Half of Waterberg pre-construction work complete while PTM mulls development options

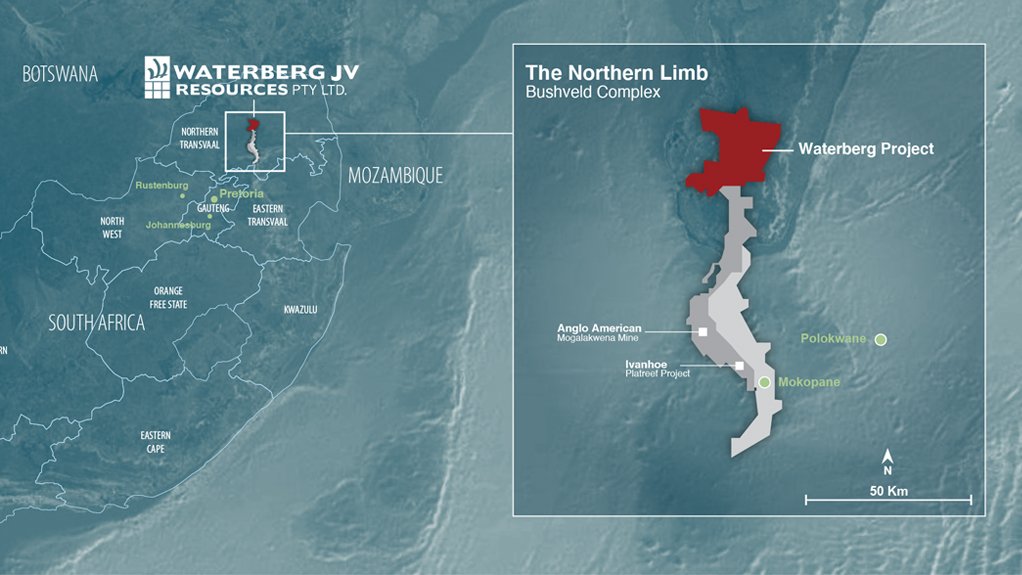

TSX-listed Platinum Group Metals (PTM) says its primary business objective remains to advance the Waterberg project in South Africa’s Bushveld Complex to a development and construction decision.

The company advises that about half of a $21-million pre-construction programme remains to be completed on site, including work on initial road access, water supply, a first-phase accommodation lodge, construction power supply and a social and labour plan (SLP).

Remaining components are being undertaken in phases as incremental budgets are approved. The “stage six budget” allows for the continuation of this work during the period to August 31 this year.

Ideally, arrangements for Waterberg project concentrate offtake or processing will be in place before a construction decision is undertaken, PTM states.

The company and its joint venture partners are assessing commercial alternatives for mine development financing and concentrate offtake.

As part of investigating smelting and refining options for base metals, PTM has engaged with all of South Africa’s integrated producers, including Impala Platinum (Implats), with a view to negotiate formal concentrate offtake agreements for the project.

Alternatively, PTM has studied and proposed the establishment of smelter and base metal refinery facilities located in either Saudi Arabia or South Africa.

“Before any processing of materials in Saudi Arabia could occur, however, South African government authorisation for the export of concentrate or matte would be required, and such approval has been requested,” PTM notes.

Government officials have, however, communicated their preference that beneficiation occur in South Africa.

PTM is therefore also investigating opportunities to collaborate and co-invest with smaller furnace operators in South Africa who are interested in modifying and expanding their existing operations such that the efficient processing of Waterberg concentrate can be undertaken.

In such a scenario the Waterberg project could be developed in stages so that smelting capacity could also be developed in stages.

The base case for mine development in the updated Waterberg definitive feasibility study (DFS) is focused on lower cost, bulk mining of F-Zone material from the F-Central deposit, followed by later mining from the T-Zone.

Although no decision has been made to alter the base case scenario, given the current price and outlook for gold, one concept being investigated is to begin staged development at the Waterberg project, first with decline development into the T-Zone, followed by smaller-scale T-Zone mining and then later expansion into the F-Central deposit at the scale planned in the Waterberg DFS.

As compared to F-Central ore, proven and probable reserves for the T-Zone have a more favourable split of platinum group metals.

The F-Central deposit, with true mining widths (hanging wall to footwall) of up to 107 m, and with about 87% of production planned from mining widths more than 15 m, is very amenable to low-cost bulk mining.

The T-Zone, with about 92% of production planned from mining widths between 2.4 m and 15 m, and 8% from areas up to 20 m thick, also allows for bulk mining albeit at a higher cost per tonne compared to the F-Central deposit.

At current metal prices, increased revenue per tonne from mining the T-Zone would more than offset higher mining costs and may allow for a lower capital expenditure and a staged development approach.

PTM confirms that internal studies are examining the financial impact of deferring capital for power lines, paste backfill, milling capacity and underground conveyors, while first operating a T-Zone mine before using free cash flow to then develop a second stage F-Central mine.

T-Zone ore and waste can be trucked to surface for processing during initial mining stages, allowing for a shortened ore build-up period and a reduced capital footprint in both underground development and other underground infrastructure requirements.

Meanwhile, the company continues to work closely with regional and local communities and their leadership on mine development plans to achieve optimal outcomes and best value for all stakeholders.

A new five-year SLP starting this year has been developed with community input and submitted to government for review and approval.

PTM also continues to advance an initiative through Lion Battery Technologies using platinum and palladium in lithium battery technologies in collaboration with an affiliate of Valterra Platinum and Florida International University.

“The investment in Lion creates a potential vertical integration with a broader industrial market development strategy to bring new technologies to market utilising the catalytic properties of platinum and palladium,” PTM notes.

PTM and Valterra are currently assessing progress to date and potential next steps towards the commercialisation and promulgation of the developed technology.

As of November 30, 2025, Waterberg is owned 37.32% by PTM, 26% by Mnombo Wethu Consultants, 21.95% by HJ Platinum Metals and 14.7% by Implats. In turn, PTM holds a further 12.97% direct interest in the Waterberg project through a 49.9% interest in Mnombo.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation