African mining investors see opportunity amid rising insecurity and recession fears

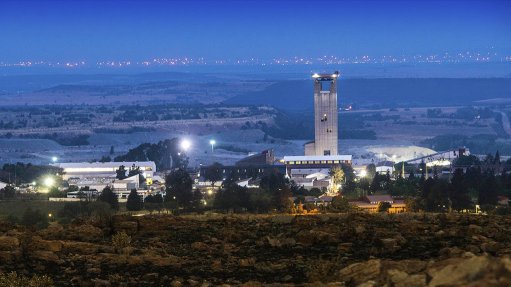

RETURNING TO FORM The Investing in African Mining Indaba is returning to the Cape Town International Convention Centre, in its traditional February slot

The “world’s largest investment conference”, the Investing in African Mining Indaba, looks to entice investors to Cape Town’s International Convention Centre in hopes of righting “Africa’s myriad economies” following successive years of geopolitical shifts and economic disruptions, says international exhibition organiser Hyve Group’s Mining Indaba portfolio director Simon Ford.

This year’s theme – ‘Unlocking African Mining Investment: Stability, Security and Supply’ – speaks to the promise of African mining that sees recent changes “create pressure points and opportunities”, says Ford, noting that global economies are seeking security of supply for their energy transitions, as well as raw materials and precious metals to bolster their economic power.

“We would say that – in many reaches of Africa – the potential of mining is still untapped, and that there is significant opportunity for mining to attract capital and be transformative.”

However, the global uncertainty and instability have yet to subside, with both the Russia-Ukraine conflict and the consequences of the Covid-19 pandemic lingering longer than many anticipated. There is also the niggling threat of a global recession.

The Dark Cloud

One of the major concerns affecting investment is insecurity.

‘Security of supply’ for manufacturers and secure and reliable access to water and power for miners are probably the foremost priorities. Naturally, because as ERM consulting director Charles Pembroke notes, “several critical minerals and metals are concentrated in a few key jurisdictions, many of which face export restrictions, weak governance and infrastructural challenges”.

However, all stakeholders should be more cognisant of the effects of ‘insecurity’ in general.

As the African Development Bank (AfDB) notes in its report titled ‘Security, Investment and Development: A Diagnostic Assessment’, globalisation and the resultant flexibility to relocate production processes and/or move capital across borders has placed conflict-affected regions at a disadvantage from an investment perspective.

The report, published in October last year, flags insecurity as one of the reasons why Africa’s share of global foreign direct investment remains perilously low at 4%. Moreover, insecurity is increasing, with the report finding that, in 2021, more than 18 000 conflicts affected the continent.

The report cites the ‘Disaster Triangle’ of rural poverty, youth unemployment and environmental degradation, which, alongside poor governance, weak State capacity and corruption, are factors that help cause insecurity.

“Fourteen African countries are classified as medium- and high-intensity conflict-affected situations. These countries share 80 land borders with other African countries, meaning that 85% of the continent’s 1.3-billion people are either living in or sharing land borders with a conflict-affected country,” the AfDB report observes. “The number of shared borders heightens the risk of cross-border spillovers, both in terms of conflict and its consequences on investment, growth and development.”

Aside from spillover effects and perceptions of risk affecting investment decisions and funding – with insecurity affecting both the terms and quantum of financing – the AfDB notes that instability also disrupts trade by upending supply chains “within and between countries”.

Law firm Webber Wentzel partner Tyron Theessen adds that supply chains were already weakened by disruptions caused by the pandemic and the war in Ukraine – evidenced by delivery delays and the rising costs of inputs as supply deficits started to bite.

Moreover, crime, as both a cause and a consequence of increased instability, is also adversely impacting on supply chain resilience.

Webber Wentzel partner Bruce Dickinson notes that attacks on long-haul trucks carrying high-value commodities to ports in South Africa have increased, while Webber Wentzel associate Tobia Serongoane notes that South African port, rail and road transport operations have been disrupted by ongoing civil unrest and violence, with “several notices of force majeure issued”.

Another factor hindering investment, and fuelled by insecurity, is resource nationalism.

“Resource nationalism has never gone away. In times of hardship, governments tend to want greater ownership of operations. The possibility of nationalising mines may be raised again, and any political discussions on this point would further deter investment,” comments Dickinson.

Pembroke adds that, “even before talk of a recession, we had already seen resource nationalist tendencies exhibited in several African countries”.

He cites examples such as legislation stipulating direct State ownership in mining projects or outlining targets for local beneficiation, local content and employment, as well as revisions to fiscal regimes.

Pembroke says that fears of a global recession, accompanied by a sharp rise in inflation and surging commodity prices, will “inevitably” see policymakers seeking further opportunities to tax mining profits, which could deter future investment, if these policies prove to be too onerous.

One of the reasons why African governments are looking to change tax regimes is that, as the AfDB notes, the pandemic put “unsustainable pressures on fiscal balances, [shrank] the national and regional investment space, threaten[ed] debt sustainability, and adversely affected people and livelihoods”.

“The cost of borrowing has also increased, limiting the ability of governments and the private sector to expand social initiatives, [and] deteriorating exchange rates have also discouraged international investors and worsened access to finance.”

Many African governments are already caught in the vicious cycle in which insecurity, owing to poverty, poor governance and fiscal pressure, begets yet more insecurity. The mining industry, its royalties and its multiplier effect, represent a potential lifeline.

The Silver Lining

A lifeline needs to be dependable, so it is fortunate that, as Ford avers: “Mining is here to stay.

The products derived from mining activity have a very real and important role both in the circular economy and in renewables. So, while we may see a shift in what is being mined, it’s clear that mining remains a very necessary part of the economy of the future.”

Dickinson adds: “We expect that, in 2023, even in the event of a global recession, there will be a continued focus on increasing investment in minerals such as copper, lithium and nickel, as well as fertilisers, with miners looking to up exploration and develop new projects, expand existing operations or pursue merger and acquisition opportunities.”

Consequently, Webber Wentzel partner Jonathan Veeran suggests that several African jurisdictions will become “very prominent” in 2023. “On the whole, the outlook for mining is reasonably good.”

“If global recession is accompanied by a softening in commodity prices, it may reduce investment in the mining sector, particularly as China’s growth rate has become harder to forecast,” cautions Dickinson, adding that many projects in the pipeline could then be deferred.

“However, the outlook is not uniform. Demand for minerals used to ‘green’ the global economy, especially the likes of copper, nickel and lithium, is expected to remain strong.”

Governments should capitalise on the opportunities presented by the global energy transition by creating an environment that is conducive to growth.

The AfDB report suggests reforms to formalise the informal sector, broaden the tax base, improve governance around tax collection, and combat illicit capital flows. This would afford governments greater freedom in allocating tax revenue, resulting in more infrastructure development programmes, which, in turn, would facilitate mining activities.

Pembroke advises governments to remember that resource wealth alone is not a recipe for success. “Governments that have greater leverage – in terms of critical mineral reserves – and the administrative capacity to negotiate constructively with industry will likely be more successful. Those that fail to consult industry risk damaging the investment climate, as has already been seen in Zambia, where some $2-billion worth of investment in expansion projects was said to be on hold under the Lungu administration.”

“Making an economy attractive to mining investors depends on having an efficient mining rights system and trusted judiciary, signing up to international treaties like the Extractive Industries Transparency Initiative, and having dispute resolution mechanisms in place to govern concessionary and mining agreements,” adds Veeran.

The AfDB report states that “Africa needs security and development, not one without the other”, emphasising that securing livelihoods, investments and developmental gains requires innovative financing.

The continental lender suggests that development finance institutions use their convening power to catalyse private investment to help States move out of conflict and poverty traps. “A dedicated grant facility and associated advisory services focused on project preparation, especially in conflict-affected countries, could facilitate a pipeline of bankable projects to attract private investors.”

It also suggested the creation of Security-Indexed Investment Bonds (SIIBs) to raise funds to support countries in upgrading their security architecture, rebuilding damaged infrastructure in conflict-affected areas, rebuilding social infrastructure and protecting zones with strategic investments.

Increasing security through SIIBs and other means is paramount, because, as AfDB president Dr Akinwumi A Adesina said at the report’s launch: “Without security there cannot be investment, without investment there cannot be growth, and without growth there cannot be development.”

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation