Impairments dent Sentula revenue as asset offloads advance

JOHANNESBURG (miningweekly.com) – As Sentula Mining continues to advance its asset divestment strategy to narrow its debt profile, the mining services provider said on Thursday that impairments were largely to blame for a 24% slip in revenue to R1.5-billion for the year ended March 31.

“Our initiatives to dispose of noncore assets are well advanced and will provide the group with the ability to extinguish its residual historic debt and to focus on growing its suite of diversified mining services businesses,” CEO Robin Berry said during a media conference call.

Group earnings were most significantly impacted by a provision for slow-moving inventory at its Benicon Sales business of R40-million, a R69-million impairment of plant and equipment at drilling subsidiary Geosearch and a R375-million impairment on mineral rights held for sale, owing to the disposal of its Benicon Coal and Benicon Mining businesses.

This followed an earlier announcement in which the company said it would dispose of all its coal assets to settle an outstanding debt obligation, while a downturn in the exploration-drilling sector had led to the company embarking on a further “rationalisation” of this segment.

“In addition, a goodwill impairment of R35-million relating to our hard rock opencast miner CCT, as well as retrenchment and restructuring costs of R12-million, further dented earnings,” noted Berry.

The company added, however, that the consolidation of its mining services business and asset offload had significantly reduced its net debt by R203-million.

Meanwhile, the loss from operating activities improved by 79% to R176-million for the period, while the basic loss a share from continuing operations decreased to 47.7c and headline loss a share increased to 43.7c.

The board did not declare a dividend for the period.

MINING SERVICES FOCUS

Aligned with its strategy, the provision of a suite of diversified mining services would now form the core of Sentula’s business. The five remaining subsidiaries continued to operate “satisfactorily” in one of the three contracted mining-related service provision areas, broadly defined as opencast mining, mobile crane hire and exploration drilling.

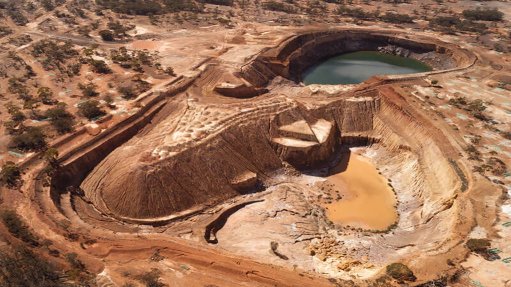

In the opencast mining services division, the bulk earthmoving businesses of Benicon Opencast Mining and CCT, supported by drillers JEF Drill and Blast, witnessed “stable” demand for their services.

“However, tough trading conditions continued and margins remained under pressure across the opencast mining contracting sector,” said Berry, adding that the consolidation of operations in Benicon and the extraction of operating synergies with CCT had created a base to re-establish the margins in these entities.

JEF Drill and Blast had, meanwhile, continued to sustain its revenue and profit base during the year and remained well-positioned to deliver sustainable earnings at current margins, as it continued to pursue opportunities to diversify its commodity and geographic exposure.

“All three businesses have their capacity contracted for the duration of the 2015 financial year,” the company stated.

The group’s mobile crane hire business Ritchie, meanwhile, continued to grow its revenue base, while maintaining margin, in line with further capacity investment. The range of mobile cranes in its fleet, in conjunction with increased visibility of work associated with a greater reliance on contracted services, had enabled the business to secure growth.

In Sentula’s exploration drilling division, the downturn in exploration in the platinum group metals sector had a significantly negative impact on Geosearch’s South African operations, leading to the downscaling and restructuring of these operations.

Negative sentiment and project delays with respect to coal investments in Mozambique also resulted in a further reduction in earnings and a scaling back of its Aguaterra operations.

“More recently, Geosearch has also seen a further reduction in the visibility of gold exploration activity, across its East, Central and West African operations. This has necessitated a further restructuring of its international operations and the consolidation of operating entities and the disposal of assets, where appropriate,” Berry explained.

VALUE DRIVER FOCUS

Despite “ongoing volatility across the entire resources sector” and the limited visibility of exploration work in the short term, he added that the company’s “firm” intention remained that of focusing on the value drivers in its diversified services business offerings.

To this end, Sentula’s strategy would continue to be delivered through the extraction of operating synergies and efficiencies associated with its opencast mining businesses, investment in opportunities to grow the “solid” drilling and blasting and mobile crane hire businesses and maintaining the group’s exploration hubs through prudent restructuring.

“The strategy is further enhanced through the finalisation of the disposal of the group’s stakes in various proprietary coal investments, for which processes for the key assets have already been well advanced,” Berry maintained.

Sentula’s “strategic association” with empowerment partner Thebe Mining Resources would continue to provide the group with a solid base for the development of the business into the future.

“We continue to explore opportunities with Thebe to unlock value across the group,” he said.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation