St Barbara disputes PNG tax assessment

Australian gold miner St Barbara has rejected a tax assessment issued by Papua New Guinea’s Internal Revenue Commission (IRC), which demands about A$175-million in additional taxes and penalties.

The company said on Tuesday that its subsidiary, Simberi Gold Company, had lodged a formal objection, arguing that the assessment misapplied tax legislation.

The IRC has imposed an additional PGK152-million (A$59-million) tax liability on revisions to Simberi Gold’s tax returns from 2017 to 2021, citing changes in allowable capital expenditure (ACE). It has also levied penalties amounting to PGK304.1-million (A$117-million).

St Barbara further highlighted calculation errors totalling PGK64-million (A$25-million) within the assessment.

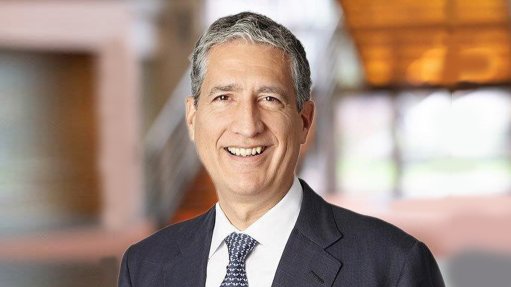

“St Barbara and Simberi Gold have made full and true disclosures of all material facts and strongly reject any suggestion of tax evasion, fraud, or misleading statements,” said MD Andrew Strelein.

He added that it was “inconceivable” for the IRC to claim a lack of transparency regarding the potential for future mining of the Simberi Sulphides, as this information had been publicly announced and repeatedly communicated to PNG authorities and the media. He also pointed out that Simberi’s current processing facility was incapable of treating sulphide ore, and that further investment and permitting would be required.

“The appropriate mine life reference for claiming allowable capital expenditure between 2017 and 2021 is clearly the predicted oxide life,” Strelein stated.

He noted that recent discussions with government officials had been encouraging, with strong support for St Barbara and Simberi Gold and a shared commitment to resolving the matter promptly.

The IRC will now review the company’s objection, with a formal response expected in due course.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation