Ewoyaa lithium project, Ghana – update

Photo by Atlantic Minerals

Name of the Project

Ewoyaa lithium project.

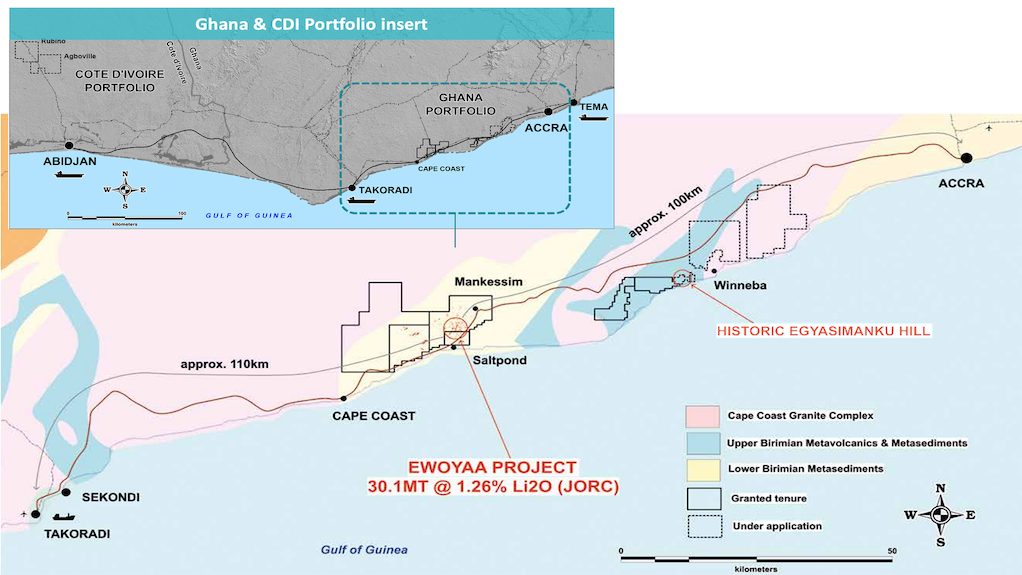

Location

Ghana.

Project Owner/s

Aim-listed lithium explorer and developer Atlantic Minerals. Piedmont has an earn-in right of 50% of Atlantic’s Ghanaian projects, including Ewoyaa, and the company holds a 10% equity interest in lithium explorer Atlantic Lithium.

Project Description

Ewoyaa has probable reserves of 25.6-million tonnes grading at 1.22% lithium oxide. Total mineral resources are estimated at 35.3-million tonnes grading at 1.25% lithium oxide.

Over the 12-year life-of-mine, the project is expected to produce 3.58-million tonnes a year of 6% and 5.5% spodumene concentrate, as well as 4.7-million tonnes of secondary product as a by-product of dense-media separation (DMS).

Development involves the opencut mining of several lithium-bearing pegmatite deposits, conventional DMS processing and supporting infrastructure.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $1.5-billion and an internal rate of return of 105%, with a payback of 19 months.

Capital Expenditure

$185-million.

Planned Start/End Date

Production of spodumene concentrate and secondary product are targeted for the second quarter of 2025.

Latest Developments

Atlantic Lithium has launched funding discussions with potential offtake partners to secure the last of the funding required to develop the Ewoyaa lithium project.

Atlantic announced a nonbinding heads of terms with Ghana’s Minerals Income Investment Fund (MIIF) on September 8, which would potentially invest $32.9-million in Atlantic and its Ghanaian subsidiaries to support the development of the project.

MIIF will invest an initial $27.9-million to acquire a 6% contributing interest in the Ghana portfolio, including the Ewoyaa project, with funding comprising development, exploration and study expenditure.

MIIF will also subscribe for more than 19.24-million shares in Atlantic Lithium, to the value of $5-million, for a 3.05% share in the company. This will entitle MIIF to nominate one person to each of Atlantic’s Ghanaian subsidiary boards while granting to fund one warrant for every two Atlantic Lithium shares subscribed for at a 40% premium to the subscription price of 25.98c a share.

The agreement will enable MIIF to participate in the competitive process for Ewoyaa's remaining available offtake.

The deal with the MIIF comes shortly after lithium developer Piedmont Lithium confirmed that it would continue with its earn-in into Ewoyaa.

As part of a staged investment agreement to earn a 50% interest in Atlantic’s spodumene projects in Ghana, Piedmont has exercised its option to acquire an initial 22.5% interest to fast-track the development of the project.

To earn the full 50% interest in Atlantic’s Ghana portfolio, Piedmont will sole-fund the first $70-million, and 50% of any additional development expenditure, towards the total $185-million development expenditure for the project indicated in the definitive feasibility study (DFS).

Piedmont has now earned its initial 22.5% interest in the project by sole-funding $5-million towards a regional exploration programme, and a further $12-million towards the delivery of a prefeasibility study and DFS.

Piedmont will now self-fund a further $70-million to earn an additional 27.5% interest in the Ghana portfolio, taking its total interest to 50%.

Piedmont’s share of production from Ewoyaa is expected to feed its $809-million Tennessee lithium project, in the US, which is expected to produce 30 000 t/y of lithium hydroxide over an operating life of 30 years.

Speaking on the sidelines of Paydirt’s Africa Downunder conference, Atlantic CEO Keith Muller told Mining Weekly Online that Atlantic has now appointed an investment bank to run an offtake process on the remaining Ewoyaa production to fund the capital gap to allow for its development.

“We have around 86 interested parties that will be approached, and this will be narrowed down to around ten in the first round of discussions,” Muller said.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Atlantic Minerals, tel +61 2 8072 0640 or email info@atlanticlithium.com.au.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation