Africa’s critical-minerals role highlighted as world moves into ‘Age of Electricity’

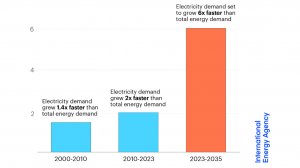

Ratio of electricity demand growth to total energy demand growth, historical and projected, under today's policy settings

Photo by IEA

With the global energy system moving into the “Age of Electricity”, the International Energy Agency (IEA) has again highlighted the central role of Africa in producing the critical minerals required to support the electrification of energy services, such as transportation, previously dominated by fossil fuels.

Releasing the ‘World Energy Outlook 2024’ report, IEA executive director Fatih Birol argued that it was becoming increasingly evident that the future of the global energy system was electric.

“We’ve witnessed the Age of Coal and the Age of Oil – and we’re now moving at speed into the Age of Electricity, which will define the global energy system going forward and increasingly be based on clean sources of electricity,” Birol asserted.

Global electricity demand growth, the report added, was already growing at twice the pace of overall energy demand and was poised to accelerate further, adding the equivalent of Japanese demand to global electricity use each year under current policy settings.

Low-emissions sources of electricity were also set to generate more than half of the world’s electricity before 2030, with demand for coal, oil and gas projected to peak by the end of the decade.

While there was uncertainty over how fast the share of electric vehicles would grow from their current share of about 20% of new car sales worldwide, a rise to 50% by 2030 would displace around six-million barrels a day of oil demand.

“If the market share of electric cars were to rise more slowly, remaining below 40% by the end of the decade, this would add 1.2-million barrels a day to projected oil demand in 2030, but there would still be a visible flattening in the global trajectory.”

For clean electricity supply to continue growing at pace, the report stressed the need for investment in electricity grids and energy storage.

“Today, for every dollar spent on renewable power, 60 cents are spent on grids and storage, highlighting how essential supporting infrastructure is not keeping pace with clean energy transitions.

“Secure decarbonisation of the electricity sector requires investment in grids and storage to increase even more quickly than clean generation, and the investment ratio to rebalance to 1:1.”

The report confirmed there to be ample clean energy manufacturing capacity to support an even faster transition of the electricity sector to cleaner sources of supply such as solar PV and wind.

However, the IEA argued for a diversification of supply chains, including for critical minerals.

While not described as a binding constraint to the growth of renewables, battery storage and electric vehicles, the IEA highlighted potential supply deficits, net of recycling, for minerals such as copper, lithium, nickel and cobalt for the period to 2035.

Here, the agency also saw “upside potential” for Africa, which was already a key player in the global critical minerals mining sector, accounting for 70% of global cobalt production and 16% of global copper production.

“In 2022, mining and extractive industries represent over 30% of total exports in 23 African countries, and critical minerals produce around $20-billion of revenue each year across the continent.

“The Democratic Republic of Congo, South Africa, Zimbabwe and Mozambique are leading producers, but a number of other countries also contribute.”

Spending on critical mineral exploration in Africa was also rebounding after years of decline, while new projects were set to expand Africa’s share of copper, lithium and natural graphite production by 2030.

“Supporting the existing mining project pipeline requires at least $1.3-billion in cumulative capital investment by 2040, with a possibility to reach around $1.8-billion if projects that are at slightly less advanced stages of development, or are seeking financing and/or permits are also considered.

“Further investment will be needed to expand related infrastructure such as ports.

“Among other factors, investors are looking for environmental, social and governance improvements in key areas, including action to address child labour,” the report adds.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation