Jaguar nickel sulphide project, Brazil – update

Photo by Centaurus Metals

Name of the Project

Jaguar nickel sulphide project.

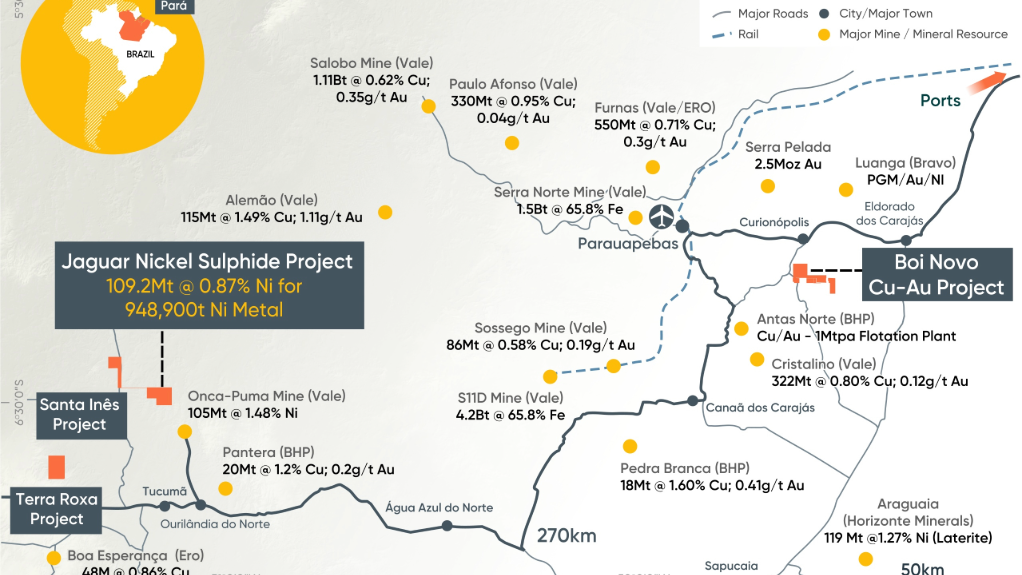

Location

Carajás, Brazil.

Project Owner/s

Centaurus Metals.

Project Description

Jaguar is currently one of the biggest undeveloped nickel sulphide projects worldwide and a highly strategic potential source of unencumbered nickel concentrate product, particularly for the electric vehicle battery supply chain.

The outcomes of a feasibility study have demonstrated the potential for the project to become a sustainable, long-term and low-cost producer of low-emission nickel for global markets.

The feasibility study only considers openpit nickel sulphide ore over an initial 18-year mine life, delivering nickel sulphide feed to a 3.5-million-tonne-a-year conventional nickel flotation plant to produce an estimated 18 700 t/y of recovered nickel metal. Total life-of-mine recovered nickel is estimated at 335 300 t.

Potential Job Creation

The development of Jaguar will provide job opportunities in and around the local municipalities. At peak construction, the workforce will comprise more than 1 200 people – 490 full-time operational personnel and about 630 mining contractor employees.

Net Present Value/Internal Rate of Return

The project delivers a pretax net present value, at an 8% discount rate, of $795-million and internal rate of return of 34%, with a payback of 2.5 years.

Capital Expenditure

Preproduction capital expenditure, including growth and contingency, is estimated at $371-million.

Planned Start/End Date

A final investment decision is targeted for the second half of 2025, based on the current environmental approvals and development timeline, with first production targeted for the second half of 2027.

Latest Developments

Centaurus Metals has announced a significant increase in the size and confidence levels of the mineral resource. The Jaguar mineral resource estimate includes the six Jaguar deposits, and two Onça deposits, along with the Tigre and Twister prospects.

The updated Joint Ore Reserve Committee- (Jorc-) compliant mineral resource estimate comprises 138.2-million tonnes at 0.87% nickel for 1.20-million tonnes of contained nickel.

The global mineral resource estimate at Jaguar has increased by 27% since the previous estimate announced in November 2022 and more than doubled since the company’s maiden estimate was announced in June 2020.

The mineral resource estimate increase is underpinned by more than 80 000 m of new drilling from the successful 2023 Jaguar Deeps campaigns at Jaguar South and Onça Preta. It is also underpinned by resource development and regional exploration drilling that successfully identified mineralisation outside of the previous mineral resource estimate and resulted in a new nickel sulphide discovery at the Twister prospect.

Centaurus MD Darren Gordon has noted that the robust outcomes of the August mineral resource estimate update have confirmed the quality and scale of the deposit as the foundation for a large-scale, low-cost nickel sulphide development.

“The size and quality of the Jaguar nickel sulphide deposit is truly world-class. With the deposit now containing 1.2-million tonnes of nickel metal, the new mineral resource estimate sets Jaguar apart as the highest-grade undeveloped nickel sulphide deposit globally, with more than one-million tonnes of contained nickel metal and unencumbered off-take rights,” he said on August 5.

Importantly, the mineral resource estimate update contains a high-grade component of 36.1-million tonnes at 1.49% nickel for 537 900 t of contained nickel metal, which has been estimated using a 1% nickel cutoff, with 8.3-million tonnes at 1.52% nickel found less than 100 m from surface.

“With this high-quality mineralisation so close to surface, the company now has a great opportunity to develop a new mine schedule prior to final investment decision (FID) that focuses on a higher nickel grade and higher recoveries early in the mine life to improve operating margins, reduce the capital payback period and improve the already strong overall project economics delivered in the recently released feasibility study,” Gordon said.

Additionally, there are 21.5-million tonnes at 1.46% nickel for 313 000 t of contained nickel metal at a 1% nickel cutoff, situated below the current feasibility study pit designs, which the company believes can form the basis of a significant future underground development at Jaguar by focusing on the Jaguar South and Onça Preta deposits. The underground operation would potentially deliver high-grade nickel feed to the plant.

The new resource delivers an estimated 138.2-million tonnes at 0.87% nickel for 1.2-million tonnes of contained nickel, with the measured and indicated component of the resource growing to 112.6-million tonnes at 0.87% nickel for 978 900 t of contained nickel, representing more than 80% of the global mineral resource estimate.

There is a significant high-grade component in the Jaguar global mineral resource estimate of 36.1-million tonnes at 1.49% nickel for 537 900 t of contained nickel metal, which has been estimated using a 1% nickel cut-off grade across the total mineral resource.

Within the high-grade mineral resource estimate, an estimate of 8.3-million tonnes at 1.52% nickel for 125 400 t is located less than 100 m from surface. This demonstrates that near-surface high-grade resources are available to enable openpit operations to run at a higher nickel grade in the early years of mining to generate strong cash flows to support early capital payback.

To maintain consistency across the Jaguar mineral resource estimate updates, the reasonable prospects of eventual economic extraction as described by Jorc 2012, has been reported within a pit shell similar to that used for the November 2022 MRE.

The company is working towards an FID in the second quarter of 2025. Completion of the mining lease and installation licence approvals, and the company’s strategic partnering process, are the key determining factors in the timing of the FID. The company believes it should receive the installation licence in the fourth quarter, while the granting of the mining lease should be delivered in the first quarter of 2025.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Centaurus Metals, tel +61 8 6424 8420 or email office@centaurus.com.au.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation