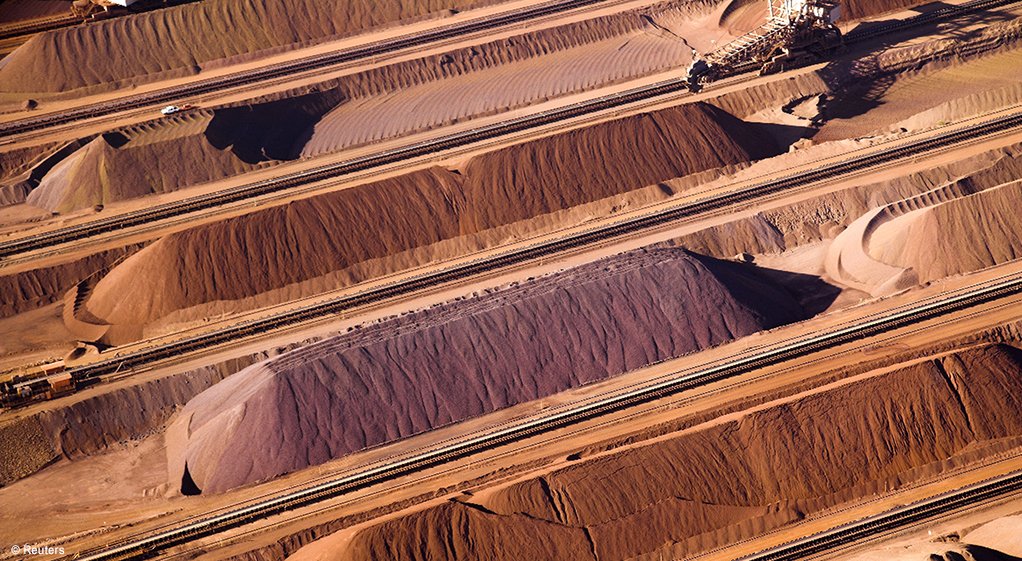

Iron-ore set for weekly decline on China's weakening property demand

Iron-ore futures slipped on Friday, on track for a weekly loss, as property demand in China weakened.

The most-traded January iron-ore contract on China's Dalian Commodity Exchange (DCE) DCIOcv1 traded 1.27% lower at 774.5 yuan ($107.83) a metric ton, as of 0328 GMT on Friday. The contract has lost 1.34% so far this week.

The benchmark September iron-ore SZZFU5 on the Singapore Exchange was 0.14% lower at $101.95 a ton. The contract has lost 0.2% so far this week.

China's crude steel output dipped to a seven-month low in July, down 4% from June and marking a second straight monthly decline. The decline reflects ongoing efforts to curb overcapacity, while high temperatures and heavy rainfall restricted outdoor construction activity.

China's new home prices fell 0.3% from the previous month in July, with demand remaining muted despite more local governments rolling out incentives for homebuying. At the same time, property investment declined 12% in the first seven months of the year from a year earlier.

However, the year-on-year declines are narrowing across tier-one, tier-two, and tier-three cities. The central government has maintained calls to stabilise the market in recent months, signalling the potential for further policy support.

Meanwhile, a pullback in steel output in recent months has improved the profitability of the sector, pushing margins for steel mills into positive territory and giving iron-ore prices room to push higher, ANZ analysts said.

Beijing's renewed focus on reducing overcapacity could see this rally being sustained, providing further support to iron-ore prices, ANZ said.

Other steelmaking ingredients on the DCE fell, with coking coal DJMcv1 and coke DCJcv1 down 0.45% and 0.03%, respectively.

Steel benchmarks on the Shanghai Futures Exchange all lost ground. Rebar SRBcv1 eased 0.81%, hot-rolled coil SHHCcv1 dipped 0.35%, wire rod SWRcv1 fell 0.7% and stainless steel SHSScv1 was down 0.69%.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation