Andrada reports solid quarter amid favourable price environment

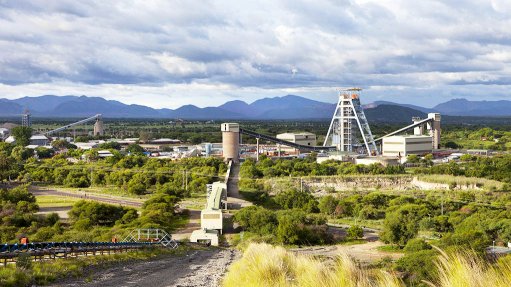

Aim-listed Andrada Mining has reported that its Uis mine, in Namibia, continued to deliver operational improvements during the third quarter ended November 30, benefitting from higher throughput, consistent recoveries and strong tin production amid a favourable price environment.

The company says performance during the period highlighted the benefits of its continuous improvement programme (CI2), with plant throughput and production metrics showing sustained progress.

Processing rate at Uis increased by 12% year-on-year to 146 tonnes an hour (t/h), delivering stable and predictable plant performance.

Tin recovery rate was stable at 73% compared with 74% in the same period last year, exceeding the company’s targeted 70% level for a third consecutive quarter.

Tin concentrate produced increased by 14% year-on-year to 429 t supported by higher throughput and contained tin produced increased by 10% year-on-year to 255 t.

Ore processed increased by 8% year-on-year to 259 396 t, while tin concentrate production increased by 14% year-on-year to 429 t.

Andrada notes that tin shipments totalled 15 for the period, representing a 7% year-on-year and 25% quarter-on-quarter increase, aligning with the company’s strategy to optimise sales during a period of elevated pricing.

The company says quarterly tin production was marginally lower than the second quarter of financial year 2026, reflecting scheduled maintenance and CI2 implementation downtime on the tin crushing circuit, both essential to support long-term throughput stability.

Despite this, it notes that the processing plant remains on track to achieve and sustain targeted performance levels.

Andrada says the operational focus remains firmly on maximising value through optimal product mix, guided by prevailing market conditions and production flexibility, noting that management continues to assess production allocation across tin and tantalum to ensure delivery against both commercial and strategic priorities.

“These initial results provide a positive indication of the latent value within our operations that we aim to unlock as we progress further in the new year, another demonstration to the phenomenal geology we have at Uis,” says Andrada CEO Anthony Viljoen.

With tin prices exceeding $40 000/t in early December, Viljoen says the commodity has emerged as one of this year’s top performers.

As the only tin producer listed on Aim, Viljoen says Andrada is uniquely positioned to capitalise on the current bull market.

In parallel, Viljoen highlights that exploration and development activities across the broader Erongo region in Namibia continue to validate the company’s strategy to develop a hub for tin and associated critical minerals, namely lithium, tantalum, copper and tungsten.

“Andrada is at the forefront of critical mineral development in Africa, with existing production providing the foundation for transformational growth through exploration and development across our expanding portfolio within achievable defined timeline,” he says.

UIS DEVELOPMENT PROJECTS

Andrada reports that commissioning of the new jig plant progressed steadily during the quarter, with a phased commissioning approach being implemented to support progressive operational throughput during ramp-up.

Initial start-up issues related to fines build-up and shaking table configuration are being addressed in collaboration with the equipment manufacturers. Until third-party ore becomes available, the jig plant will use Uis ore to maintain operations and optimise performance.

Meanwhile, Andrada says it remains strongly encouraged by the long-term potential of high-grade ore supply from the Goantagab and is optimistic that the parties will reach an outcome enabling implementation of the existing supply agreement.

In parallel, Andrada says it is committed to building a pipeline of value-accretive third-party ore partnerships to complement its production strategy and unlock additional regional growth opportunities.

LITHIUM DEVELOPMENT

Andrada continues to advance discussions with potential offtake partners for its petalite product, in both the technical and industrial markets.

Metallurgical testwork is ongoing, alongside a comprehensive evaluation of potential production pathways. Findings from this study are expected to be released in the second half of calendar year 2026 and will inform Andrada’s broader lithium integration strategy.

The company also reports that drilling activity at its Lithium Ridge joint venture project, in Namibia, has accelerated in partnership with Chilean miner SQM, with a third rig deployed to fast-track the exploration programme.

Initial assay results are expected during the first half of calendar year 2026.

This programme is targeting spodumene-bearing pegmatites across the licence area and forms part of Andrada’s strategy to establish a second lithium asset alongside Uis.

COMMODITIES MARKETS OVERVIEW

Andrada notes that tin prices have surged by about 40% year-to-date, breaching $40 000/t in December, and are expected to remain strong amid global shortages.

The company says its established Uis production and extensive tin resources position it to benefit from this structurally favourable market.

Tantalum demand is forecast to grow up to 7% compound annual growth rate (CAGR) through 2030, creating a tightening market. The company says tantalum production at Uis enhances project economics, while mineralisation at Lithium Ridge supports future scale and value.

Global lithium demand is forecast to rise from 1.3-million tonnes (2022) to 5.2-million tonnes lithium carbonate equivalent (LCE) by 2040. Andrada says it is positioned to supply both technical-grade petalite from Uis and battery-grade spodumene from Lithium Ridge.

Regarding copper, Andrada says a supply shortfall of up to six-million tonnes is expected by 2035.

The company says drilling at Brandberg West confirmed copper grades up to 2%, with prices up about 30% year-to-date to $11 600/t, highlighting Andrada’s diversification potential.

Moreover, the tungsten market has grown to $6.12-billion this year (CAGR 8.1%), driven by price increases and Chinese export restrictions (about 80% of supply). The market is projected to reach $8.7-billion by 2029, the company notes.

Andrada says the notable mineralisation intersections of tungsten grades at 2% recorded from the exploration drilling programme at Brandberg West, position the company favourably to capture value from this potential upside.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation