Specify energy transition action now, the money’s there for it, UN climate envoy urges

UN Climate Action Finance Envoy Mark Carney covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

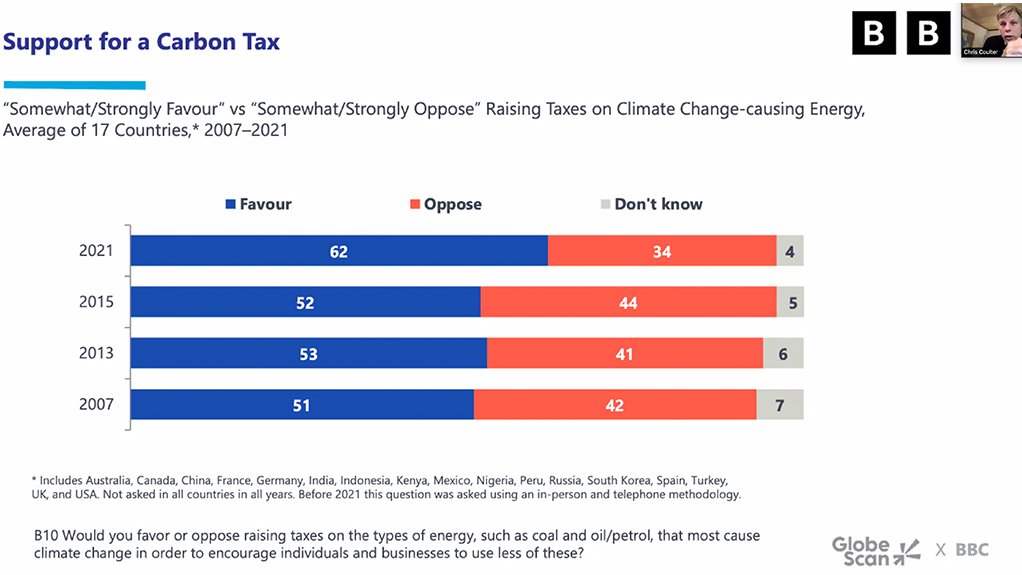

Global populations favouring the imposition of carbon taxes.

JOHANNESBURG (miningweekly.com) – The energy transition is woefully under specified, the United Nations special envoy on climate change action and finance Mark Carney told a global webinar, in which he described the specifying of energy transition action as being “a matter of urgency”.

Such specification, the webinar heard, needed to include:

- a framework for the responsible retirement of stranded assets; and

- the winding down of assets that will not live out their entire geological life.

Some $4-trillion to $5-trillion a year is needed for the transition and available for it is more than $130-trillion – the value of the collective balance sheets of already committed financial institutions, asset owners, asset managers, banks, insurers, export credit agencies and others. (Also watch attached Creamer Media video.)

“Broad brush, the money’s there, and in terms of the commitments of these institutions, obviously it’s net zero by 2050 at the latest. But very importantly, it’s a fair share of the 50% reduction by 2030 – so there is a near-term target, an actionable target,” said Carney.

More than 5 000 major companies round the world now have the most rigorous science-founded, target-based net-zero plans.

Moreover, there are five-year decarbonisation blueprints for more than 500 banks and asset owners, and these need to be rolled out within 18 months and reported on annually.

The future will thus be brought to the present by these institutions, said Carney, who was speaking during a GlobeScan webinar covered by Mining Weekly.

GlobeScan CEO Chis Coulter, who moderated the online event in which Anglo American CE Mark Cutifani and Shell Foundation chairperson Gail Klintworth also took part, pointed out the significant increase in the past six years of global populations favouring the imposition of carbon taxes.

The majority favour a tax on coal, oil and petrol, which was indicative of some of the climate change anxiety being experienced across a broad front, said Coulter. (Also see attached slide.)

Regarding the measures that should be taken on a go-forward basis, these five points were raised:

- countries need to close the planet’s global warming gap by introducing and implementing credible and predictable policies as a matter of urgency;

- scaled capital needs to be merged into developing economies that need an extra $1-trillion a year by the end of this decade;

- nature resilience needs to be harnessed through tree planting and other carbon-sink measures;

- clear pathways for renewable energy need to be set; and

- the just transition must be assured by the provision of action-specific leadership as it forms a major part of ensuring that energy transitions are successful.

“There are pathways for renewable increases, there are some simpler necessary elements of ending coal, but it’s very fuzzy in the middle in terms of fossil fuels,” said Carney, who described the just transition as forming a key part of getting the energy transition right.

A broader environmental, social and governance, or ESG, highlighting would allow the private sector to play a huge role in the just transition, even though it is first and foremost a public sector agenda.

WORLD UNITING AROUND NET-ZERO PATHWAY

Coming out of COP26, the world is coalescing around a net-zero pathway for global warming, which Carney sees as “the first net positive”.

The world is already at 1.1 ℃ warmer and the impactful frequency of extreme weather events has become far more severe. It is non-linear between 1.5 ℃ and 2 ℃, with 2 ℃ being a death sentence for Barbados, the world has heard.

By the end of COP26, countries had moved from 30% of global emissions covered by country-level net-zero objective two years ago to more than 90% now.

“So, again, a big shift,” he added.

Other positives out of COP26, he noted, were a series of side deals, some of them quite significant, including an end to deforestation by 2030, signed by more than 100 countries. COP26 also saw much greater private sector action, some of it mandatory for companies listed in the UK.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation