Tianqi weighs bid to protect interests in Chile's SQM-Codelco lithium deal

BEIJING/SANTIAGO - China's Tianqi Lithium, a major shareholder in Chile's SQM, said it may consider action to protect its interests in a key deal signed by SQM and Chilean state miner Codelco.

Friday's pact, while seen as pivotal to boost the Andean nation's lithium output, would potentially dilute Tianqi's stake in SQM, the world's second-largest producer of the metal critical in electric vehicle batteries.

"The company will conduct a comprehensive assessment within the legal framework and may consider actions to ensure the protection of its shareholder interests," Tianqi told the Shenzhen Stock Exchange in a statement on Sunday.

Tianqi is SQM's second biggest shareholder, with a stake of more than 22% bought for $4.07-billion in 2018.

The planned 2025 partnership between the two needed to win government approvals and meet conditions such as completion of a consultation process with indigenous communities, it added.

Their deal was hammered out in months of complex talks, during which Tianqi repeatedly urged a shareholders' vote to ensure transparency and full participation.

Changes in future returns from SQM may cut investment income and dividends for Tianqi, it said in the statement.

Tianqi's SQM dividends of 2.28-billion yuan ($315-million) were about 5.6% of revenue in 2023, the annual report showed.

The deal allows SQM to lift production by 300 000 metric tons of lithium carbon equivalent (LCE) through 2030, while aiming for annual output of 280 000 tons to 300 000 tons through 2060.

In a joint statement, the companies said the increase would come from use of new technologies and improved operations.

The partnership start depends on Chile's financial regulator rejecting Tianqi's request for shareholders to vote on the joint venture. SQM says only a board vote is needed.

On Friday, Goldman Sachs warned investors to focus on whether Tianqi would seek legal action to block the deal.

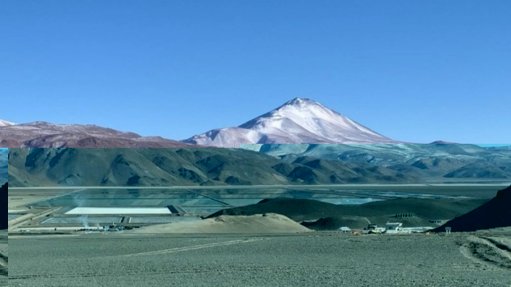

Chile is the world's second largest producer of lithium after Australia, thanks to output from SQM and Albemarle.

The global shift toward EVs in the fight on climate change has fuelled a rush by automakers and others for more supplies of the ultralight metal.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation