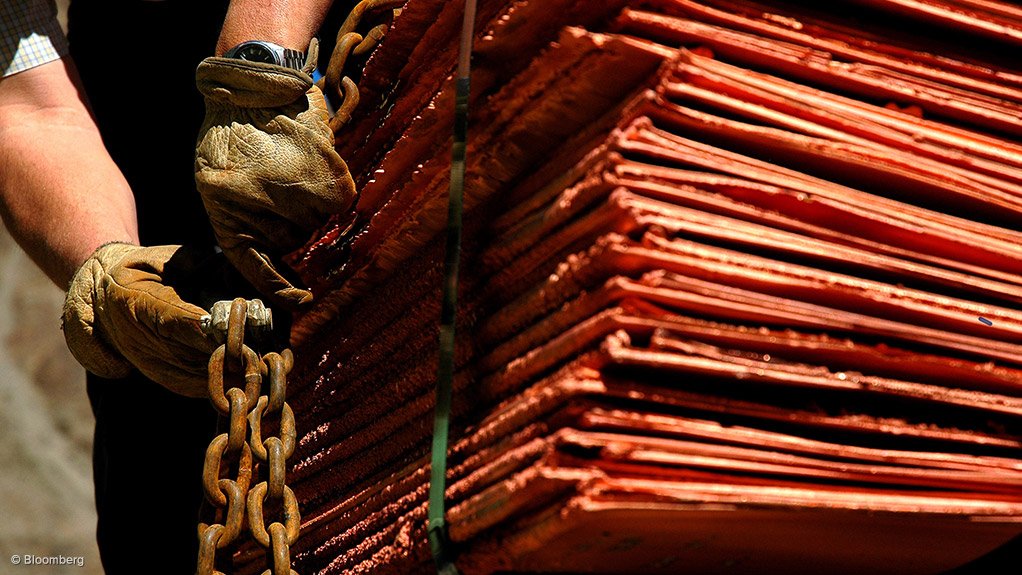

Global copper exchange stocks top 1Mt for first time in two decades

Copper stocks on the world's three biggest metal exchanges have exceeded one-million metric tons for the first time in more than two decades, as an inventory build due to soft demand in China adds to recent stockpiling in the United States.

Combined copper stocks on the US Comex exchange HG-STX-COMEX, London Metal Exchange and the Shanghai Futures Exchange are at 1 012 065 tons, LSEG data showed on Friday, after the LME and ShFE reported further inflows.

The total is the highest since August 2003 and equivalent to around 3.5% of annual global refined copper consumption of 28.7-million tons, as estimated by the International Copper Study Group for 2026.

ShFE stocks CU-STX-SGHrose 9.5% from last week to an 18-month high of 272 475 tons on Friday, with consumption in top copper user China quiet ahead of the Lunar New Year break next week.

"You're not actually getting real physical demand. If anything it's been restocking out over there," said Sucden Financial senior broker Robert Montefusco. "I think a lot of the physical guys had to step in and purchase or keep stock purely because it looked like the price was running away."

LME copper CMCU3 hit a record high of $14 527.50 a ton on January 29.

More than half the global inventories, 535 715 tons, are on the Comex HG-STX-COMEX, whose copper warehouses are located solely in the United States. Large amounts of metal have flowed to the U.S. the past year ahead of the possible imposition of import tariffs from 2027.

Recently, however, the Comex stock build has levelled off as LME prices trade higher LMECMXCUH6 and draw more metal into LME sheds instead. Copper stocks MCU-STOCKS on the LME, which has warehouses around the world, are the highest since April at 203,875 tons.

There was a 1 824-ton decrease in Comex stocks on Wednesday, the first dip since late October, with most of the outflows from Baltimore, exchange data showed.

"There is a lot of stock moving from Baltimore, going from one warehouse to another," Montefusco said, adding that he did not see any major drawdown in Comex stocks before there is clarity on US tariffs.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation