Ewoyaa lithium project, Ghana – update

Photo by Atlantic Minerals

Name of the Project

Ewoyaa lithium project.

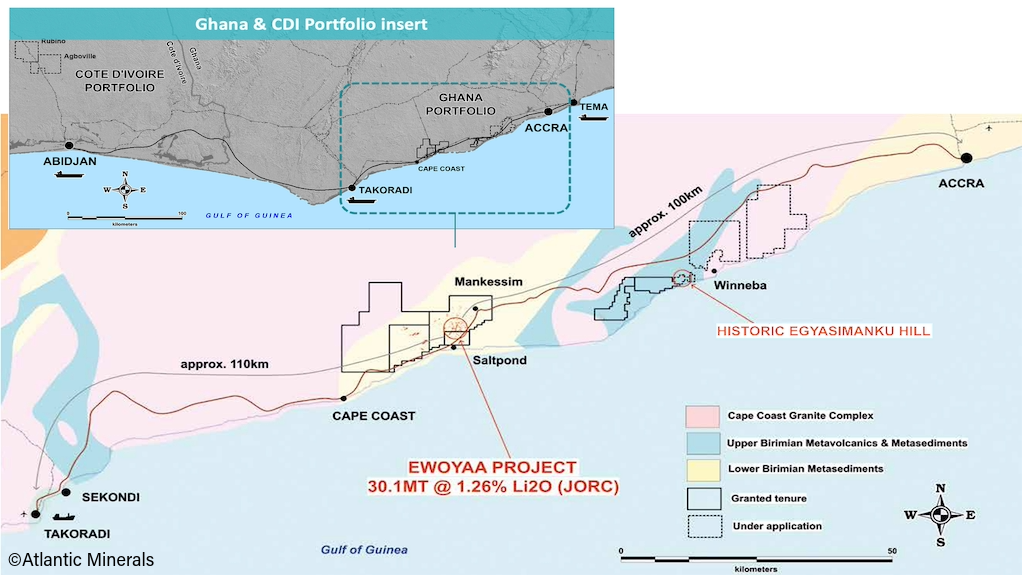

Location

Ghana.

Project Owner/s

Aim-listed lithium explorer and developer Atlantic Minerals. Piedmont has an earn-in right of 50% of Atlantic’s Ghanaian projects, including Ewoyaa, and the company holds a 10% equity interest in lithium explorer Atlantic Lithium.

Project Description

The Ewoyaa project is set to be Ghana’s first lithium-producing mine.

Over the 12-year life-of-mine, the project is expected to produce 3.58-million tonnes a year of 6% and 5.5% spodumene concentrate, as well as 4.7-million tonnes of secondary product as a by-product of dense-media separation (DMS).

Development involves the opencut mining of several lithium-bearing pegmatite deposits, conventional DMS processing and supporting infrastructure.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an 8% discount rate, of $1.5-billion and an internal rate of return of 105%, with a payback of 19 months.

Capital Expenditure

$185-million.

Planned Start/End Date

Production of spodumene concentrate and secondary product is targeted for the second quarter of 2025.

Latest Developments

Atlantic Lithium has secured funding of up to £28-million through binding agreements with Long State Investments to advance the project. The financing package includes an £8-million share placement agreement and a £20-million committed equity facility, both spanning 24 months and structured to provide the company with flexibility while minimising shareholder dilution. An initial placement of £2-million has been raised, with further tranches available at the company’s discretion.

Atlantic Lithium CEO Keith Muller has said the agreements provide immediate and longer-term financial support, strengthening the company’s position during a critical stage of development. Long State’s participation, through Patras Capital, underscores its confidence in the project’s strategic importance and growth potential.

The company plans to hold an extraordinary general meeting in October 2025 to secure shareholder approval for the facility-related share and warrant issuances. Major shareholder Assore International Holdings has pledged support for the resolutions.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Atlantic Minerals, tel +61 2 8072 0640 or email info@atlanticlithium.com.au.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation