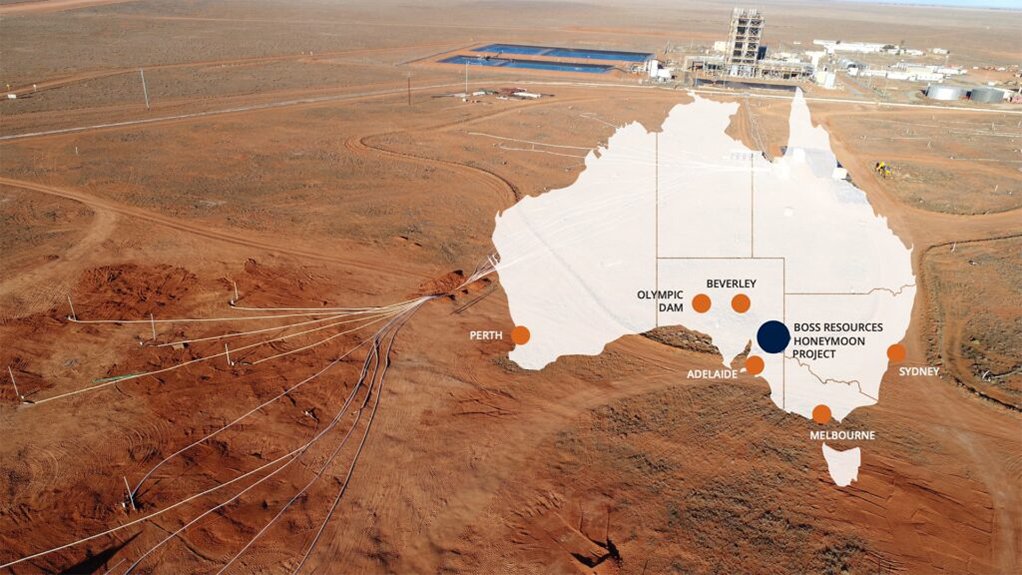

Honeymoon uranium restart project, Australia – update

Name of the Project

Honeymoon uranium restart project.

Location

South Australia.

Project Owner/s

ASX-listed Boss Energy.

Project Description

An enhanced feasibility study on the project has resulted in a 22.5% increase in production capacity, compared with a 2020 feasibility study on the project.

The project comprises two main exploration areas – the Eastern and Western tenement regions – with one granted Mining Lease 6109 totalling a 2 595 km2 tenement package.

The enhanced feasibility study was based on revised capital and operating estimates, a revised wellfield design plan and revised economic assumptions reflecting continued improvement in the outlook.

The study is based on using only 36-million pounds of the project’s global Joint Ore Reserves Committee-compliant resource of 71.6-million pounds.

The study proposes the removal of the existing solvent-extraction (SX) plant and replacing it with ion-exchange (IX) capacity. IX will be used as the only uranium-recovery technology in two stages to match the wellfield development schedule.

The startup phase will produce 1.63-million pounds of uranium in Year 2. Works for this phase include replacing the existing SX processing facility with three NIMCIX trains.

Additionally, various modifications will be made to improve performance in the leach liquor, precipitation, drying and packaging circuits to allow for the production of uranium by replacing the existing vacuum dryers with a calciner kiln.

The ramp-up IX circuit will mirror the startup NIMCIX circuit.

In the ramp-up phase, production will increase to 2.45-million pounds a year in Year 3, with the installation of a duplicate IX facility that will operate in parallel with the startup IX facility.

Life-of-mine production has increased from 20.74-million pounds in the 2020 feasibility study to 21.81-million pounds in the enhanced feasibility study.

The project’s mine life has decreased from 12 to 11 years.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The enhanced feasibility study estimates a pretax net present value, at an 8% discount rate, of $308.75-million, an increase of 35%, compared with the 2020 feasibility study.

The internal rate of return is estimated at 47.1%, compared with 51.4% in the 2020 feasibility study.

Payback has decreased from four years in the 2020 feasibility study to 3.5 years in the enhanced feasibility study.

Capital Expenditure

The cost of the project has increased from $69.98-million to $80.01-million.

Planned Start/End Date

Not stated.

Latest Developments

Boss Resources plans to start a seismic reflection programme to increase the inventory at its Honeymoon uranium project.

This new, innovative method of seismic acquisition is low-cost, low-impact and quicker than drilling, the company has said, and will be used to identify likely uranium-bearing sediments within known mineralised palaeochannels ahead of a forthcoming drilling campaign. This will enable the company to reduce the number of drill holes required to locate additional resources, streamline ground-based workflows and preserve exploration funds.

Key Contracts, Suppliers and Consultants

GR Engineering Services (process plant redesign); AMC Consultants (mineral resources estimate); Australian Nuclear Science and Technology Organisation Minerals Laboratories (supporting testwork for the optimised NIMCIX and elution design); Groundwater Science (wellfield design and production scheduling); Inception Group (in situ recovery support); and Infinity Corporate Finance (financial modelling services).

Contact Details for Project Information

Boss Energy, tel +61 61 8 9388 1474 or email info@readcorporate.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation