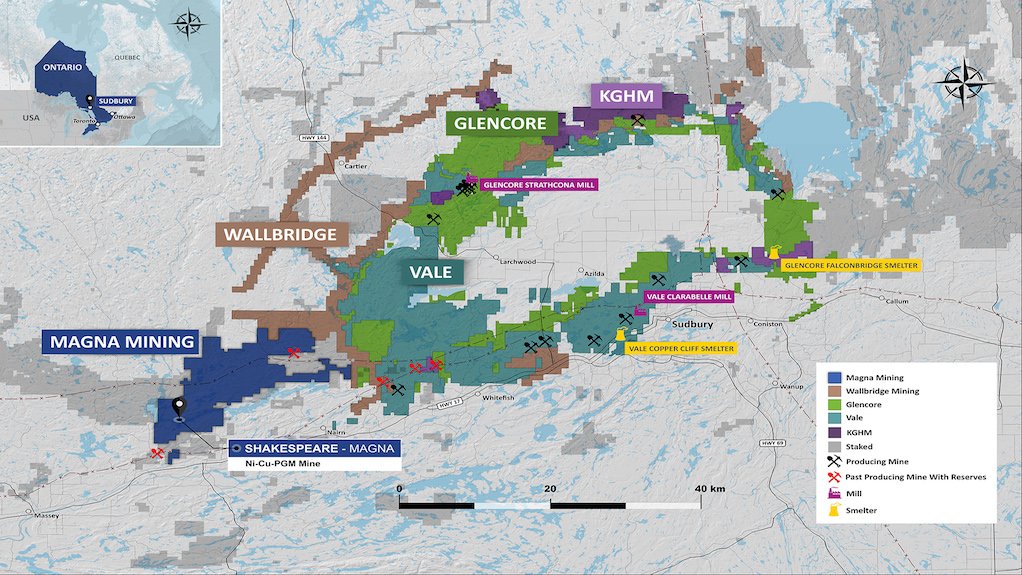

Shakespeare nickel project, Canada

Name of the Project

Shakespeare nickel project.

Location

Ontario, in Canada.

Project Owner/s

Magna Mining.

Project Description

A feasibility study has demonstrated the potential of the Shakespeare project to be the next nickel producing mine in Canada, and has confirmed Magna Mining’s belief that the project is an attractive standalone operation at current nickel and copper prices.

The study has further shown the positive economics of the project, including a modest upfront capital cost and strong leverage to the price of nickel and copper.

The mining rate will average 11.5-million tonnes a year in the first four years, peaking at 11.9-million tonnes a year in Year 3 before tapering off until the end of the mine life.

It will recover 65.7-million pounds of nickel, 86.7-million pounds of copper, three-million pounds of cobalt and 177 000 oz of platinum-group metals over a 7.1-year mine life.

The mine has been designed to provide 4 500 t/d of mill feed to the process plant to be built adjacent to the pit.

Material from the pit will be used to build the co-disposal area for the storage of waste and tailings in the adjacent valley. This facility will be lined, allowing for the long-term storage of potentially acid-generating tailings material from the process plant and any such material from the mine beneath the water level, as well as control of the drainage from the waste stored within its footprint.

The process plant will generate potentially acid-generating tailings and nonacid-generating tailings that will be separated at the plant. The latter will be stored with the nonacid-generating tailings waste rock from the mine.

The co-disposal area includes settling and polishing ponds, and a water treatment facility for any variances in water quality encountered before discharge into the environment. The water management system has been designed to reuse site water for process applications, minimise freshwater requirements and effectively collect contact runoff in accordance with legislative requirements. The study proposes the use of an owner-operated fleet, including 12-91 t trucks, hydraulic excavators, wheel loaders and drills.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The base case results demonstrate a pretax net present value, at 6% discount rate, of $221-million, an internal rate of return of 27.2% and a 3.4-year payback.

Capital Expenditure

Initial capital requirements of $232.9-million, including all mine preproduction costs, co-disposal area preparation and sustaining capital of $9.2-million (including closure).

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts and Suppliers

None stated.

Contact Details for Project Information

Magna Mining CEO and director Jason Jessup, tel +1 705 665 0262 or email jason.jessup@magnamining.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation