Minerals Council welcomes small input cost decrease for the mining sector in May

Industry body Minerals Council South Africa says mining input costs rose by 6.6% year-on-year in May, marking a 0.6 percentage point decrease compared with April.

The decrease is a positive development, with May’s figure also having been below the first-quarter input cost increase of 6.9% year-on-year.

Additionally, Statistics South Africa’s Producer Price Index increased by 4.6% year-on-year in May, down from 5.1% in April.

Notably, input costs such as rubber products, transport equipment, imported intermediate products and mining and quarrying inputs were lower in May, compared with May last year, while labour, final manufactured costs, electricity, finance costs, petroleum and machinery costs increased.

The Minerals Council reports that the analysis of individual components contributing to total mining input cost inflation in May reveals persistently high inflation rates for electricity, which increased by 12.8% year-on-year.

This rise fully reflects the National Energy Regulator of South Africa’s approved increase of Eskom’s tariffs by 12.74% that became effective in April.

Costs for finance, insurance, real estate and business services remained elevated at 11.8% year-on-year, reflecting the increased cost of lending and trade financing.

Additionally, coke and refined petroleum costs rose by 9.2% year-on-year in May, driven primarily by an increase in Brent crude prices, which averaged $83.10/bl in May, compared with $75.80/bl in May 2023.

The increased cost of Brent crude translates to more expensive petrol, diesel and engine oils used in mining.

Machinery and equipment costs also increased by 7.1% year-on-year in May.

Conversely, various intermediate inputs, including other mined resources such as coal and metals used in extraction processes, decreased year-on-year in May. This 9.5% decline in mining and quarrying inputs has helped to reduce the overall input costs from this component over the past year.

Moreover, the strengthening of the nominal effective exchange rate helped to reduce the costs of imported intermediate inputs for the sector in May.

The price of transport and storage also decreased by 4.5% month-on-month in May, reflecting lower road freight costs and an improved payload income for freight transportation in the mining sector.

In May, the gold sector experienced the highest average increase in input cost inflation for the fifth consecutive month. The coal, other mining and quarrying, and platinum group metal sectors saw the next-fastest rises in input costs.

Looking ahead, the council expects electricity prices to continue trending upward, particularly as winter tariffs and local municipal tariff increases become effective.

While some inflationary pressure persists, particularly in energy and finance-related costs, the easing of other input costs and the favourable exchange rate movements, have contributed to a more balanced inflationary environment for the mining sector, it states.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

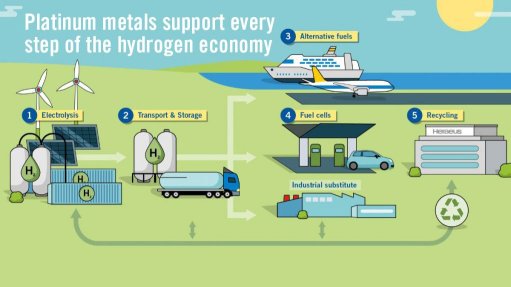

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation