Nyanzaga gold project, Tanzania

Photo by Perseus Mining

Name of the Project

Nyanzaga gold project (NGP).

Location

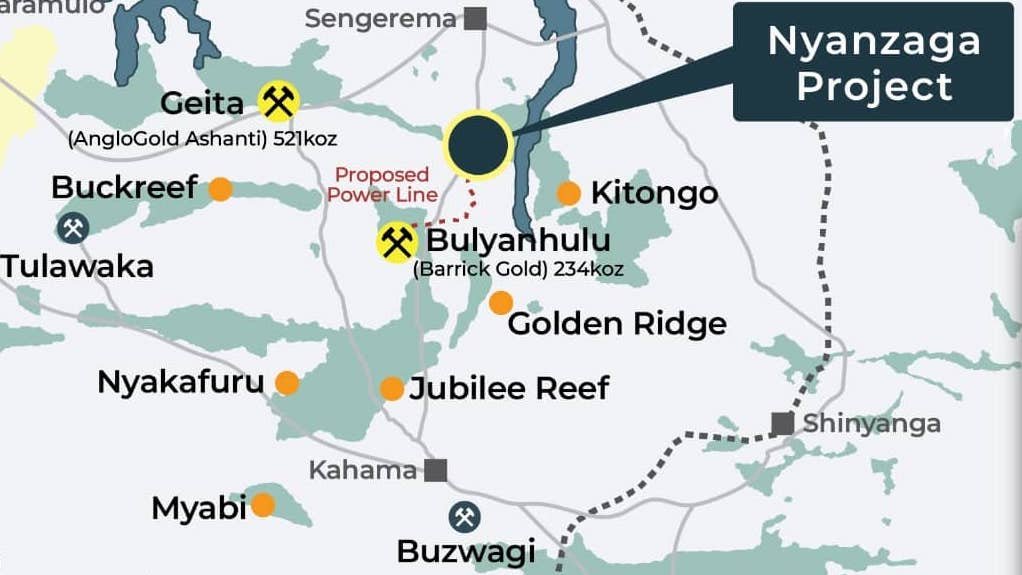

Lake Victoria Goldfields region, north-west Tanzania.

Project Owner/s

Africa-focused gold miner Perseus Mining.

Project Description

A final investment decision to proceed with the project was made in April 2025.

The NGP comprises the adjacent Nyanzaga and Kilimani deposits. The probable reserve is estimated as 52-million tonnes, grading 1.40 g/t gold and containing 2.3-million ounces of gold.

The updated feasibility study proposes gold production of more than 200 000 oz/y from 2028 to 2035, with peak production of 246 000 oz in the 2028 financial year.

Perseus plans to mine the Nyanzaga (Tusker) and Kilimani deposits using a large openpit, as opposed to the smaller openpit and underground mine concept considered in the previous feasibility study.

Openpit mining will be undertaken with medium- to large-scale off-highway equipment, including 180 t to 350 t class excavators and 90 t to 150 t class dump trucks.

Trucks haul ore to surface ore stockpiles, with waste being hauled to and disposed of in waste rock dumps. Front-end loaders will be used for stockpile rehandling.

Drill-and-blast practices will be used to break competent rock.

Drill-and-blast techniques, including presplit and trim shots, will be applied to minimise openpit wall damage, and blasting is proposed to be configured to minimise ore loss and waste dilution.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at a 10% discount rate, of $404-million and an internal rate of return of 26%.

Capital Expenditure

$523-million. This includes $49-million in contingency, and preproduction capital of $51-million.

Planned Start/End Date

The project is expected to produce first gold in the first quarter of 2027.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Perseus Mining, tel +61 8 6144 1700.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation