Sylvania reports positive results despite lower PGM prices

Platinum group metals (PGMs) producer and developer Sylvania Platinum says its revenue and net profit for the 2023 financial year remained respectable, despite the impact of a significantly lower PGMs basket price.

The Sylvania Dump Operations (SDO) produced 38 405 oz of platinum, palladium, rhodium and gold (4E) PGMs for the six months to December 31, 2023. Production was largely unchanged from the prior comparable six-month period.

The sustained production level was primarily owing to improved PGM recovery efficiencies and a reduction in work-in-progress stock, as well as the PGM feed tons being marginally higher, despite PGM feed grades being 9% lower than the prior comparable period.

The improved PGMs recovery efficiency was attributed to the successful commissioning and optimisation of the Tweefontein and Lannex secondary milling and flotation (MF2) circuits in South Africa.

These two MF2 circuits were the last to be commissioned at the existing SDO operations, following the company’s roll-out of the programme initiated during the 2017 financial year.

The Lannex MF2 flotation circuit was commissioned during the first quarter of the current financial year, and optimisation continues following the addition of the complementary fine grinding circuit that was commissioned in the second quarter of the financial year.

The 9% decrease in PGMs plant feed compared with the corresponding period in the first half of the 2023 financial year was primarily related to lower PGMs feed grade in dump feed sources to Lannex, Mooinooi and Lesedi.

Feed grade optimisation and blending strategies remain a continuous focus area for operations and the company continues to assess higher-grade third-party tailings material in the industry as alternative feed sources to supplement PGM feed grades and production.

SDO cash costs increased by 13% from $602/oz to $682/oz. This was mainly owing to the significantly higher than inflation electricity rate increase from the national power utility, increased reagents and consumable costs associated with additional MF2 circuits, and transport and purchase costs associated with higher-grade third-party feed material.

The higher maintenance costs at Lesedi and Lannex owing to abnormal mill repairs during the period under review also contributed to the higher cash cost.

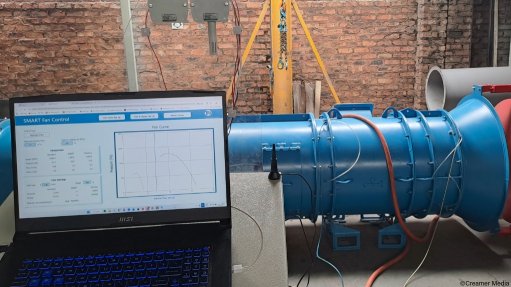

During the period, the SDO developed a new improved planned maintenance system which was successfully implemented at the Millsell operation, in South Africa.

This is expected to improve plant availability, capacity and runtime, resulting in improved process stability and increased efficiencies, and is being rolled out to priority operations.

Despite the continued challenging price environment, the company performed well during the first half of the financial year and is well positioned for a solid performance during the second half of the 2024 financial year, maintaining production guidance of 74 000 oz to 75 000 oz of 4E for the full 2024 financial year.

“Additionally, the SDO is well positioned within the industry due to a stable production base, improving PGM recovery efficiencies and low operating costs – with the company placed in the lowest quartile of the industry cost curve.

“Sylvania’s low-cost strategy has ensured that the SDO remain cash generative even at lower basket prices. Enabled by our cash-generating operations and disciplined operating cost and capital control, the company has sufficient cash reserves to continue to fund capital and optimisation projects, as well as advancing our exploration projects and returning value to shareholders,” says CEO Jaco Prinsloo.

The exploration projects in the Northern Limb also hold significant potential for the company. In the second half of this year, the focus remains on further improving confidence in the resources, while expanding and quantifying the potential benefit from these assets.

Following on from the Exploration Results and Resource Statement that was released in the 2023 financial year, the company continues to develop the projects through additional technical studies and re-interpretation of historical information.

This additional information will assist the company in ascertaining how best to develop these projects.

Despite the current lower 4E PGMs basket price, the board remains optimistic about the overall medium- to long-term PGMs price outlook, based on the respective supply and demand trends for platinum, palladium and rhodium.

In the meantime, the SDO remain well positioned within the industry, with a stable production base, low operating costs and improving PGM recovery efficiencies.

Additionally, with the current elevated chrome ore prices and through the strategic alliance with Limberg Mining Company in the Thaba joint venture, Sylvania is well positioned to diversify its revenue streams, create value for shareholders, and benefit from the rising demand for chrome going forward.

Management will continue to focus on the parameters that it is able to control, with a specific focus on improving direct operating costs, maintaining a safe, stable and efficient production environment, and ensuring disciplined capital allocation and control.

The average gross basket price for PGMs for the six months was $1 311/oz compared with $2 513/oz for the prior comparable period.

The group recorded net revenue of $40.8-million for the six months under review, a 49% year-on-year decrease, as a result of the lower basket price and negative sales adjustment for the period.

Capital expenditure incurred for the period was $7.4-million on specific optimisation and stay-in-business projects; Thaba joint venture (JV) development was $1.3-million and $400 000 was on exploration projects.

OPERATIONAL UPDATES

Meanwhile, Sylvania owns various mineral asset exploration and development projects on the Northern Limb of the Bushveld Igneous Complex located in South Africa, for which it has approved mining rights.

Targeted studies are under way on both the Volspruit and Northern Limb PGM opportunities to determine how best to optimise the respective projects. Significant progress has been made towards unlocking mineral potential on these projects to generate value for shareholders.

The assessment of the Aurora project exploration data continues, the results from which will enable a decision on how best to unlock value from the project under current market conditions.

Relogging continues across the Aurora project area with more than 90% of the historical core having been relogged. Compilation of the data is ongoing and once a geological model has been compiled a decision will be taken on whether to implement a drilling programme to assess gaps in the current database.

This is likely to occur during the fourth quarter of the 2024 financial year and will allow for an updated mineral resource estimate (MRE) and preliminary economic assessment to be commissioned for Aurora if results warrant.

The October 2022 MRE for the Aurora project was only for the La Pucella target area representing just 12% of the combined Aurora project area and containing approximately 16.2-million tonnes in the measured and indicated categories at a grade of 2.63 g/t 2E plus gold.

Moreover, detailed design of the Thaba JV project, in South Africa, is progressing as planned, expediting the completion of civil and structural design and drawings for all areas.

Process design is complete for all plant areas and progress with electrical design is sufficient to enable procurement of long lead items. Procurement of all mechanical long lead item packages is complete, and the team is now busy with the procurement of lower priority mechanical packages.

During the third quarter of the current financial year, the structural steel and platework fabrication and construction packages will be awarded and procurement of electrical long lead items will be completed.

The main civils contractor commenced work in November 2023 and the demolition and removal of old works on site was completed in December 2023.

The civils contractor is busy with earthworks for the chrome plant, thickeners, and flotation plant and the first concrete pour commenced towards the end of January 2024.

The structural steel and platework site contractors will be established from March 2024. The planned construction start of the High Voltage Distribution Yard is March 2024.

“We are also undertaking continuous operational performance improvements including the optimisation of feed sources, throughput, recoveries, and cost-saving initiatives. Additionally, we expect to provide further clarity on the significant potential of our exploration projects as we continue our studies and increase our resources,” says Prinsloo.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation