Tulu Kapi gold project, Ethiopia – update

Photo by Kefi Gold and Copper

Name of the Project

Tulu Kapi gold project.

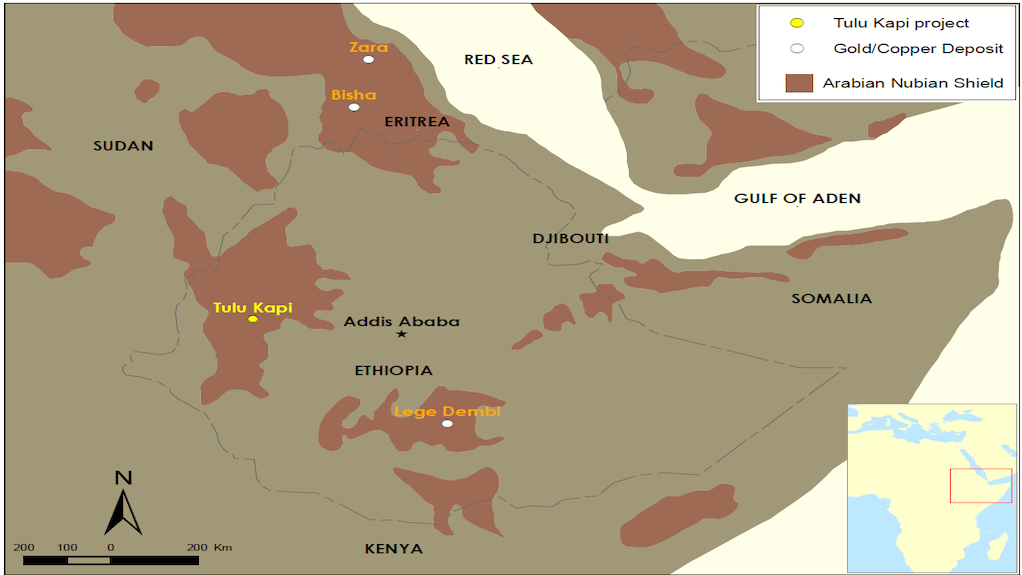

Location

Western Ethiopia.

Project Owner/s

Kefi Gold and Copper (formerly KEFI Minerals) will own 80% of the exploration and holding company for the government of Ethiopia, KME, which, in turn, will own 56% of Tulu Kapi Gold Mines Share Company (TKGM), thus bestowing Kefi with a 45% beneficial interest in the project.

Project Description

Tulu Kapi has an ore reserve estimate of 15.4-million tonnes at 2.1 g/t gold for 1.1-million ounces of gold.

Openpit gold production is estimated at 140 000 oz/y over a seven-year mine life.

Total life-of-mine production is estimated at 980 000 oz.

The conventional openpit mining operation will include a carbon-in-leach processing plant. The mine will be connected to Ethiopia’s electricity grid through a new 47-km-long, 132 kV dedicated power line relatively close to the country’s major hydropower-generation source. An emergency diesel power plant will also be installed to provide emergency backup power for critical process equipment in the event of a grid power failure.

A preliminary economic assessment has indicated the economic attractiveness of mining the underground deposit adjacent to the Tulu Kapi openpit after the startup of the openpit and the repaying of project debts through positive cash flows.

Potential Job Creation

About 150 local personnel have been employed to prepare new host lands.

TKGM has started compensation procedures for the small portion of the community who is to be resettled and occupies the site for the planned electricity substation. Starter homes have been fabricated and are being delivered to site for assembly.

Net Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

While there have been no material changes in the estimated $253-million in capital costs of the project – comprising about $221-million for development, about $21-million for sustaining capital and about $21-million for closure costs – a standby facility has now been included in the finance plan to provide additional headroom.

Planned Start/End Date

Commissioning of the project is planned for 2023, with key development activities due to start in December 2021.

Latest Developments

With an abatement in civil hostilities in Ethiopia, Kefi Minerals met with the Ethiopian Ministries of Mines and Finance in the fourth quarter of 2021, to align expectations towards normal conditions for international project financing and the timing for the launch of the Tulu Kapi gold project.

During the three months to December 31, the company essentially completed technical and legal due diligence, while advancing detailed documentation, the arrangement of insurances and other normal requirements for project finance for the project.

As a result, Kefi expects to launch the Tulu Kapi project early this year, subject to the continuing improvement of the security situation and the satisfaction of normal conditions precedent for financing such a project.

During the fourth quarter of 2021, security events in Ethiopia stalled Kefi’s progress at Tulu Kapi. “But we preserved the finance syndicate and our preparations for the project launch when security and other normal conditions are satisfied as early as possible in 2022,” Kefi executive chairperson Harry Anagnostaras-Adams says.

Key Contracts, Suppliers and Consultants

Corica Group (mining contractor).

Contact Details for Project Information

KEFI Gold and Copper, tel +90 232 381 9431, fax +90 232 381 9071 or email info@kefi-minerals.com.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation