Saudi's Manara in advanced talks to buy stake in First Quantum's Zambian mines

Saudi Arabia's Manara Minerals is closing in on a deal to buy a minority stake in Canadian miner First Quantum Minerals' Zambian copper and nickel assets, three people familiar with the details told Reuters.

Manara, a joint venture between Saudi Arabian mining company Ma'aden and its $925-billion Public Investment Fund, is in advanced talks to acquire between 15% and 20% equity in the Zambian assets, the sources said.

The stake could be worth between $1.5 billion and $2 billion, one of the sources added.

First Quantum's sale of a stake in the Zambian assets could be concluded by year-end, the sources said. There is no certainty that a deal will be signed as the negotiations are ongoing, they added.

Both First Quantum and Manara Minerals declined to comment on the sale.

The potential deal is in the spotlight as copper is a much sought-after element for the clean energy transition due to its uses in the manufacture of electric cars and data centers powering artificial intelligence.

First Quantum earlier this year said it was in talks with potential investors to sell a partial stake in the Zambian mines, while also exploring the sale of its Spanish mine Las Cruces to raise capital and cut debt after the Panama government ordered the shutdown of its flagship Cobre Panama mine.

Manara has emerged as a front runner for the purchase as the Saudi firm's strategy to acquire a minority interest fits with First Quantum's aim to retain a majority stake in the mines, said the sources, who did not wish to be quoted as they are not authorised to speak with media.

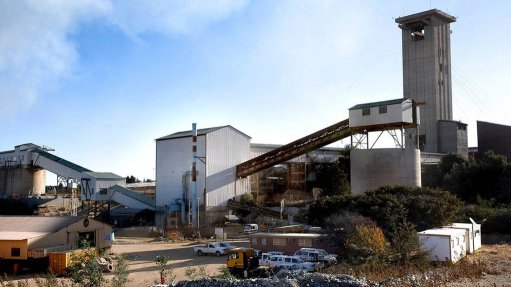

First Quantum owns the Kansanshi and Sentinel copper mines in Zambia, which have become key to future output after Cobre Panama's shutdown. First Quantum also owns the Enterprise nickel mine in the country.

"This is not a surprise - First Quantum has disclosed exploring a sale to shore up its balance sheet and the Saudis have been increasingly active in acquiring mining stakes," Citigroup analysts said in a note after Reuters' story.

First Quantum shares rose as much as 4.9% in early morning trade in Toronto.

The Zambian mines contributed $1.08 billion to First Quantum's revenue in the second quarter of this year. Zambian state firm ZCCM-IH owns 20% of Kansanshi.

First Quantum plans to spend an additional $1.3 billion at Kansanshi over the next five years, part of a $2 billion spending plan to raise copper output to about 277,000 tons per year by 2033 from about 130,000 tons in 2023.

The Canadian miner has shed 40% of its revenue due to the closure of its flagship Cobre Panama mine last November, which when operational was one of the newest and biggest copper mines of the world.

The company had to undertake a series of capital restructuring measures earlier this year to strengthen its balance sheet, including a share offering worth $1 billion.

Manara has made significant investments in metals including copper, nickel and lithium as part of Saudi Arabia's aggressive push to secure minerals and transform into a hub for battery and electric vehicle manufacturing.

The firm is also in talks with the Pakistan government to be part of the Reko Diq copper mine currently under development, which is owned by Barrick Gold, Pakistan state enterprises and the provincial government of Balochistan.

An anticipated rally in the price of copper, spurred by a widening supply gap, is expected to continue to support the metal above $10,000 per ton by the end of 2025, according to Bank of America.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation