Mina do Barroso lithium project, Portugal

Name of the Project

Mina do Barroso lithium project.

Location

The project is located near Boticas, in northern Portugal.

Project Owner/s

Savannah Resources.

Project Description

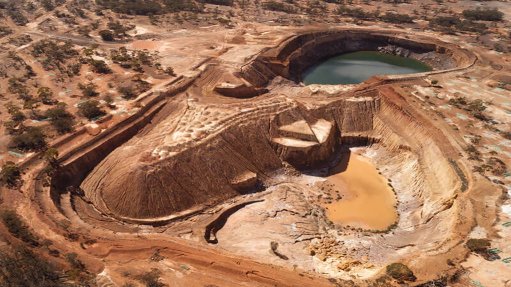

A scoping study has confirmed that Mina do Barroso has the potential to be a major European producer of spodumene lithium, with robust project economics and the potential to deliver substantial shareholder value.

The study is considered a base case for the project and is based on a mine and concentrator-only development for the production of spodumene concentrate.

The project will use a contract miner and fleet.

Conceptual openpit mine planning has been developed, targeting a plant feed rate of 1.3-million tonnes a year, with an estimated average life-of-mine (LoM) mill head grade of 1.02% (diluted) lithium oxide and an average overall strip ratio of 5.2:1 (waste:ore ratio). The project will have an LoM exceeding 11 years.

The flowsheet comprises a combined 1.3-million-tonne-a-year dense-media separation and flotation circuit, with an overall plant availability of 85% for the recovery of spodumene. The study estimates average production of 175 000 t/y of spodumene concentrate at 6% lithium oxide.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $356-million and an internal rate of return of 63.2%, with a payback of 1.7 years.

Capital Expenditure

Initial capital expenditure is estimated at $109-million.

Planned Start/End Date

Construction is expected to start in the second quarter of 2019, with production expected to start in the first quarter of 2020.

Latest Developments

Savannah Resources has added to its flagship Mina do Barroso project by exercising its option to acquire the adjacent 2.94 km2 Aldeia mining lease.

The lease application comprises three blocks and has yielded “excellent drilling results”, with a mineral resource estimate of 3.5-million tonnes at 1.3% lithium oxide on Block A.

“The drilling on Block A has returned the highest grade lithium intercept associated with the Mina do Barroso project to date of 45 m at 1.67% lithium oxide, including 22 m at 2.00% lithium oxide,” Savannah Resources CEO David Archer has said.

The average grade for the initial resource estimate is also about 25% higher than the current average for the project.

“The Aldeia deposit also remains open to further resource expansion and bears many similar characteristics to the Grandao orebody, located just 2 km away,” Archer adds.

The company recently also bought out the minority 25% shareholding in Mina do Barroso.

Savannah says the payment structure of the deal is attractive, as the company will pay for the acquisition through instalments over a six-year period. These instalments will start once the current mining lease application has been approved and transferred to a Savannah subsidiary company.

The total purchase price for the acquisition of the proposed lease area (once granted) is €3.25-million. Once triggered, the agreed payment schedule consists of an initial €55 000 payment upon execution with the balance due in 71 equal monthly instalments.

Key Contracts and Suppliers

Hatch (engineering services); PayneGeo (geological model and resource estimations); Minesure (analysis and definition of the scoping level mining inventory and contractor costs); Primero Group (primary engineering group and lead manager for the feasibility study); Knight Piésold (lead geotechnical and hydrological engineering); Quadrant (consultant on transport and logistics requirements), Nagrom (assay and metallurgical testwork services), ALS (assay and metallurgical testwork services); VISA Consultores (environmental-impact statement assessment); CV&A Consultores and S317 Consulting (stakeholder management strategy, community engagement plan and sourcing of European Union funding); and Noah’s Rule (financial adviser).

On Budget and on Time?

Not stated.

Contact Details for Project Information

Savannah Resources, David Archer, tel +44 20 7117 2489.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation