Los Azules copper project, Argentine – update

Photo by McEwen Mining

Name of the project

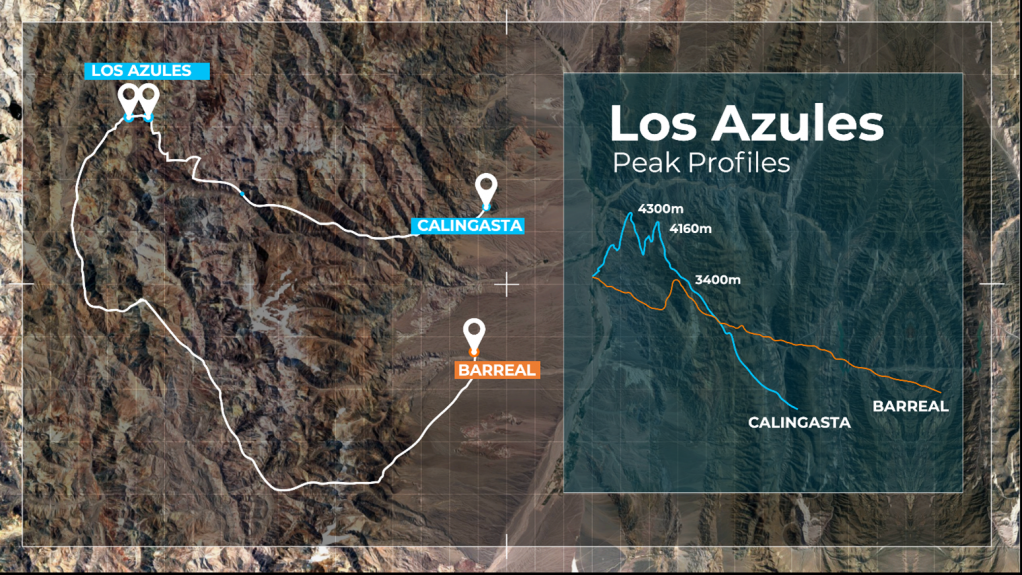

Los Azules copper project.

Location

San Juan province, Argentina.

Project Owner/s

McEwen Mining 46.4%, Stellantis 18.3%, Nuton 17.2%, Rob McEwen 12.7%, Victor Smorgon Group 3% and other shareholders 2%.

Project Description

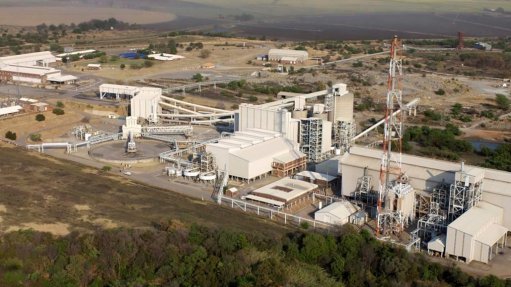

The large, high-grade openpit copper project has significant growth potential.

According to the updated preliminary economic assessment (PEA), completed in 2023, Los Azules is expected to produce an average of 322-million pounds of copper cathode a year over a 27-year life-of-mine.

The 2023 PEA financial model does not include potential future development phases focused on primary copper mineralisation found beneath the supergene copper.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an after-tax net present value, at an estimated 8% discount rate, of $2.66-billion and an internal rate of return of 21.2%, with a payback of 3.2 years.

Capital Expenditure

Initial capital expenditure is estimated at $2.46-billion in the base case.

Planned Start/End Date

Not stated.

Latest Developments

Nuton, a copper technology venture of Rio Tinto, has pumped $35-million into McEwen Copper.

McEwen previously announced a nonbrokered private placement financing of up to 2.34-million shares at $30 a share for up to $70-million. The first tranche was led by a $14-million investment by TSX-listed McEwen Mining and a $5-million investment by Rob McEwen.

In this second tranche of the offering, Nuton has acquired an additional 1.17-million common shares of McEwen Copper for $35-million. Two other investors have acquired 66 669 common shares for $2-million.

Following the closing of the second tranche, McEwen Copper has raised $56-million.

Nuton now owns 17.2% of McEwen Copper on a fully diluted basis. Following these share issuances, McEwen Copper will have 32.8-million shares outstanding, giving it an after-money market value of $984-million.

Proceeds from the offering will be used to advance ongoing work on the feasibility study, scheduled for publication in the first half of 2025.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

McEwen Mining +1 647 258 0395 or email info@mcewenmining.com.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation