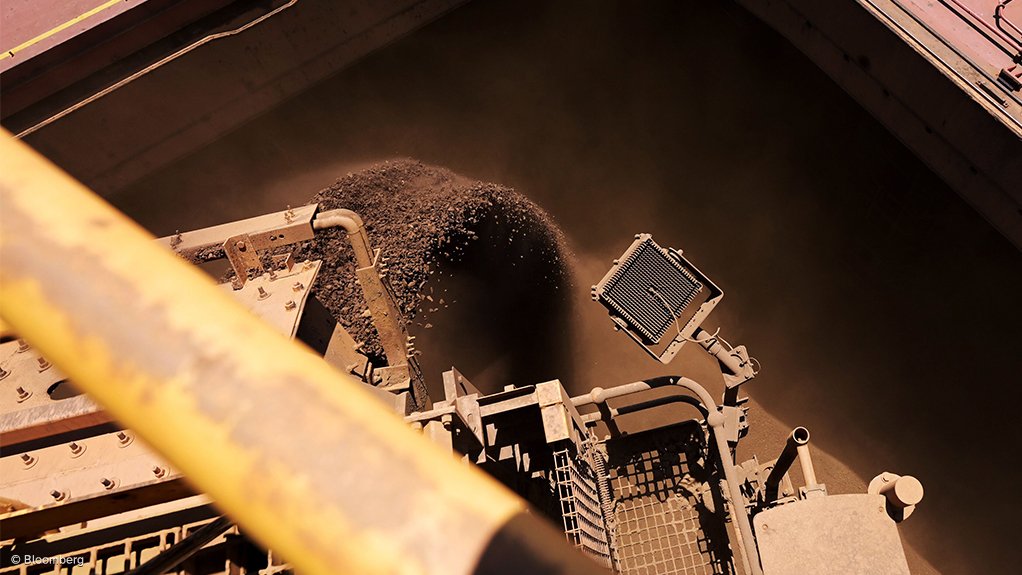

Xi’s giant iron-ore trader is shaking up a $130bn market

Just three years after its founding, a Chinese government-run trader has become the single biggest force in the country’s $130-billion market for iron-ore imports.

The rise of China Mineral Resources Group (CMRG) has allowed it to tame one of the world’s wildest commodities markets — sending volatility in iron-ore futures to a record low. It’s also playing a role in negotiations with global mining companies, potentially shifting the balance of power between China’s vast steel industry and major suppliers like Rio Tinto and BHP.

CMRG is transforming a market that has been a thorn in the side of Chinese leaders for 15 years. Now its clout is such that its stockpiles have become akin to a national reserve, to be released when steelmakers are struggling or built up when prices are cheap, according to people familiar with its activities, who declined to identified discussing a sensitive matter.

“The existence of CMRG is primarily aimed at fundamentally solving the problem of excessive dependence on iron-ore imports,” said Bancy Bai, a ferrous metals analyst at consultancy Horizon Insights. “It has established iron-ore inventories in over a dozen major domestic ports,” she said.

Chinese authorities have long tried to smooth market fluctuations in markets ranging from local stocks and the yuan to key commodities, but iron ore has been an especially tricky market to manage. As the main raw material for China’s one-billion-ton steel industry, price spikes risk fueling inflation in Asia’s biggest economy.

Ever since 2010 — when a system of annually negotiated contracts was ditched in favor of floating spot rates — Chinese officials and steel-mill executives have bemoaned the pricing power of iron ore majors like Rio, BHP and Brazil’s Vale SA.

During a Covid-era price surge in 2021, for example, the market became a key target for intervention as officials raised trading costs, censored industry research, urged inventory sales, and cajoled traders to halt “malicious” speculation.

NEW FORCE

President Xi Jinping’s government created CMRG in 2022 with a mission to reshape China’s relationship with its iron ore suppliers, taking on an intermediary role rather than leave China’s fragmented steel industry at the mercy of miners and traders.

CMRG is now the biggest trader of the commodity after elbowing out other players, according to market participants. It also represents more than half of China’s steelmakers in talks with suppliers such as Rio Tinto and BHP, they said.

Price action has been unusually placid in the past six months. While China’s slowing economy and the downtrend in steel demand are a major reason, observers say CMRG has also played a role.

“A shift in marginal bargaining power from miners to mills was inevitable once peak steel passed in China,” said Joel Parsons, a Singapore-based portfolio manager at Drakewood Prospect Fund. “The interesting question is to what extent CMRG may be accelerating the process.”

Iron ore is bought and sold in different ways: on the spot market for individual, up-front shipments, or via longer-term term contracts linked to daily reference prices. After a halting start, CMRG has pushed into the spot market and had over 40 cargoes on the water as of June 19, according to an offer sheet reviewed by Bloomberg. Those included products from BHP and Rio.

Vale has been absent. The Brazilian company hasn’t struck spot deals with CMRG because it believes long-term contracts with Chinese mills are sufficient, said a person familiar with the matter.

So far, none of the big miners currently supplies CMRG in term contracts. Talks on doing so were continuing, Simon Trott, Rio’s chief executive of iron ore, said recently.

CMRG, Rio, BHP and Vale all declined to comment for this story.

One advantage is that CMRG has more tolerance for losses because it’s State-run, and as its presence has grown, more established trading houses have retreated, according to people familiar with the matter.

The group has helped “keep prices at the level they should be with supply and demand, rather than having those short term spikes,” Aurelia Waltham, analyst at Goldman Sachs Group, told a conference in Singapore last month. In an earlier note, the bank said CMRG could be holding as much as 20 million tons of ore at ports, based on conversations with steel mills.

For those mills, getting on board with CMRG as a reliable, steady supplier is a no-brainer. But for miners, the consolidation is likely to weaken their bargaining power, setting the stage for a tussle over pricing for a long time to come.

“The unique structure of the iron ore market, with its concentrated supply from very low-cost producers and the specific quality demands, means that CMRG’s leverage, while enhanced, will not be absolute,” said David Cachot, iron-ore research director at Wood Mackenzie.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation