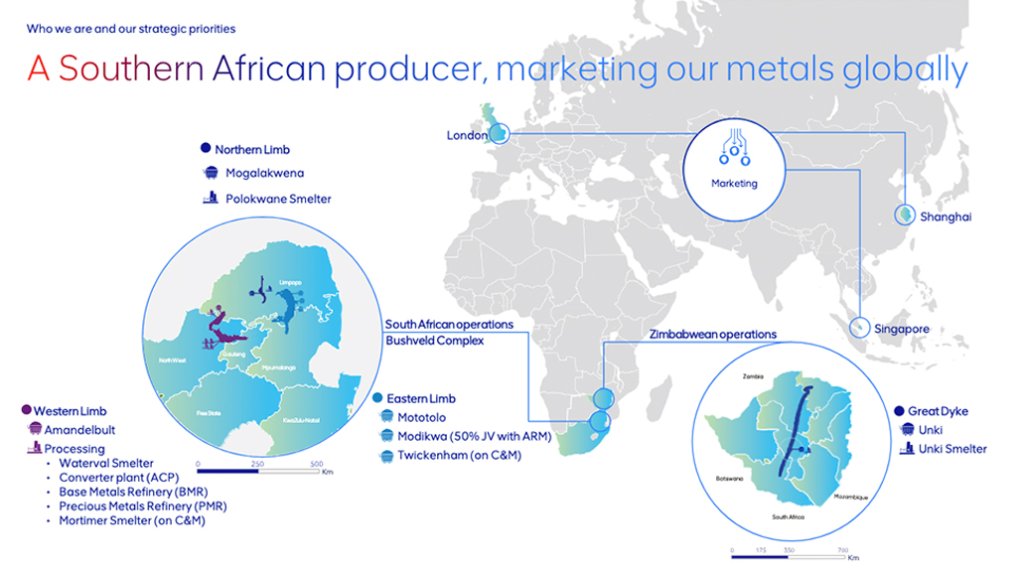

African mining, global marketing.

JOHANNESBURG (miningweekly.com) – Confidence in the outlook for platinum group metals (PGMs) was expressed at the capital markets day of Anglo American Platinum, which is on its way to becoming the demerged and standalone Valterra Platinum.

“The market fundamentals of supply and demand suggest upside to the current PGM basket price,” CEO Craig Miller highlighted about a group of precious metals that touch lives globally in the form of platinum, palladium, rhodium, iridium and ruthenium.

Existing demand is stronger than we had previously forecast, with demand for PGMs in catalysts more robust, and use in a wide range of industrial applications continuing to grow in line with GDP.

“As we look further out, we also see the prospect of new demand segments to support the energy transition and the technologies addressing climate change, and we reinforce our outlook that the demand for our metals is strong and it's sustainable,” an upbeat Miller stated during the presentation attended in-person by Mining Weekly.

“At the same time, we continue to see primary supply decline on the back of lower investments in existing and new assets across the sector, while secondary supply, which comes from the recycling market, continues to under-deliver against forecasts.

“We therefore believe that there will continue to be deficits in the balance between the PGM supply and demand, particularly in platinum and rhodium, which gives us positive outlook for PGM prices. So, as we go forward, we do have a differentiated value proposition.

“Firstly, we have an outstanding asset base, being clear around the role of each asset within the portfolio and the investments that we continue to make to grow as well as sustain our asset integrity, supporting the continued delivery of steady production. In addition, our global marketing organisation delivers the right solutions for our customers and helps us maximise the value potential from every single ounce that we produce.

“Secondly, we've got the capabilities and the discipline to make the most out of that asset base. The primary objective is to make sure that all our managed operations remain in the most competitive part of the cost curve. This sets us up for through-the-cycle profitability, realising superior earnings margins.

“Thirdly, we bring our assets and our capabilities together with a strong balance sheet, with a clear capital allocation framework and a real discipline in how we execute.

“That should translate into a consistent and leading shareholder returns and great prospects for all our stakeholders.

“We have mine plans that give us a clear pathway to multiple decades of production. I'm grateful we don't have the reserve replacement challenges of many of our precious metal peers, and instead, can focus on optimising the full potential from our outstanding endowment. We also have a great balance. We have enough breadth in the portfolio to give us the diversification and a wide range of options to enhance value.

“Our marketing business provides a real connection to our customers and helps us to shape the demand for PGMs in a deliberate way. We have the team. We have the systems and the plans in place to position each one of our assets in the first half of the cost curve.

“Being in an industry that is unlikely to see significant sources of new supply, and where the low-hanging fruits on costs have already been taken out, gives us the assurance of delivering cash through the cycle.

“We've put in place a new organisation structure, which is set up to make the most of our status as an independent company through efficient governance, clear accountability and a new level of agility.

“All of this sits behind our commitment to continue to deliver on our action plan, which involves a further R4-billion of cost reductions in 2025 helping us to achieve our target and getting our all-in sustaining costs across the assets below $950 per three element ounce.

“I believe we've got a great team in place to deliver on those plans, and we have now embedded sustainability across the business to make sure that we work in lockstep with our stakeholders, including our primary commitment to achieving zero harm and therefore making all of this a reality,” Miller outlined.

PLANET-FRIENDLY METALS

The planet-friendly PGM metals are found in a myriad of everyday products that improve lives significantly in a variety of extraordinary ways.

Because of their purity, high melting points, catalytic properties and corrosion resistance, PGMs are critical minerals found in computer hard drives, monitors and cell phones.

PGMs are used in catalytic converters and vehicle exhausts to reduce emissions and in hydrogen fuel cells to power cars, trucks, buses and buildings. The proton exchange membrane electrolysers that generate green hydrogen, also rely on the characteristics that PGMs provide.

In addition, PGMs are trusted in medical devices like pacemakers, stents and hearing aids, and relied on for anti-cancer treatments.

Moreover, platinum’s lustre and anti-tarnish attributes have facilitated the use of this Southern Africa-dominant precious metal in jewellery. With gold now three times more expensive than platinum, the biggest gap since 1900, an opportunity has arisen to regain market share from white gold, which was was invented as a cheaper alternative to platinum.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation