Singapore reviewing short seller claim against India's Vedanta, documents show

LONDON - The Singapore Police Force is reviewing a complaint by short seller Viceroy Research that natural resources conglomerate Vedanta improperly funded its 2024 dividend, documents viewed by Reuters show.

Vedanta Ltd told Reuters it had paid all dividends in full compliance with applicable laws, calling Viceroy's allegations "baseless".

"We maintain that the allegations in the short seller's dubious 'reports' are malicious and ill-informed, and the company unequivocally rejects them," the company said.

It added that no SPF investigation was under way and it had not been contacted by Singapore police. Vedanta previously rejected separate earlier accusations made by Viceroy in July.

The SPF declined to comment on the matter when contacted by Reuters.

ALLEGATIONS OF BOOSTED DIVIDENDS

India-based Vedanta Ltd specialises in the exploration, extraction and processing of minerals, along with oil and gas.

In an August 7 letter to the SPF, seen by Reuters, US-based Viceroy alleged the company propped up its dividend by using a $900-million loan from Oaktree Capital Management.

Viceroy said Vedanta Ltd, which is valued at roughly $20-billion, used the loan and accounting tricks to make its reserves look bigger on paper and make a payout to investors that was not backed by real cash earnings. It later repaid the loan and reversed write-offs through entities domiciled in Singapore.

Viceroy stated that its conclusions are primarily drawn from publicly available reports, forensic analyses of Vedanta's filings and site visits to its assets.

In an email seen by Reuters, the SPF replied to Viceroy's complaint, assigning it a reference number indicating it was reviewing the matter.

UK-based Vedanta Resources owns 56% of Vedanta, while the rest is held by institutional shareholders.

In July, Viceroy published a report saying it had taken a short position against the debt of Vedanta Resources, alleging that the British firm was "systematically draining" its Indian unit, which Vedanta Ltd disputed.

It also alleged that Vedanta Ltd's dividend policy serves its parent's financing needs, not its own cash flow, adding that billions of dollars in disputed expenses were hidden off its balance sheet.

A spokesperson for the Indian firm said at the time that the report was "a malicious combination of selective misinformation and baseless allegations."

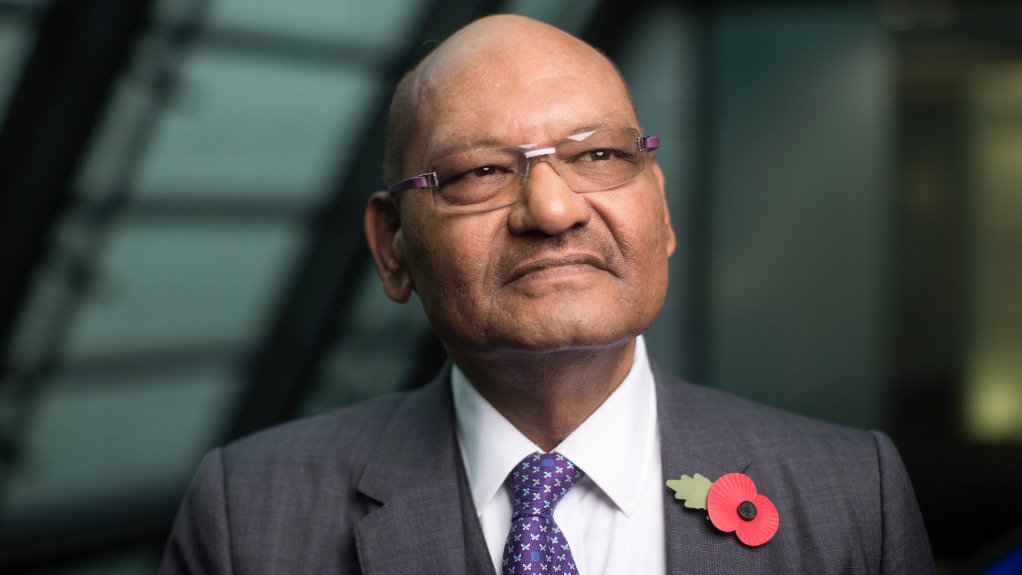

Vedanta Ltd has been under pressure since India's government objected to a demerger plan into four separate entities launched by chairman Anil Agarwal in 2023, after an unsuccessful attempt to take the group private three years earlier.

As part of the plan, Vedanta Resources said last year it would focus on cutting its debt pile, bringing net debt down by $1.2-billion to $11.1-billion in fiscal 2025.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation