JSE makes it easier to list, stay listed – Mokorosi

JSE Origination Head is interviewed by Engineering News & Mining Weekly’s Martin Creamer.

The Johannesburg Stock Exchange (JSE) has made it a lot easier to list on the JSE and to stay listed. Removed have been listing requirements that do not add investor protection but take a lot of time and effort.

Good market response was seen in October with the listing of Primary Healthcare Properties of the UK, which allows investors to have access to offshore markets while the shares remain categorised as local, owing to the nature of the inward listing.

“Investors are looking for excellent assets and so anybody thinking about listing is welcome to reach out to us. We'd love to hold your hand on that journey,” JSE origination and deals head Sam Mokorosi enthused to Mining Weekly in a Zoom interview. (Also watch attached Creamer Media video.)

Considerable educational-type work is being done by the JSE to incentivise non-institutional retail investors to invest in greater numbers on the exchange.

One of the challenges is that many small caps that do capture the imagination of retail investors, have reduced retail research coverage.

To overcome this, investor showcases that highlight the enticing aspects of small market capitalisation businesses have been introduced, along with the broadcasting of stock picks that remain on YouTube, as well as the clinching of a television partnership to provide ongoing visibility to listed companies. Interestingly, trading statistics and volumes typically increase around the timing of those shows.

What also needs to be highlighted are assets rich in environmental, social and governance (ESG) characteristics, which are attracting big and small investors.

Mining Weekly: Will South Africa ever be able to attract listings in the same way as mining jurisdictions such as Canada and Australia?

Mokorosi: Canada and Australia have a lot of things going for them, even though our mining activity is quite strong. The investor universe of Canada and Australia is very different from ours. It's very strong in retail investors, which are able to take risk with much smaller junior mining companies and exploration companies. But we are trying to copy some of the great things that that they have in Australia and Canada. Flow-through shares, for example, have been instrumental in bringing investment into exploration companies in Canada. That's something that we've been speaking to the regulators about to see if we can explore putting that in South Africa. Superannuation in Australia allows for some investors to use their pension to do some stock picking and that's been excellent for mining companies, specifically juniors and exploration companies, and that's something that we're exploring as well, to bring back that flurry of junior mining and exploration mining listings on to the JSE.

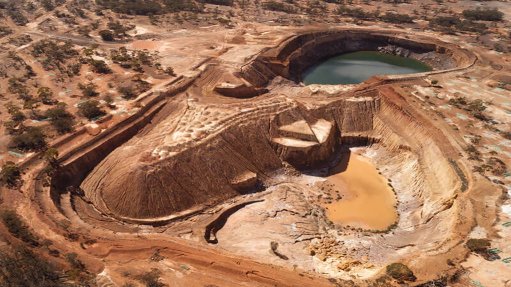

What drivers led to Copper 360 being able to list so successfully on the JSE's AltX this year?

Copper 360 is a really exciting story, tapping into some of the ESG, some of the green, and some of the electric vehicle (EV) movements that we're seeing all over the world. Renewable energy and EVs need a lot of copper and so I think investors saw the potential in Copper 360, which were able to raise funds, list, and be oversubscribed in their fund raise. It's really been good to see the developments in the company as they've increased their reserves and continued to grow as a company from a minerals perspective.

Had Copper 360 not committed itself to a listing, would it, in your view, have been able to raise the R152-million it was seeking?

It’s always hard to tell but what we hear from investors is that when you list – and that's whether listing debt or equity – you always broaden the number of investors that can look at you. Large asset managers struggle to invest in unlisted instruments because their mandates require a listing, so, certainly, we’re of the opinion that the listing did open up their universe of potential funders, because the investors that don't have a preference of whether you're listed or not, can participate in a listing, and then those investors that definitely need a listing, can then also participate in the listing, so it's all about broadening that base of potential investors.

Copper 360 is outspoken about its ambition to build Africa’s next copper giant “slowly from the ground up”. What can the JSE do now to help Copper 360 achieve that ambition?

We continue to present a platform and a marketplace where companies can raise more capital, so I think part of the winning combination is going to be living up to their promises in terms of production levels, and cost containment, and then really be an excellent operator in the markets. As it shows investors that it can deliver on its promises, time and time again, we've seen that the JSE is a place for companies not only to raise capital on listing, but secondary capital raises are quite frequent, and they can come back to the market and tap the market. We have a venue that allows for both bonds and equities. Whether it's looking for debt capital or listed equity capital, that remains available on the JSE.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation