Sibanye-Stillwater’s 2025 headline earnings soar 281%, R3.7bn dividend declared

Sibanye-Stillwater 2025 results covered by Mining Weekly's Martin Creamer. Video: Darlene Creamer.

Sibanye-Stillwater headline earnings per share up 285%.

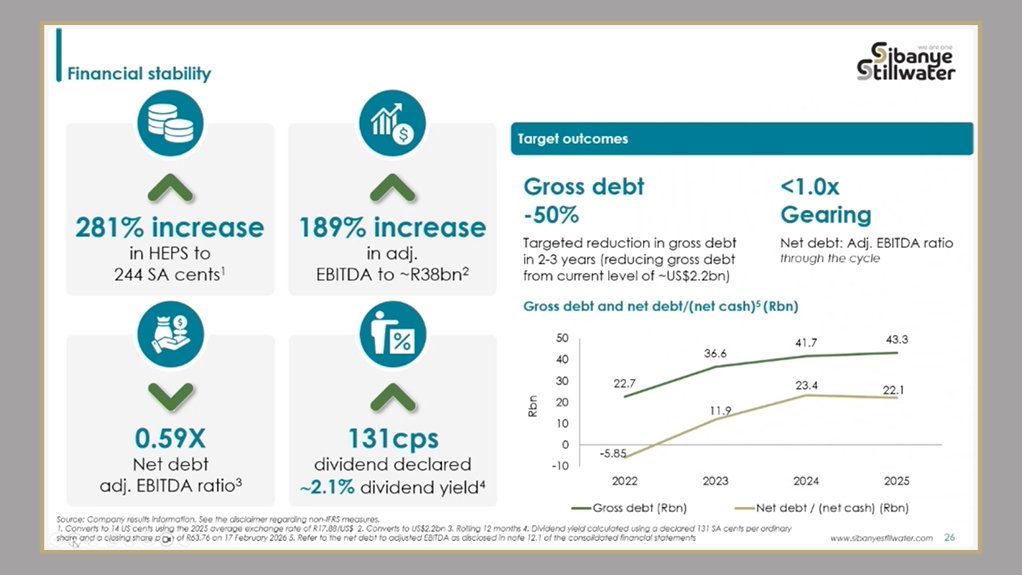

JOHANNESBURG (miningweekly.com) – The 2025 headline earnings per share of Sibanye-Stillwater soared by 285% and earnings before interest, taxes, depreciation and amortisation (Ebitda) came within a hair’s breadth of trebling with a 189% increase of just under R38-billion, the Johannesburg Stock Exchange-listed gold and platinum group metals (PGMs) mining company reported on Friday, February 20.

Despite the complex financial accounting matters, driven primarily by impairments, the Appian settlement, fair value losses, and higher share-based payment expenses, core operational financial performance reflected a significant turnaround. (Also watch attached Creamer Media video.)

Against that background, the board has declared a final cash dividend of R3.7-billion for the six months ended December 31, representing 35% of normalised earnings.

This represents an increase of 146% compared with the last dividend that Sibanye-Stillwater paid in 2023. Taxes and royalties, which have also increased in proportion to profitability, rose to R4.3-billion.

Without 2025’s non-routine cash impacts, including gold price hedging put in place in December 2024, money available would have increased by R5.2-billion to some R14.6-billion.

Liquidity headroom is at a strong R40-billion, which is roughly five-and-a-half months of operating expenditure plus capital expenditure.

The next priority on the debt profile will be the upcoming renewal and downsizing of the 2026 R675-million bond, the target date for completion of which is the first half of this year, Sibanye-Stillwater CFO Charl Keyter spelt out during the very comprehensive 2025 results presentation, covered by Mining Weekly.

“If I could try and summarise our strategic refresh in one word, it would be simplification,” said CEO Dr Richard Stewart, who reported that Sibanye-Stillwater ended 2025 in a position of strengthened financial and operational performance, with positive momentum continuing during 2026.

“Specifically, what we're really focusing on in the short term is maximising and driving operating margins. We're doing that through a keen focus on operational excellence and simplifying the operating model that we have, and then further simplification through our portfolio, such that we’re focusing on the highest return cash generative assets, and ensuring an appropriate management focus in that regard.

“This is all coupled with a very disciplined capital allocation framework, which we shared as being roughly a third towards shareholder returns, a third towards reducing our gross debt, and a third towards growth.

“Our PGM operations and organic growth will be our immediate focus,” Stewart emphasised.

South Africa PGM operations produced 1 797 928 four-element ounces of PGMs despite a 29% decline in surface production owing to heavy rainfall and the transition between tailings storage facilities.

All-in sustaining cost rose 10% to R24 193/4E oz on higher PGM price-linked royalty payments and increased sustaining capital. Higher second-half PGM prices drove a 125% Ebitda increase to R16.7-billion.

The US PGM operations produced 284 069 two-element ounces at an AISC of 21 516 oz, well below plan.

There was a 114% Ebitda to R12.5-billion from the production of 632 341 oz of gold by South Africa gold operations.

The US recycling business contributed R4.1-billion Ebitda while Keliber lithium greenfield project in Finland absorbed €299-million capital.

The Century zinc operation in Australia recovered on improved production stability, zinc price support, and reduced treatment charges while the Sandouville nickel refinery in France received its last nickel matte. The site has been placed on care and maintenance.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation