Fortescue expands in copper with Alta buy

The Cañariaco project hosts reported measured and indicated mineral resources of 1.1-billion tonnes at 0.42% copper-equivalent.

Australian miner Fortescue on Monday announced that it would acquire the remaining 64% of Canada-listed Alta Copper in a cash transaction that valued the copper developer at C$139-million, advancing its strategy to build a global copper portfolio.

Under a binding agreement, Fortescue would acquire the shares it did not already own in Alta Copper through a Canadian plan of arrangement, offering cash consideration of C$1.40 a share. The offer represents a 50% premium to Alta Copper’s 30-day volume-weighted average price (VWAP) and a 100% premium to the VWAP prior to the start of exclusive negotiations between the parties in November.

Fortescue currently holds about 36% of Alta Copper’s issued common shares and will acquire the balance through its wholly owned subsidiary, Nascent Exploration.

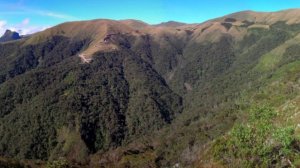

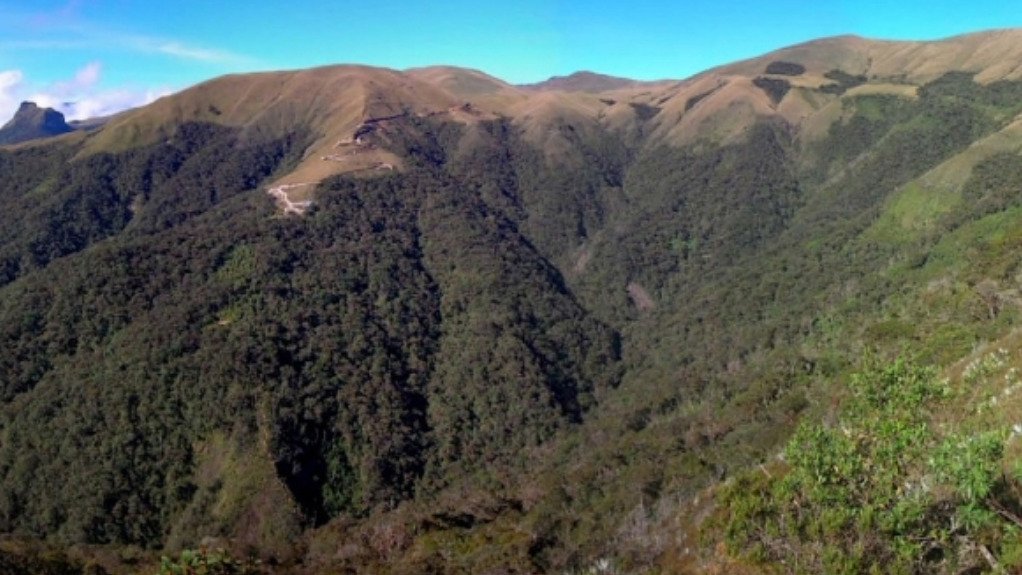

Alta Copper owns 100% of the Cañariaco copper project in northern Peru, located within an emerging porphyry belt that hosts a number of large exploration and development opportunities. The project covers about 91 km2 and includes the Cañariaco Norte and Cañariaco Sur deposits, as well as the Quebrada Verde prospect.

The Cañariaco project hosts reported measured and indicated mineral resources of 1.1-billion tonnes at 0.42% copper-equivalent, with a further 0.9-billion tonnes at 0.29% copper-equivalent in inferred resources. A preliminary economic assessment completed in June last year outlined the potential for a long-life copper operation.

Fortescue said the transaction aligned with its critical minerals strategy, which prioritised the expansion of its copper portfolio and related exploration footprint. The company believes it is well positioned to advance the Cañariaco project, drawing on its established presence in Latin America since 2018, as well as its technical, permitting and community engagement capabilities.

Alta Copper’s board of directors and special committee have unanimously recommended that shareholders vote in favour of the transaction. Directors, officers and other shareholders representing about 12.5% of the issued shares have entered into voting support agreements backing the deal.

The transaction would require approval from Alta Copper shareholders at a meeting expected to be held in January, as well as court approval and other customary closing conditions.

Subject to these approvals, the transaction is targeted to close in the March quarter of 2026.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation