Jubilee receives first payment from South African business sale

Aim- and AltX-listed Jubilee Metals has advised shareholders that the process to complete the sale of its South African chrome and platinum group metal (PGM) business continues after shareholders approved the deal on August 28, with the company having received a first payment tranche of $15-million.

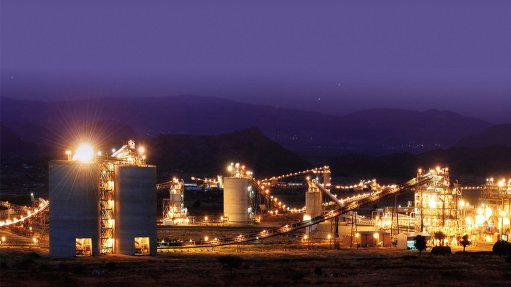

Jubilee announced early in June its decision to dispose of its chrome and PGM business in South Africa to focus fully on its Zambian operations, where the directors see material opportunities to deliver growth.

The company received a conditional binding offer from a private mining and metals trading company to acquire the South African chrome and PGM operations for up to $90-million, which would be paid through a combination of upfront cash and deferred cash over three years.

Jubilee and the buyer have made submissions to the South African Competition Commission for approval, while the last major condition precedent to the deal is audit related.

The company, which retains its investment in the Tjate platinum project, in South Africa, expects the sale of its other chrome and PGM assets to concluded by the end of the year.

The funds realised from the sale of the chrome and PGM business in South Africa is expected to ensure a steady flow of non-dilutive capital for the company, allowing for its three-pillar strategy to be pursued in Zambia.

According to its three-pillar strategy, Jubilee aims to be a long-term comprehensive copper producer at 25 000 t/y. The group aims to undertake exploration, mining, concentrating and cathode refining through its three distinct business units: Roan, Sable and its Large Waste Project, in Zambia.

The Roan operation comprises a processing facility of waste, tailings and previously mined material, with current production coming from bought run-of-mine material grading an average 1.65% copper. The material is mostly oxide copper with more than 85% of copper concentrate produced, which goes for further copper cathode refining at the Sable operation.

Roan’s production for the first quarter of the 2026 financial year is on track to reach 915 t of copper in concentrate.

Jubilee plans to add a dedicated copper leach circuit at the Roan facility targeting super fine oxide copper. The circuit will recover the very fine fraction that accounts for the majority of copper losses in Jubilee’s process.

The Sable refinery, in turn, is undergoing an expansion targeted for completion in the third quarter of the 2026 financial year. The expansion will accommodate increased production from the nearby Molefe mine, the Project G mine and other near-surface opportunities in the area.

Jubilee is progressing partner discussions for the Molefe mine for it to operate as a joint venture.

The company estimates $5.5-million of investment is still required at Sable, which the company will seek to fund from existing resources and from the proceeds of the South African assets sale.

The Sable refinery will be migrated closer to the Molefe and Project G mines to reduce transport costs. For now, Sable is being expanded to offer a yearly processing capacity of about 14 000 t of copper units, comprising 11 500 t of cathode and 2 500 t of copper-equivalent sulphide concentrate.

Meanwhile, the Large Waste project is undergoing an upgrade to its resource definition to improve the targeted ore reclamation mine design as well as the initial ore reclamation zone of the vast rock dump area.

Jubilee expects near final designs for the project will be completed by the end of the third quarter of the 2026 financial year. Discussions with a potential funding partner also continues, with Jubilee expecting the talks to be finalised before the end of December.

The group secured the rights to the Large Waste project through a purchase agreement of $18-million, of which 50% has been settled. Jubilee has been developing separation techniques to pre-classify the 240-million tonnes of surface material formed by historical mining activity on site.

Jubilee CEO Leon Coetzer says the three-pillar strategy offers flexibility to the group’s operations and supports a more robust business approach to withstand in-country risks, while offering growth opportunities.

“Our Roan operation is performing to plan, currently using about 30 000 t a month of the installed 45 000 t a month mill and float capacity to process previously mined materials grading an average 1.6% copper.

“We hold the option to increase throughput further through both increased processing of historical tailings material and the introduction of the new Roan front-end. Implementation of these options will only be considered after the seasonal change expected during the upcoming rainy season,” Coetzee explains.

The company will publish its operational results for the first quarter of the 2026 financial year in the next four weeks.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation