Kobada gold project, Mali – update

Photo by Toubani Resources

Name of the Project

Kobada gold project.

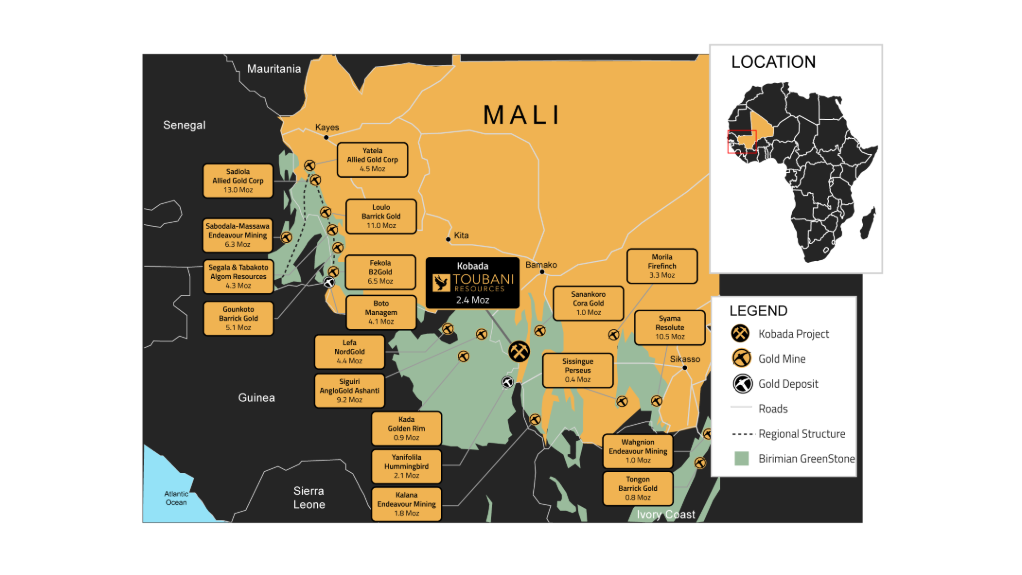

Location

Southern Mali.

Project Owner/s

Africa-focused gold developer Toubani Resources and 35% shareholder Eagle Eye Assets (EEA).

Project Description

A definitive feasibility study (DFS) completed in October 2024 has confirmed Kobada as a significant gold development asset underpinned by its large-scale, free-dig and open-pittable oxide resource.

The ore reserve estimate is 53.8-million tonnes at 0.90 g/t for 1.56-million ounces of gold.

The DFS proposes average production of 162 000 oz/y over the current 9.2-year life-of-mine for total gold production of 1.49-million ounces of gold.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $870-million and an internal rate of return of 72%, with a payback of 1.25 years.

Capital Expenditure

The October 2024 DFS estimates total initial development capital of $216-million.

Planned Start/End Date

First gold production is targeted for the third quarter of 2027.

Latest Developments

Toubani Resources has stated that operations at the project remain unaffected by recent fuel supply restrictions and security concerns reported in the country’s capital, Bamako.

Drilling activities are continuing as planned, with a second reverse-circulation rig expected on site shortly to accelerate anomaly testing and sterilisation programmes ahead of finalising infrastructure locations. Other project-readiness activities are advancing while the Bamako office continues to operate normally.

Following approval of the Kobada environmental- and social-impact assessment in October, Toubani is progressing with permitting activities, maintaining close engagement with authorities and stakeholders. The company has appointed Ausenco Services as its engineering, procurement and construction management contractor, with initial engineering work under way and long-lead orders placed.

Toubani's licence for the project remains in good standing, and discussions with Malian authorities on completing the investment framework are advancing.

In addition, Toubani shareholder EEA has reaffirmed its support.

“We look forward to supporting Toubani in progressing key project milestones in the near term and finalising its funding arrangements, which includes EEA’s significant A$70-million follow-on equity investment and $160-million gold stream.”

Upon completion of the funding package, Toubani expects to hold A$177-million in cash, before any drawdown from the $160-million gold stream.

Key Contracts, Suppliers and Consultants

Ausenco (engineering, procurement, and construction management contractor); Minxcon Group South Africa (mineral resource estimate); DRA Americas (mining and mineral reserves); Maelgwyn Mineral Services (metallurgical testwork); ABS-Africa (environmental and social studies); Epoch Resources (tailings storage facility); SENET (processing plant and infrastructure, including economic valuation and report compilation); Knight Piésold (DFS – tailings dam design and costing); Global Commodity Solutions (DFS – geology and exploration); Entech (DFS – mineral resources); Oreology (DFS – pit optimisations, mine design and mine scheduling); Minero Consulting (DFS – mining operating and capital cost estimation, and ore reserves); Lycopodium (DFS – metallurgical testwork review, process plant design, process plant operating and capital cost estimation); ABS Africa (DFS – environmental and social impact); Anandarasa Advisory (DFS – financial modelling); and Cantilever Future Solutions (DFS – study management and environmental, social and governance oversight); and Endeavour Financial (financial adviser).

Contact Details for Project Information

Toubani Resources, email info@africangoldgroup.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation