Peabody warns it may walk away from Anglo deal over Moranbah North uncertainty

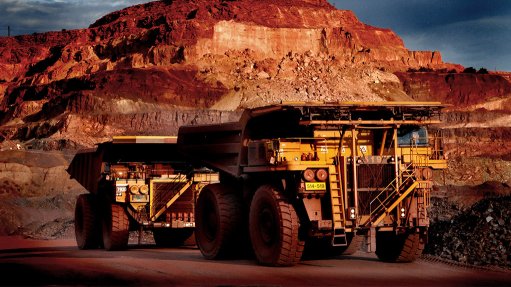

US-based Peabody Energy has issued a material adverse change notice to Johannesburg- and London-listed Anglo American related to its planned $3.78-billion acquisition of Anglo’s steelmaking coal assets.

The notice, announced on Monday, raises the possibility that the deal could be terminated if issues at the Moranbah North mine, in Australia's Queensland, are not resolved.

“While we have remained on track to complete the steelmaking coal acquisition from Anglo, the issues at Moranbah North have created significant uncertainty around the transaction,” Peabody president and CEO Jim Grech said in a statement.

“A substantial share of the acquisition value was associated with Moranbah North, yet there is no known timetable for resuming longwall production.”

Peabody warned last month that it was reviewing the deal to buy Anglo’s coal portfolio after workers at the Moranbah North mine, in Queensland, had to be evacuated owing to a fire on March 31.

If the situation is not resolved “to Peabody’s satisfaction in the limited timeframe specified under the companies' acquisition agreements”, the US coal miner may exercise its option to walk away from the transaction, the company stated.

Anglo American responded to the Peabody statement by saying that it did not believe the "small contained ignition" that resulted in the "controlled and safe withdrawal of personnel to the surface" should scupper the deal.

Anglo said in a statement that initial re-entry to Moranbah North mine was completed on April 19, and that it was continuing to work closely with the safety regulator, Resources Safety and Health Queensland, industry experts and other key stakeholders to progress towards a structured restart to longwall production.

"As a result of the progress made to date towards a safe restart and the information available, Anglo American does not believe that the stoppage at Moranbah North constitutes a material adverse change in accordance with the definitive agreements with Peabody. Anglo American expects to continue working with Peabody towards addressing its concerns and satisfying the remaining customary conditions in those agreements that are required for completion of the transaction," the company reported.

The sale of its steelmaking coal business is part of Anglo's broader effort to reshape its portfolio and exit carbon-intensive businesses. The company is seeking to divest coal, nickel, platinum and diamonds to focus on copper and iron-ore, in a pivot toward commodities more aligned with global energy transition goals.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation