Yet more plans around infrastructure delivery – but is it enough?

By Raymond Obermeyer, Managing Director at SEW-EURODRIVE South Africa

A key element of government’s economic recovery plan is a large infrastructure drive. The country is not alone in this ambition with many states looking to invest in infrastructure as a way to aid their economic recovery. The US, for example, is planning to spend around $ 1 trillion on infrastructure projects over the next five years and hopes to pass a $550 billion infrastructure bill this week.

The challenge for South Africa, however, is a weak government balance sheet which means that the state will have to rely on public private partnerships to deliver much of the promised infrastructure. And to entice private capital there will need to be more policy certainty, less onerous bureaucracy and a more efficient infrastructure procurement process.

Infrastructure investment needs to deliver value for money if it is to grow the economy. As the Infrastructure for South Africa report found, “The long-term economic effect of infrastructure has a greater impact on employment levels than the short-term employment created by the construction of infrastructure itself.”

The report, published earlier this year by Business Leadership South Africa, assessed the obstacles and solutions to greater infrastructure investment. Of the policy-led stimulus options suggested by the report, the right moves are being made in some areas including in terms of own generation energy licensing and involving more private sector companies in port and rail operations.

A host of entities have been tasked with realising South Africa’s ambitions, including Infrastructure South Africa (ISA) which is tasked with project preparation, packaging, funding and providing strategic oversight over all gazetted projects and the Infrastructure Fund at the Development of Southern Africa (DBSA).

There are a multitude of plans plotting the way forward in terms of infrastructure delivery. One of the more recent examples is the National Infrastructure Plan (NIP) 2050, which was gazetted for public comment in August. The NIP positions infrastructure investment as a “non-negotiable foundation of transformation and inclusive growth” and aims to address the state’s acknowledged institutional blockages and weaknesses as far as the rollout of infrastructure programmes are concerned.

If there is one thing the South African government is particularly good at it is making plans, particularly around infrastructure. Ironically, NIP is intended to support two other plans, the National Development Plan (NDP) 2030 and the SA Economic Reconstruction & Recovery Plan, the latter which was announced in 2020 as part of the government’s strategy to revitalise the economy in the wake of the pandemic and consequences of the hard lockdown.

Essentially, the NIP aims to identify critical actions and suggest ways to improve and implement public infrastructure delivery in both the short and long terms focusing on, amongst others, improving and strengthening state capacity, regulations and public-private infrastructure delivery and management. This includes an improved approach to monitoring and reporting on progress.

It identifies four critical network sectors: energy, freight transport, water, and digital communications. As far as energy is concerned the NIP envisages a reduced reliance on coal fired power stations and an increased reliance on renewable energies. It says emergency power of 4 000MW will need to be procured in the 2021/22 financial year with 3 200MW procured in 2021 and a further 10 000MW procured in 2022 as part of the Renewable Energy independent Power Producer Programme (REIPPP). Given that a lack of reliable energy supply has significantly constrained the economy this is certainly positive.

Its plan for freight transport includes facilitating domestic and cross border movement of goods across supply chains by 2050 by upgrading and modernising South Africa’s transport system and integrating an efficient, reliable and sustainable multi-modal transport system in order to move freight off the country’s roads.

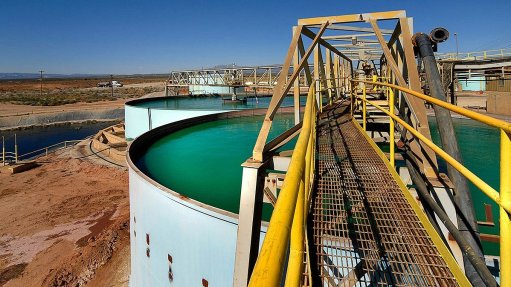

For water its plans include the implementation of a responsive water resource planning system, improving its ability to finance and deliver water projects, and rehabilitate existing water infrastructure. The plan includes at least two irrigated agricultural projects.

As far as digital communications is concerned, the NIP plans to extend easy access to affordable broadband of at least 10Mbps to 100% of the population by 2030. South Africa is currently way behind as far as its NDP 2030 goals around digital connectivity are concerned. Ensuring that universally accessible high-speed broadband becomes a reality will require political will and public-private partnerships.

Encouragingly, the NIP acknowledges that all of these initiatives will require private-public co-operation. Of the R6.4 trillion that needs to be spent on these four key sectors by 2050, around a third of the capital will need to come from the private sector.

While the NIP has been greeted with cautious optimism, the reality is that until measurable progress has been made, it remains yet another plan. The sector most likely to benefit from an uptick in public sector infrastructure delivery in the short and medium term is the civil construction sector. Although the sector saw a small improvement in confidence in the third quarter of 2021, the majority of respondents in the FNB-Bureau for Economic Research civil confidence index remain pessimistic about the current business conditions arguing that they have yet to see a significant number of projects materialise. This is despite the fact that a number of larger construction companies have reported improved domestic order books.

Although Minister of Public Works and Infrastructure Patricia de Lille has assured that the country’s infrastructure drive is gaining momentum, the civil construction sector remains unconvinced. In 2020 government announced – and subsequently gazetted – 50 strategic projects which it said would be fast-tracked to stimulate the economy. However, far from being fast-tracked, government has been criticised for the slow pace at which these projects have been awarded and implemented.

By its own admission, government has insufficient capacity to plan, finance, procure and implement infrastructure projects. The NIP outlines many of these concerns which include a lack of properly prepared and bankable projects; under expenditure against annual budgets; and large cost and time overruns as well as delays in implementing identified projects. Similarly, there are unintended consequences of regulations including detrimental procurement practices.

Addressing South Africa’s infrastructure deficit is no small task and will require a concerted effort on the part of both government and the private sector to find a way forward. Whether the NIP provides a suitable framework for the way forward remains to be seen. What will be interesting to note in the upcoming Medium Term Budget Policy Statement (MTBPS) is just how committed government is to infrastructure investment.

Ends

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation