South African economy at a crossroads

By Raymond Obermeyer, Managing Director at SEW-EURODRIVE South Africa

South Africa faces a critical crossroad currently; one which requires creative and innovative solutions to put the economy back on a sustainable financial path. Achieving this will require structural reforms to enable a more business-friendly environment aimed at encouraging investment in order to grow the economy.

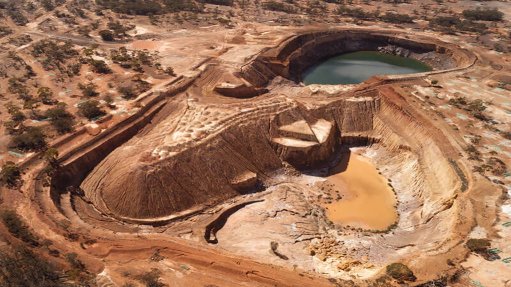

The country has benefited in recent months from a commodities boom which provided an unexpected tax windfall. This has resulted in an unprecedented trade surplus – meaning that more capital has flowed into the country than out of it - helped to underpin the rand, contained inflation and kept interest rates at historically low rates. The state’s finances have benefitted from the mining sector’s stellar results through improved tax collections which has, in turn, increased calls for a universal basic income grant.

However, as history shows, no commodity boom lasts forever. What happens when the price of commodities inevitably cool, and the state’s finances are no longer able to benefit from better than expected tax collections? Any commitment to a universal basic income grant must be based on sustainable sources of revenue.

All indications are that the recent economic tailwinds are not enough to alleviate the tenuous position of the country’s debt to GDP ratio or avoid further future ratings downgrades unless government is able to significantly reign in public sector expenditure.

As Business Leadership South Africa CEO Busi Mavuso wrote in her weekly note recently, South Africa’s government has no choice but to constrain spending so that the country’s fiscal outlook improves. A deteriorating debt position is a risk to the entire economy. A fiscal crisis, she says, would inevitably trigger a financial crisis and deep recession which will ultimately diminish confidence and reduce investment appetite. She argues that difficult trade-offs must be made between constraining consumption expenditure while at the same time protecting public sector investment.

South Africa’s economy was in trouble even prior to the Covid-19 pandemic, characterised by low levels of growth, growing unemployment and poor business confidence. The pandemic has exacerbated the challenges facing the country.

There is no question that last month’s unrest which resulted in looting and the destruction of property did little to promote the country’s investment case and weighed heavily on business confidence, particularly in KwaZulu-Natal. Indications are that the protest action cost the country around R50 billion in lost output. The state’s failure – or inability – to protect businesses was a missed opportunity to restore private sector confidence.

The fragile state of the economy is reflected in the disappointing month-on-month manufacturing output figures. According to Statistics South Africa manufacturing production fell by 0.7% for the third consecutive month in June this year, indicating that a recovery in this sector has stalled and failed to reach pre-Covid levels. Expectations are that the July figures will be even worse which will weigh on the sector’s contribution to GDP. In line with this, the latest Absa Purchasing Manager’s Index has fallen to a 14-month low representing declining sentiment.

The pandemic has decimated livelihoods, particularly amongst lower level workers. While initiatives to expand social grants are necessary, they ultimately do little to tackle the real issues behind growing levels of inequality. And, unless these issues are meaningfully addressed, growing levels of inequality are likely to feed continued protests in the future.

There is extensive research available showing a strong correlation between economic growth and social stability. The former must urgently be prioritised with quick wins from low hanging fruit. These include the introduction of a business friendly regulatory environment which is aimed at restoring private sector confidence and encouraging investment into local operations. Labour laws need to be amended so that they don’t dissuade businesses from hiring staff. We need to increase the beneficiation of extracted minerals into higher-value products and urgently increase the country’s manufacturing output. At the same time our country’s youth need to be armed with the necessary skills to ensure their employability in a rapidly approaching Industry 4.0 world.

Ultimately, this will require the ruling party to set its prevailing ideology aside in favour of creative but practical policies which enable inclusive economic growth, boost confidence and encourage investment. With the necessary political will, South Africa has the potential to create a more positive future for itself, fuelled by opportunities for greater levels of trade as a result of the African Continental Free Trade Agreement. The time is now ripe for meaningful reform.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation