Despite volume slump, Omnia sees growth opportunities in mining sector

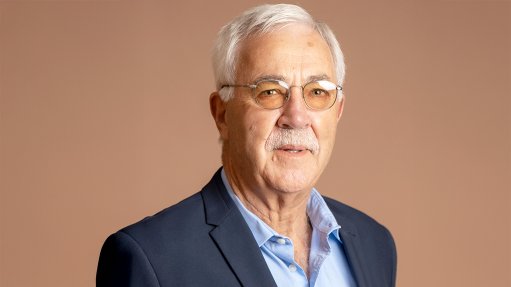

JOHANNESBURG (miningweekly.com) – Despite the downturn in global mining revenues and volumes, JSE-listed Omnia’s Mining division has been “remarkably resilient” and continues “to forge ahead in maintaining its position as a leading player” in the opencast mining industry on the African continent, group CEO Rod Humphris said on Tuesday.

The Mining division achieved a lower operating profit of R526-million for the financial year ended March 31, down 27% year-on-year, owing to lower volumes being mined, while price pressures led most mines to reduce output and cut expenditure on explosives and services, he noted at a presentation of the group’s results, in Johannesburg.

Continued low commodity prices also caused most mines to seek a price reduction, through renegotiations with current suppliers or through tenders with potential new suppliers, and to reduce output volume and expenditure on explosives and services.

“Overall, market conditions remain challenging, affected by softer demand in mining and minerals across Africa, especially in gold, platinum, copper and iron-ore; reduced mining activity in coal, uranium, vanadium, gold and platinum; and reduced greenfield activity in sub-Saharan Africa and brownfield expansions at existing mines,” Humphris acknowledged.

Further, market oversupply and customer focus on pricing had led to increased price competition, which, in turn, resulted in lower margins. To counteract this impact, Omnia implemented various internal initiatives and projects to reduce the cost of final products sold to customers.

While the weakening rand was positive for explosives supplier BME’s South Africa sourced and manufactured products sold into Africa, it was negative for inputs bought in dollars. Average sales prices increased 2%, mainly as a result of the weaker rand.

Net working capital was well controlled and decreased to R842-million as a result of the reduction in overall sales revenue.

Further, the division’s total revenue decreased by 15% to R4.55-billion on the back of a 17% reduction in volumes.

Humphris attributed the loss in volumes and its impact on the explosives business in the Mining division in particular to the loss of two major contracts – the Optimum Coal mine contract and a major mine contract in West Africa – in the fourth quarter of the 2015 financial year. Excluding the year-on-year effect of these lost contracts, the current year’s volumes would only be down by 5%.

Nevertheless, the division continued to find opportunities and had recently been successful in securing large volumes in the Copperbelt of Zambia, which would impact on the 2017 financial year’s results, Humphris said. He added that Omnia’s Mining division was “well placed” to respond to an improvement in market conditions.

Despite the demand for explosives in South Africa and in Africa being “hard hit” in the past two years, BME had secured a number of large contracts, which was expected to have a favourable impact in the new financial year. This would also assist in restoring the division’s level of profitability, as well as have a positive impact on the Agriculture division, owing to higher production throughput and lower unit costs.

“Additionally, BME’s electronic detonators continue to grow in volume,” Humphris said, highlighting the group’s world record blast at the Daunia opencut coal mine in Queensland, Australia, where the Axxis digital detonation system and 5 665 electronic delay detonators were used.

Other new markets included high-tech precision blasting applications, such as that used in the city of Singapore for the construction of its mass rapid transport rail system.

Humphris added that the use of emulsion application systems underground, which were introduced about a year ago, was a “fantastic new area for development for underground markets”.

Highlighting the growth opportunities in the mining business, Humpris said the group would increasely concentrate on underground initiation systems and electronic detonators, as well as continue the roll-out of the portable emulsion systems for the underground markets.

Protea Mining Chemicals continued to perform above expectation as it increased its footprint in Africa and was budgeted to have another year of growth, building on the considerable improvement in earnings achieved in the 2016 financial year.

While the division would continue to build on the benefits of the restructured business model and new information technology platforms, it still faced considerable pressure on margins and volumes, Humphris said.

Nevertheless, new developments in the division included the introduction of new mining chemicals products in Southern African markets, as well as the implementation of a long-distance sulphuric acid logistics solution in Namibia.

Omnia’s business development team was also focusing on raw material backward integration opportunities, potential acquisitions and energy projects.

“Our very strong balance sheet will allow us to consider investment opportunities, some of which are already at an advanced stage of investigation and analysis,” Humphris said.

FINANCIAL PERFORMANCE

Omnia’s overall revenue remained flat at R16.8-billion, based on an improved performance by the Agriculture division which was offset by weaker performances in the Mining and Chemicals divisions, as a result of the general slowdown in both sectors.

Gross profit for the year under review decreased by 14% to R3.41-billion, compared with R3.94-billion in 2015, owing to lower volumes in all three divisions and competitive pricing in the mining sector. Operating profit fell 19% year-on-year to R1.19-billion, while headline earnings a share dropped 29% to R10.33.

Profit after tax decreased 25% to R702-million, as a result of the lower operating profit, which was still commendable under the tough macroeconomic environment, Humphris said.

The group’s balance sheet remained ungeared, while cash generated was up by R1.3-billion to R2.3-billion.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation