Newmont sells Australian mine and project for $475m

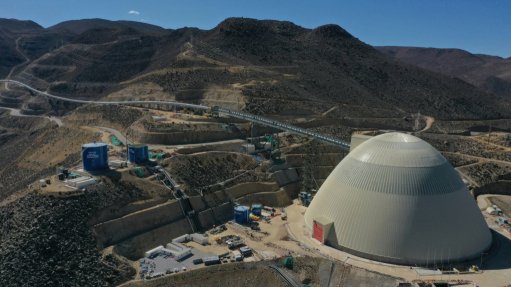

US-based mining giant Newmont on Tuesday announced the sale of its Telfer mine and a 70% interest in the Havieron gold/copper project in Western Australia for $475-million.

London-listed Greatland Gold will acquire the assets, which Newmont inherited through its acquisition of Newcrest last year. The transaction will mark the first sale under Newmont’s divesture plan announced in February.

“I am pleased that Telfer and Havieron are being sold to Greatland, a company with a highly experienced management team and board of directors. I have full confidence that the Greatland team will be outstanding stewards of these assets,” commented Newmont president and CEO Tom Palmer in a statement.

Under the terms of the agreement, Newmont expects to receive gross proceeds of up to $475-million, which includes a cash payment of $207.5-million due upon closing, equity consideration of $167.5-million in Greatland shares to be issued at closing, and deferred contingent cash consideration of up to $100-million, subject to future performance metrics.

Palmer said that, including the Telfer divestiture, Newmont remained on track to achieve at least $2-billion in total proceeds from the sale of its noncore assets.

Besides Telfer and its stake in Havieron, Newmont has placed another five mines and one project on the chopping block. These mines include Éléonore, Musselwhite and Porcupine, in Canada, CC&V, in the US and Akyem, in Ghana, as well as the Coffee project, in Canada.

Going forward, Newmont’s focus will be on six managed tier-one assets, including Boddington, Tanami, Cadia and Lihir, in Australia, Peñasquito, in Mexico, and Ahafo, in Ghana, as well as assets owned through two non-managed joint ventures at Nevada Gold Mines in the US and Pueblo Viejo in Dominican Republic.

With the expectation that the Greatland transaction would close in the fourth quarter of 2024, Newmont has made minor adjustments to its noncore gold and copper production guidance to reflect the Telfer divestiture, which was classified as ‘held for sale’ in Newmont’s financial statements.

Greatland MD Shaun Day said earlier this year that he would be interested in acquiring full ownership of the Havieron deposit that Greatland discovered in 2018. In terms of a joint venture agreement, Greatland had a right of last refusal in respect of any sale by Newmont.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation